Question: Note 1: When one spouse is an active participant in a retirement plan and the other is not, two separate income limitations apply. The active

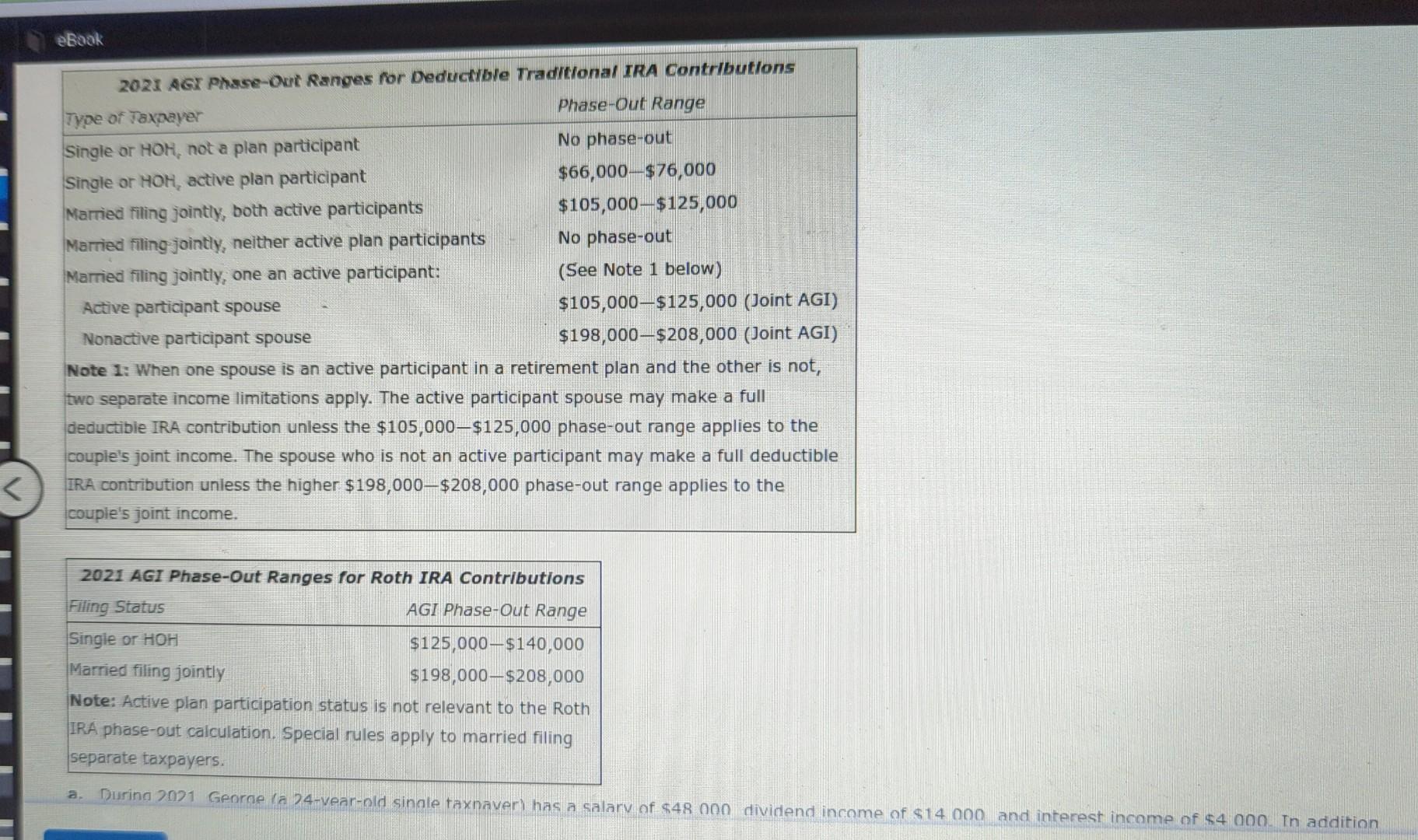

Note 1: When one spouse is an active participant in a retirement plan and the other is not, two separate income limitations apply. The active participant spouse may make a full deductible IRA contribution unless the $105,000 - $125,000 phase-out range applies to the couple's joint income. The spouse who is not an active participant may make a full deductible IRA contribution unless the higher $198,000$208,000 phase-out range applies to the couple's joint income. Note 1: When one spouse is an active participant in a retirement plan and the other is not, two separate income limitations apply. The active participant spouse may make a full deductible IRA contribution unless the $105,000 - $125,000 phase-out range applies to the couple's joint income. The spouse who is not an active participant may make a full deductible IRA contribution unless the higher $198,000$208,000 phase-out range applies to the couple's joint income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts