Question: Note: 1st question: answer is 4 decimal places , guess not to be 5% or 7% Thanks! will give thumb up if answer correctly Case

Note:

1st question: answer is 4 decimal places, guess not to be 5% or 7%

Thanks! will give thumb up if answer correctly

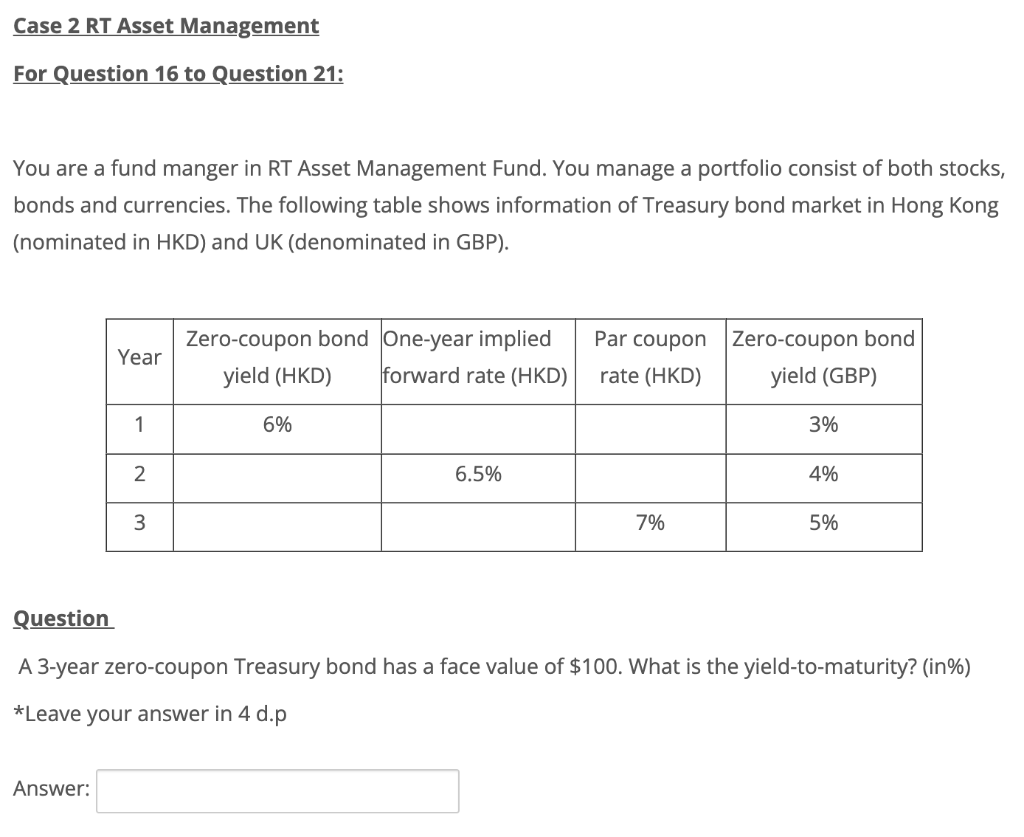

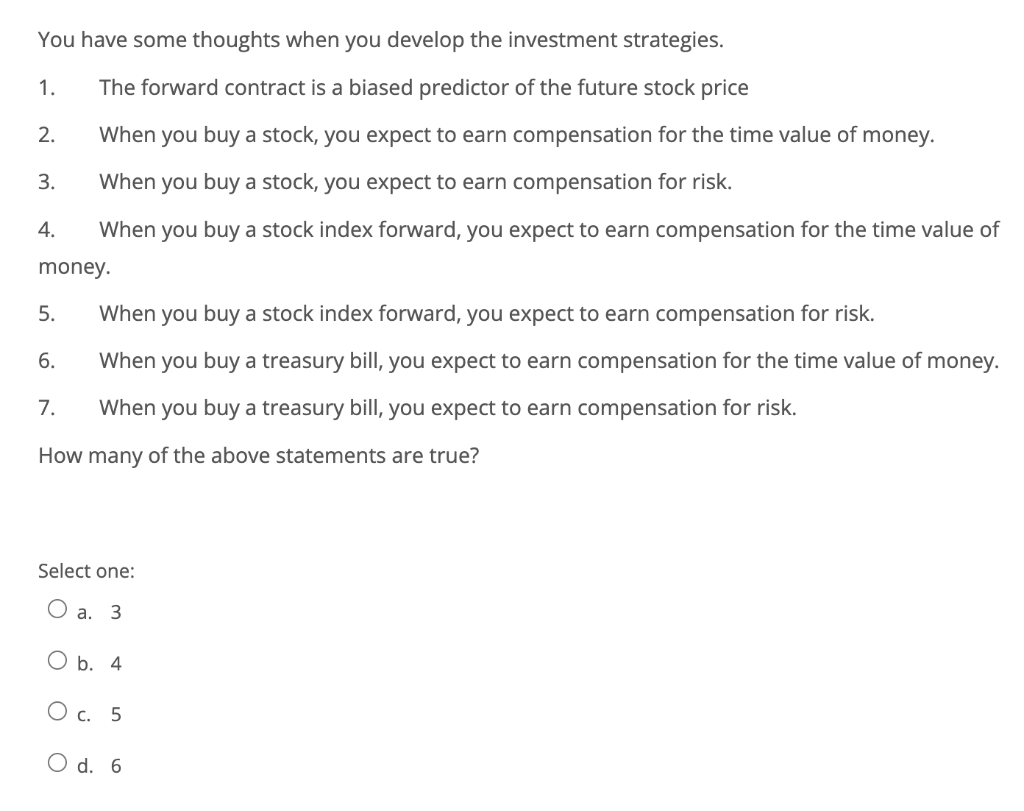

Case 2 RT Asset Management For Question 16 to Question 21: You are a fund manger in RT Asset Management Fund. You manage a portfolio consist of both stocks, bonds and currencies. The following table shows information of Treasury bond market in Hong Kong (nominated in HKD) and UK (denominated in GBP). Year Zero-coupon bond One-year implied yield (HKD) forward rate (HKD) Par coupon Zero-coupon bond rate (HKD) yield (GBP) 1 6% 3% 2 6.5% 4% 3 7% 5% Question A 3-year zero-coupon Treasury bond has a face value of $100. What is the yield-to-maturity? (in%) *Leave your answer in 4 d.p Answer: 2. You have some thoughts when you develop the investment strategies. 1. The forward contract is a biased predictor of the future stock price When you buy a stock, you expect to earn compensation for the time value of money. 3. When you buy a stock, you expect to earn compensation for risk. 4. When you buy a stock index forward, you expect to earn compensation for the time value of money. 5. When you buy a stock index forward, you expect to earn compensation for risk. 6. When you buy a treasury bill, you expect to earn compensation for the time value of money. 7. When you buy a treasury bill, you expect to earn compensation for risk. How many of the above statements are true? Select one: O a. 3 O b. 4 O c. 5 O d. 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts