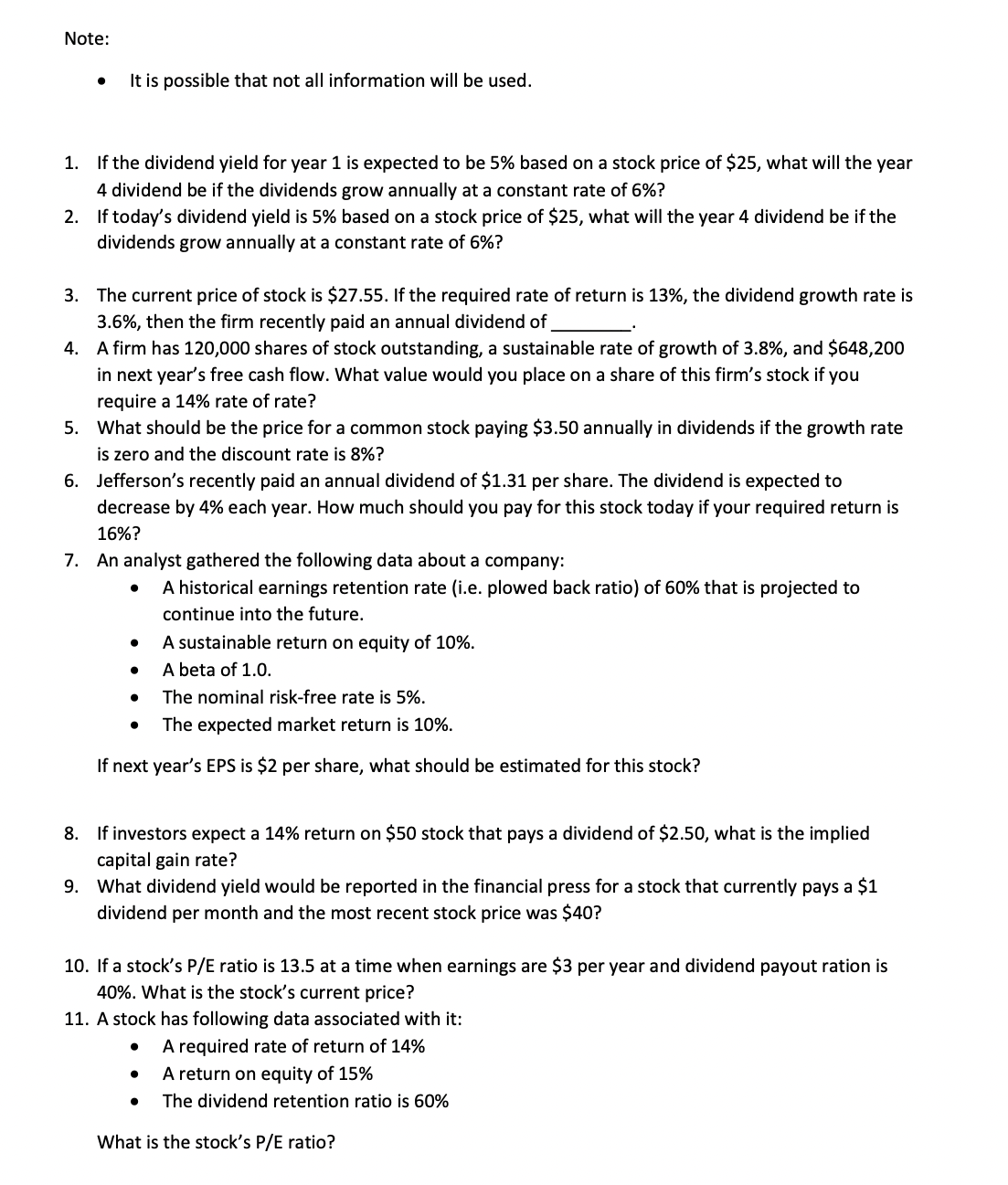

Question: Note: 10. 11. o It is possible that not all information will be used. If the dividend yield for year 1 is expected to be

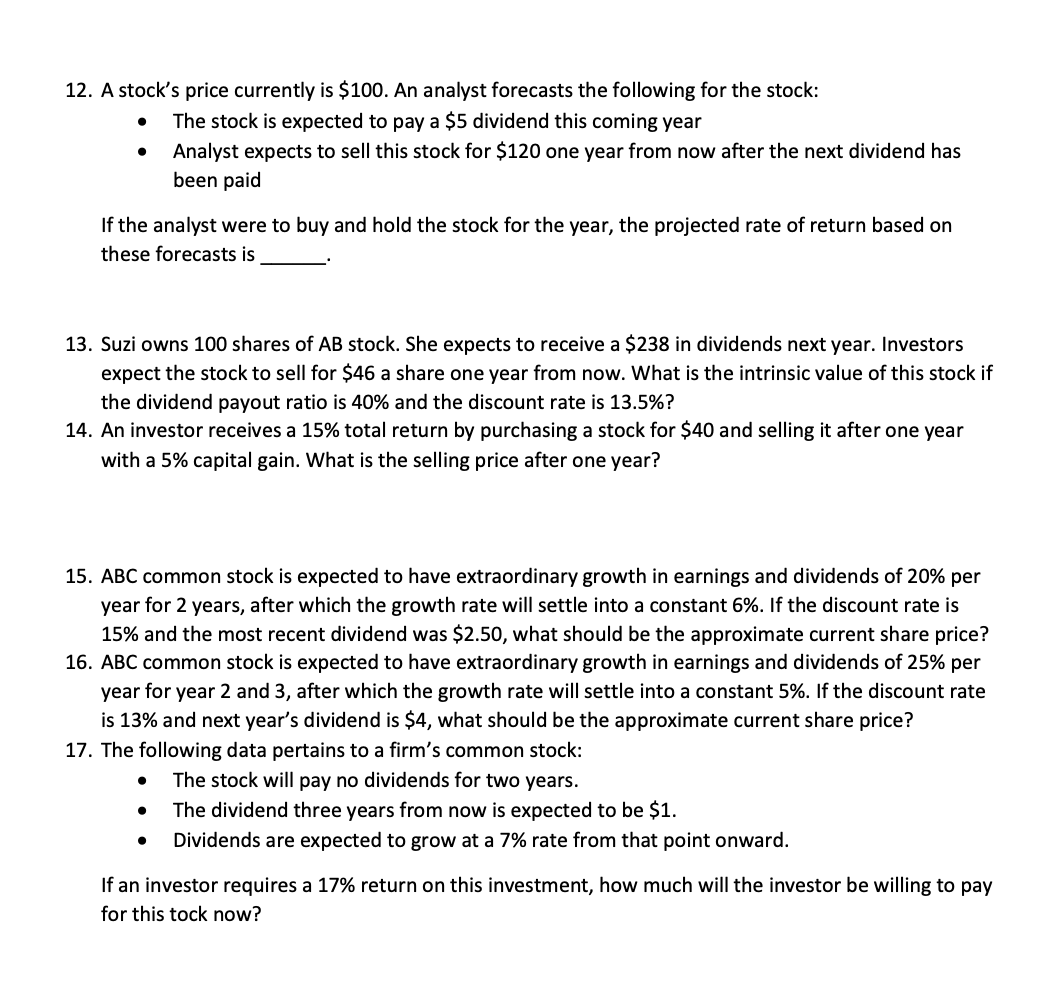

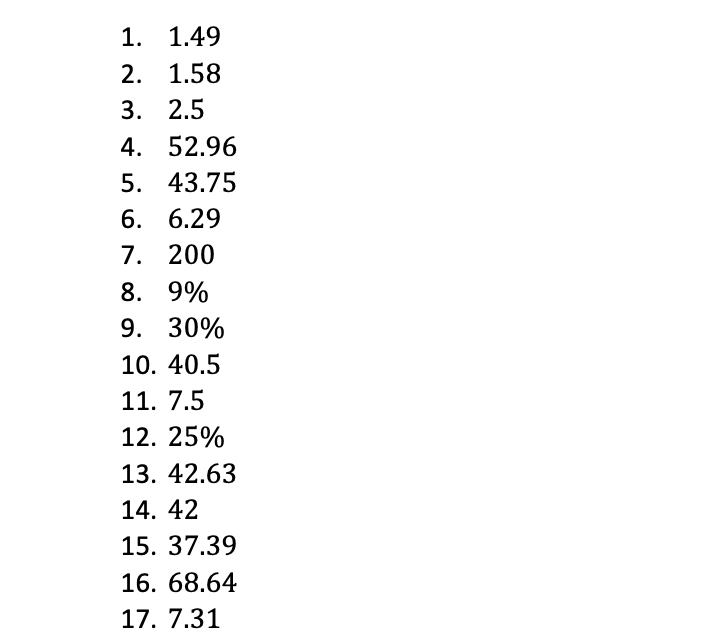

Note: 10. 11. o It is possible that not all information will be used. If the dividend yield for year 1 is expected to be 5% based on a stock price of $25, what will the year 4 dividend be if the dividends grow annually at a constant rate of 6%? If today's dividend yield is 5% based on a stock price of 525, what will the year 4 dividend be if the dividends grow annually at a constant rate of 6%? The current price of stock is $27.55. If the required rate of return is 13%, the dividend growth rate is 3.6%, then the firm recently paid an annual dividend of . A firm has 120,000 shares of stock outstanding, a sustainable rate of growth of 3.8%, and $648,200 in next year's free cash flow. What value would you place on a share of this firm's stock if you require a 14% rate of rate? What should be the price for a common stock paying $3.50 annually in dividends if the growth rate is zero and the discount rate is 8%? Jefferson's recently paid an annual dividend of $1.31 per share. The dividend is expected to decrease by 4% each year. How much should you pay for this stock today if your required return is 16%? An analyst gathered the following data about a company: 0 A historical earnings retention rate (i.e. plowed back ratio) of I60% that is projected to continue into the future. 0 A sustainable return on equity of 10%. o A beta of 1.0. o The nominal risk-free rate is 5%. o The expected market return is 10%. If next year's EPS is $2 per share, what should be estimated for this stock? If investors expect a 14% return on 550 stock that pays a dividend of $2.50, what is the implied capital gain rate? What dividend yield would be reported in the financial press for a stock that currently pays a $1 dividend per month and the most recent stock price was $40? If a stock's P/E ratio is 13.5 at a time when earnings are $3 per year and dividend payout ration is 40%. What is the stock's current price? A stock has following data associated with it: o A required rate of return of 14% o A return on equity of 15% o The dividend retention ratio is 60% What is the stock's P/E ratio? 12. 13. 14. 15. 16. 17. A stock's price currently is 5100. An analyst forecasts the following for the stock: 0 The stock is expected to pay a $5 dividend this coming year 0 Analyst expects to sell this stock for $120 one year from now after the next dividend has been paid lfthe analyst were to buy and hold the stock for the year, the projected rate of return based on these forecasts is Suzi owns 100 shares of AB stock. She expects to receive a $238 in dividends next year. Investors expect the stock to sell for $46 a share one year from now. What is the intrinsic value ofthis stock if the dividend payout ratio is 40% and the discount rate is 13.5%? An investor receives a 15% total return by purchasing a stock for $40 and selling it after one year with a 5% capital gain. What is the selling price after one year? ABC common stock is expected to have extraordinary growth in earnings and dividends of 20% per year for 2 years, after which the growth rate will settle into a constant 6%. If the discount rate is 15% and the most recent dividend was $2.50, what should be the approximate current share price? ABC common stock is expected to have extraordinary growth in earnings and dividends of 25% per year for year 2 and 3, after which the growth rate will settle into a constant 5%. If the discount rate is 13% and next year's dividend is $4, what should be the approximate current share price? The following data pertains to a rm's common stock: 0 The stock will pay no dividends for two years. 0 The dividend three years from now is expected to be $1. 0 Dividends are expected to grow at a 7% rate from that point onward. If an investor requires a 17% return on this investment, how much will the investor be willing to pay for this took now? \f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts