Question: note : 800 words each question. Gopro in 2017: Wi11 Its Turnaround Strategy Restore Profitability? contect DAVID L. TURNIPSEED University of South Alabama JOHN E.

note : 800 words each question.

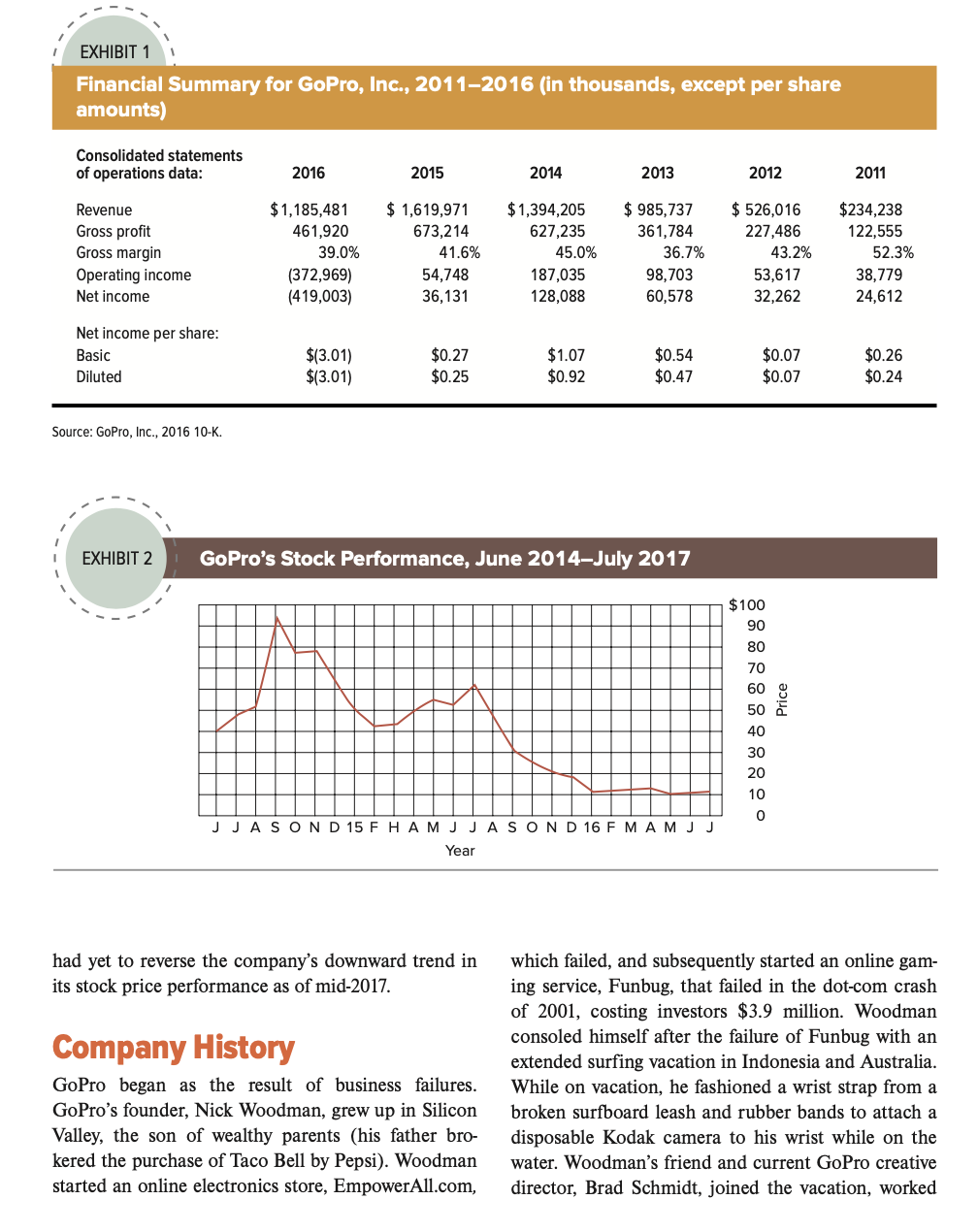

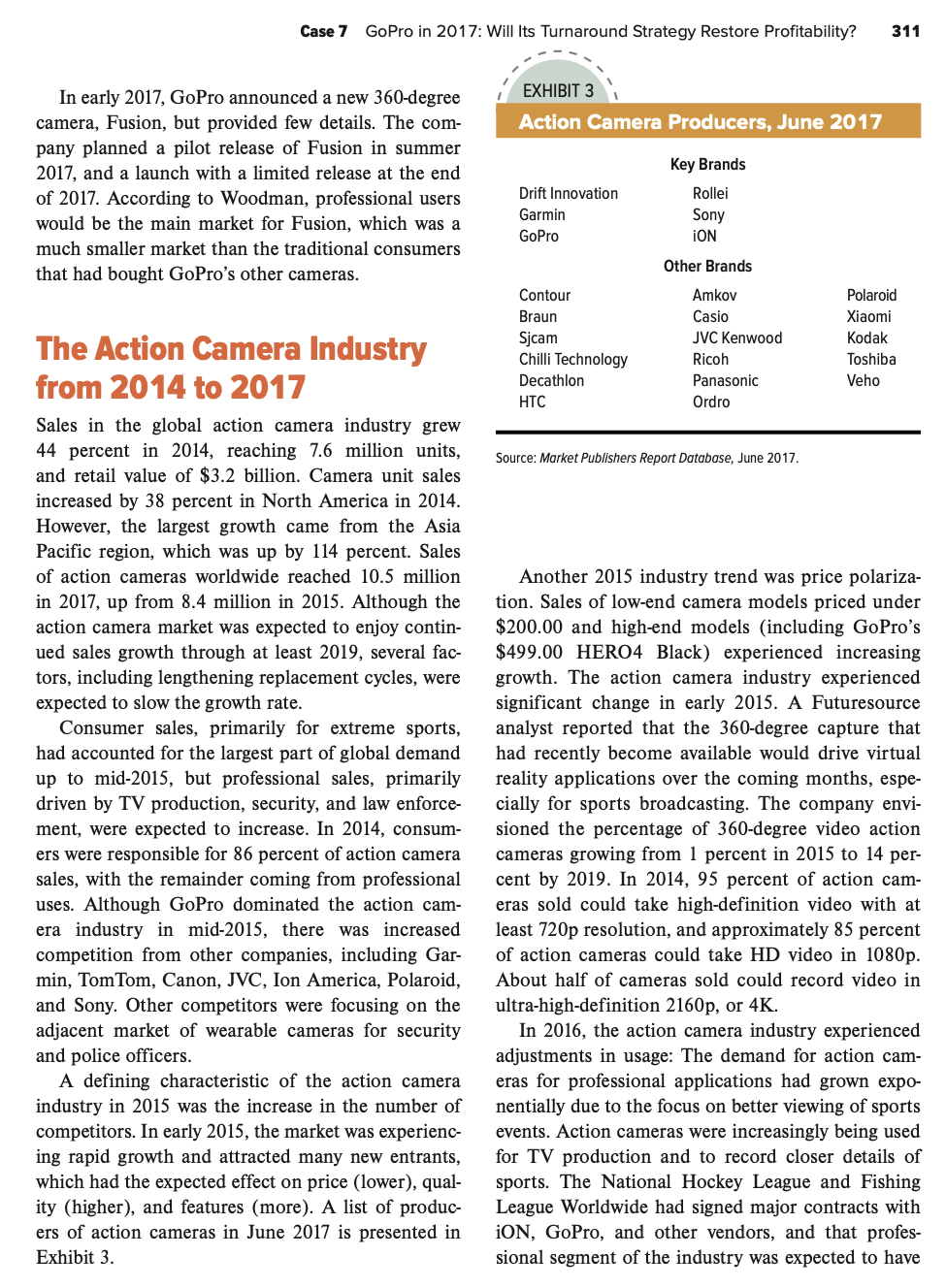

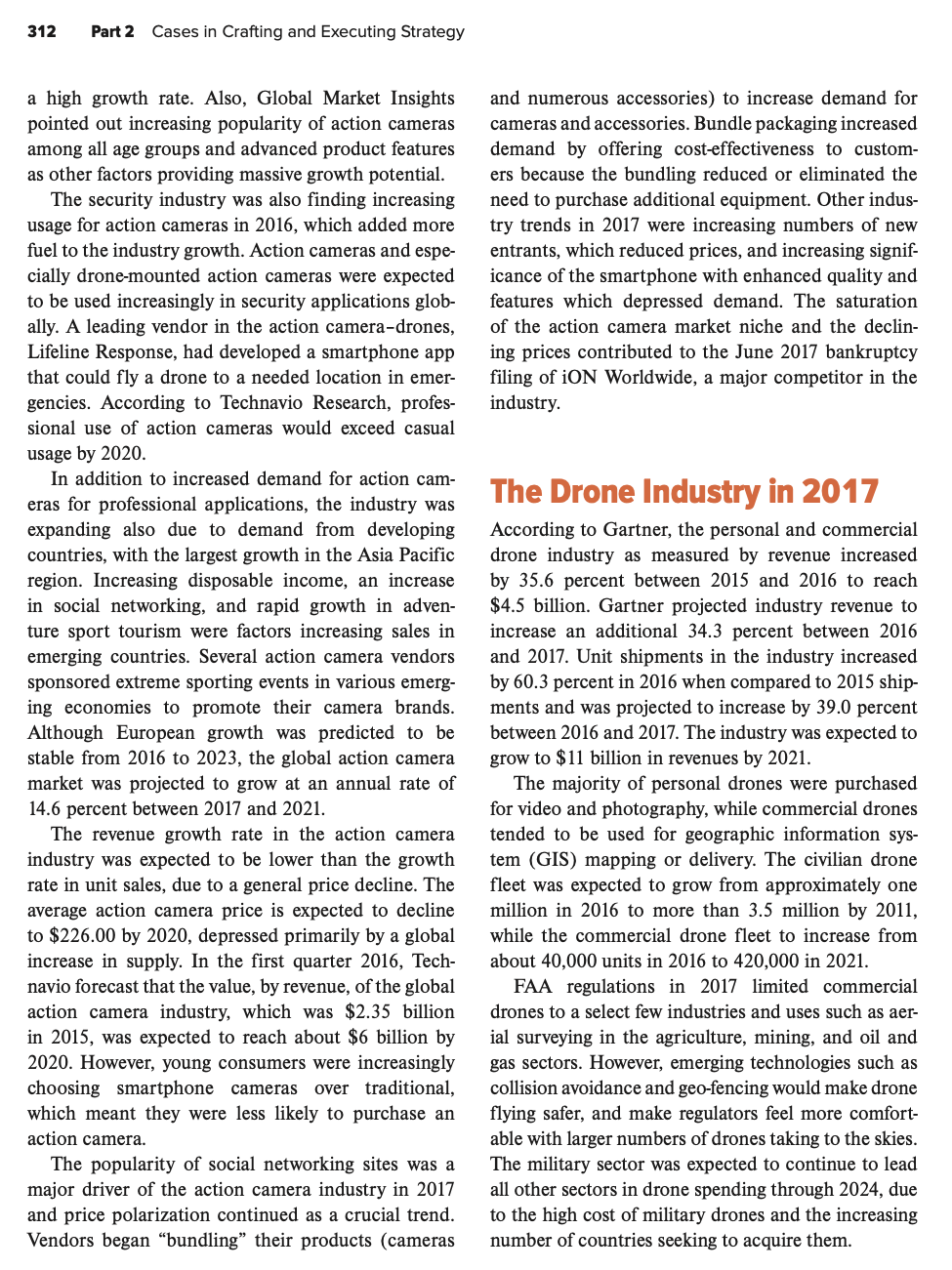

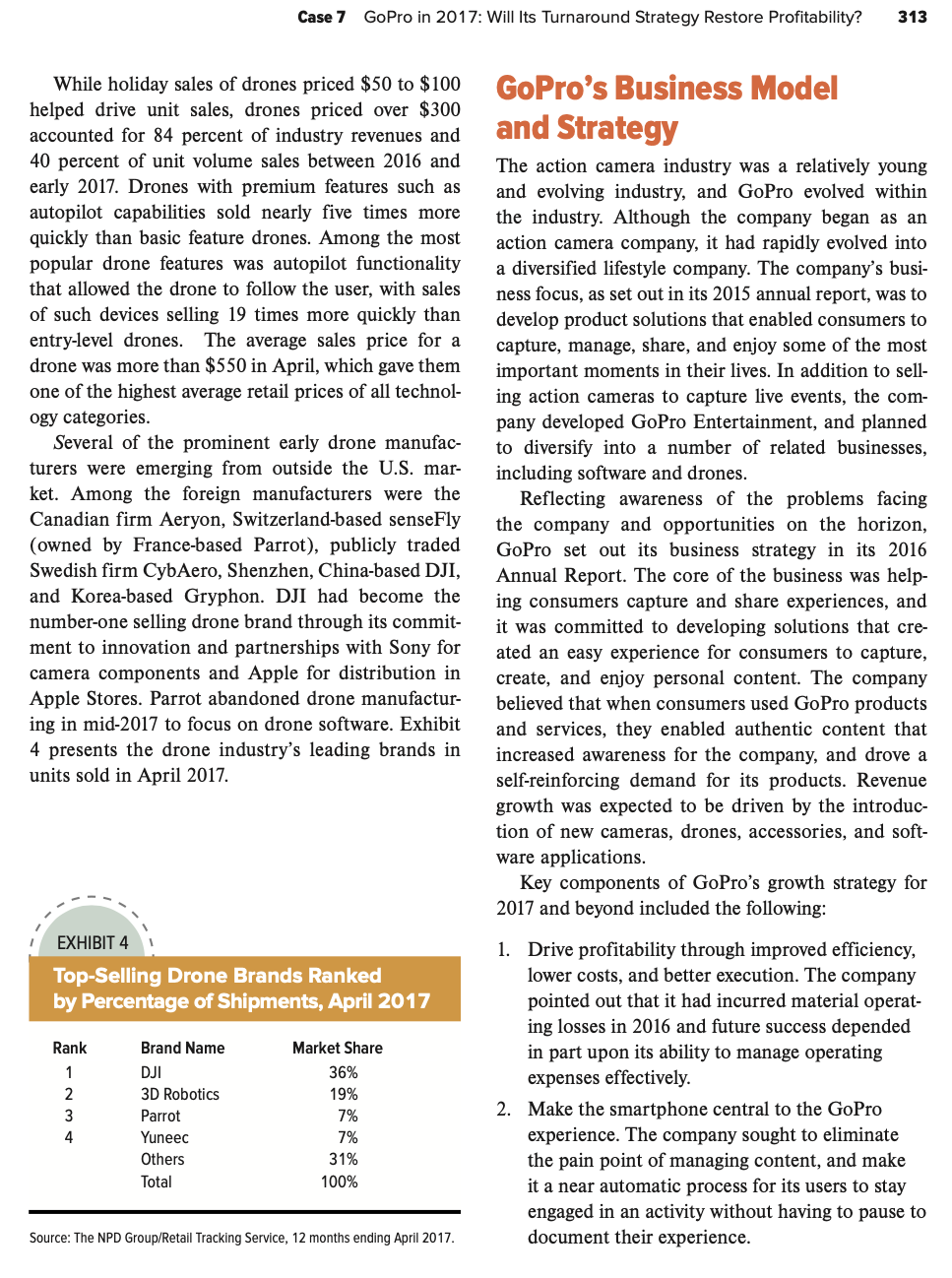

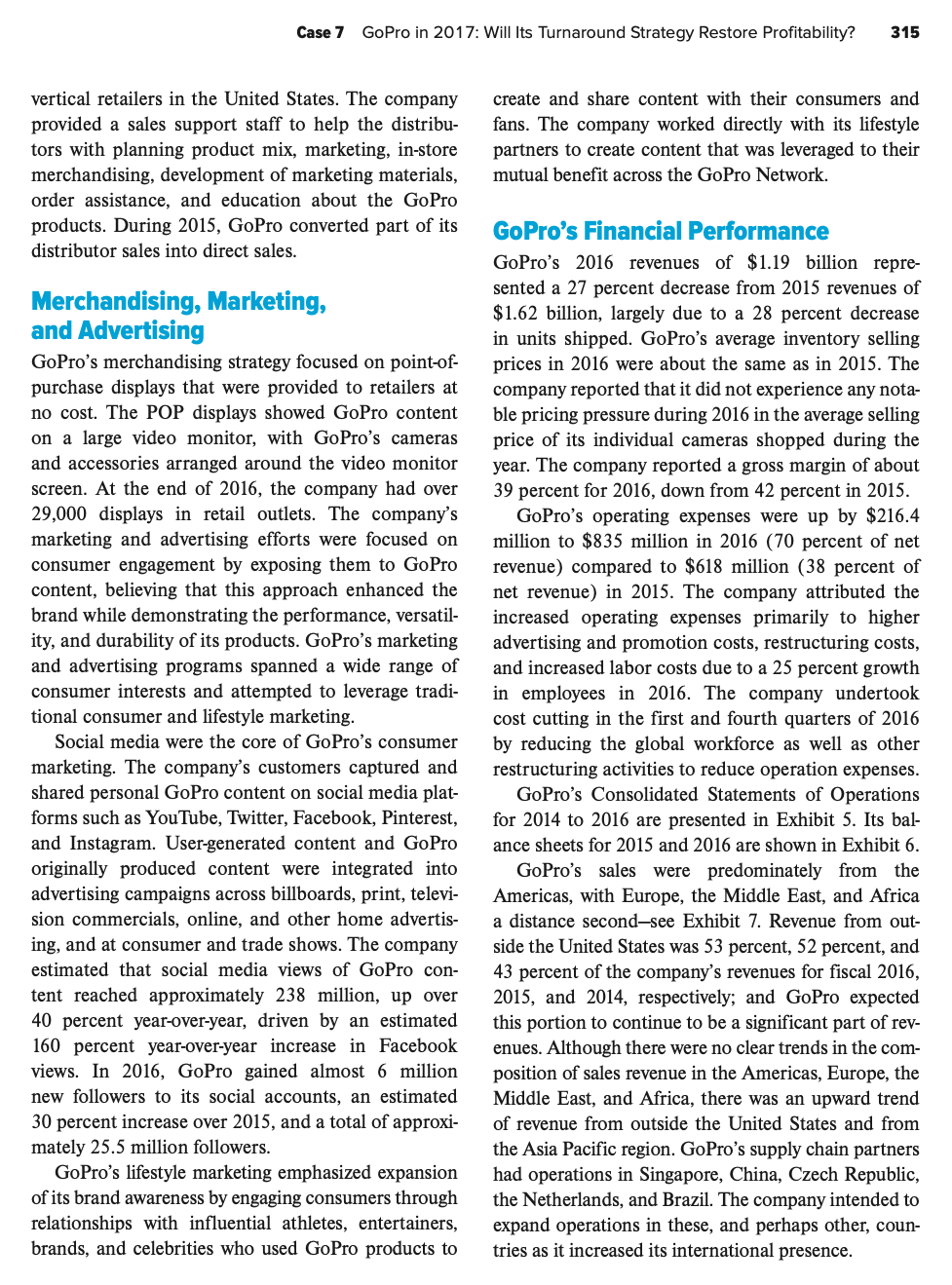

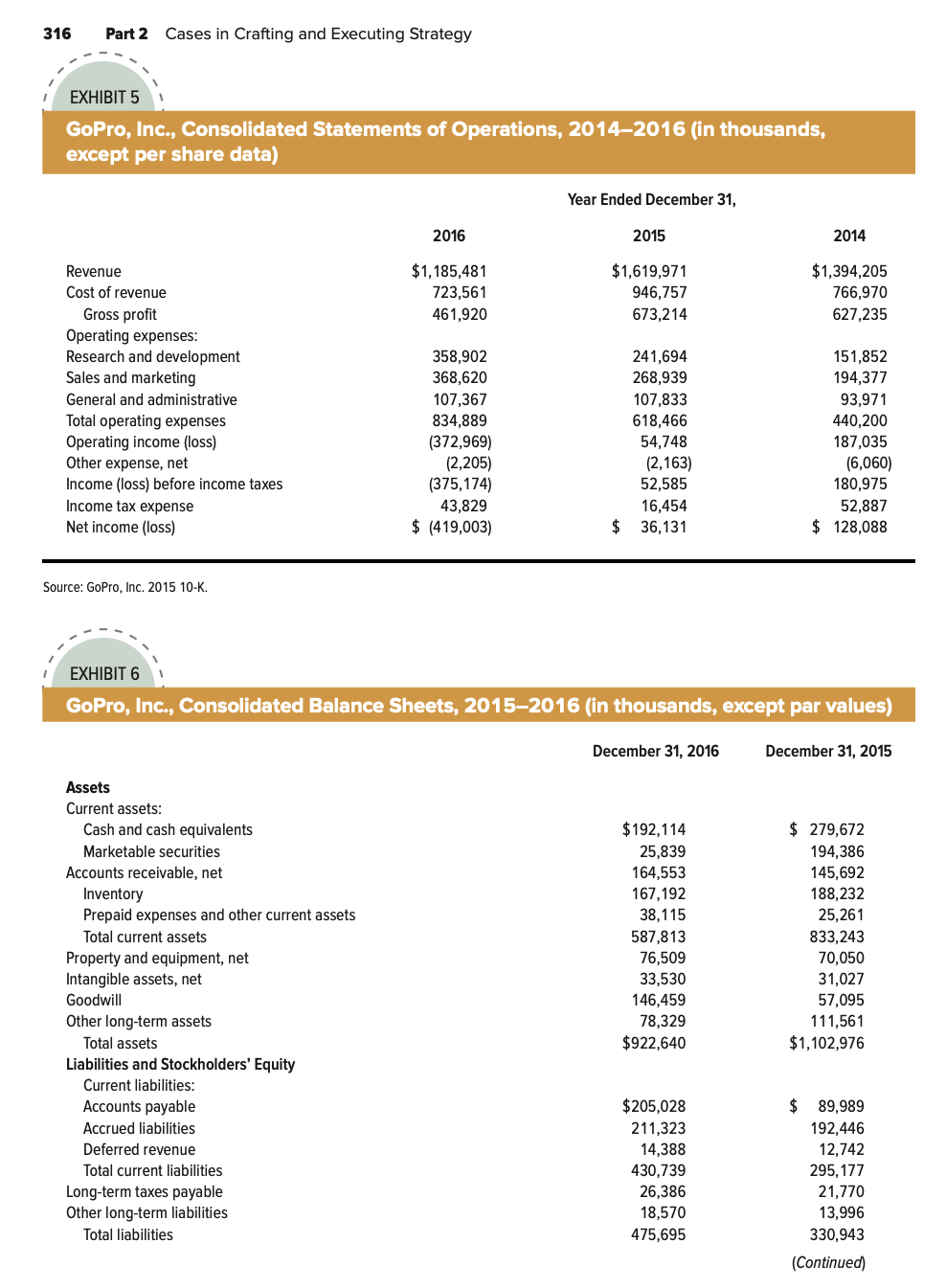

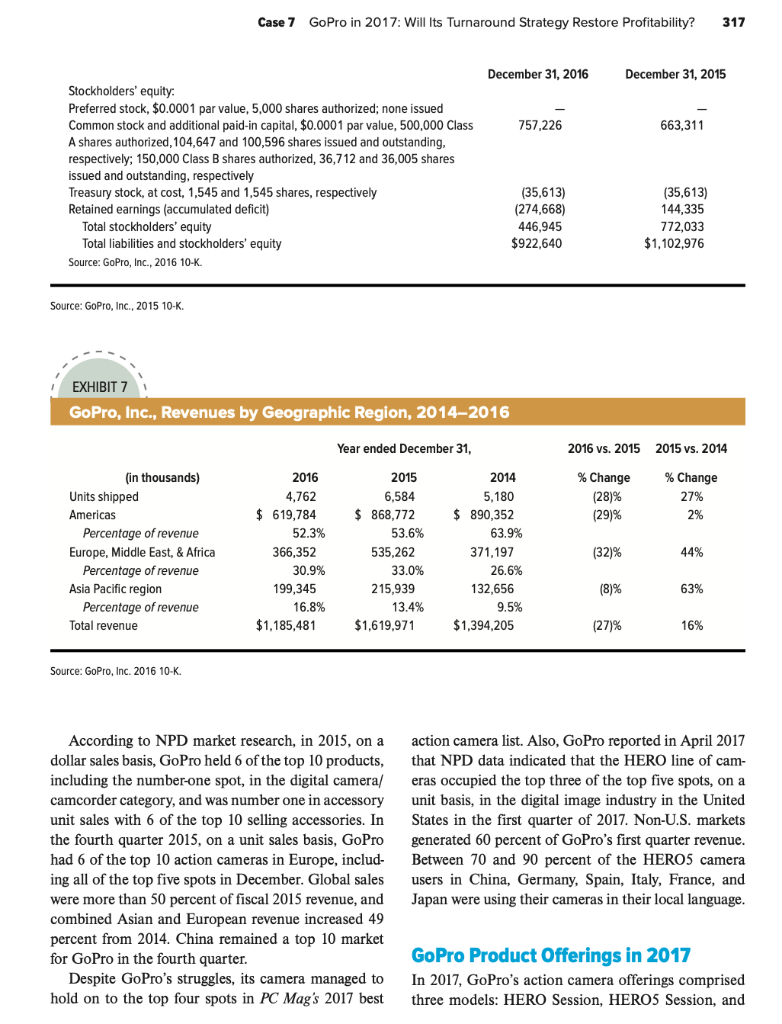

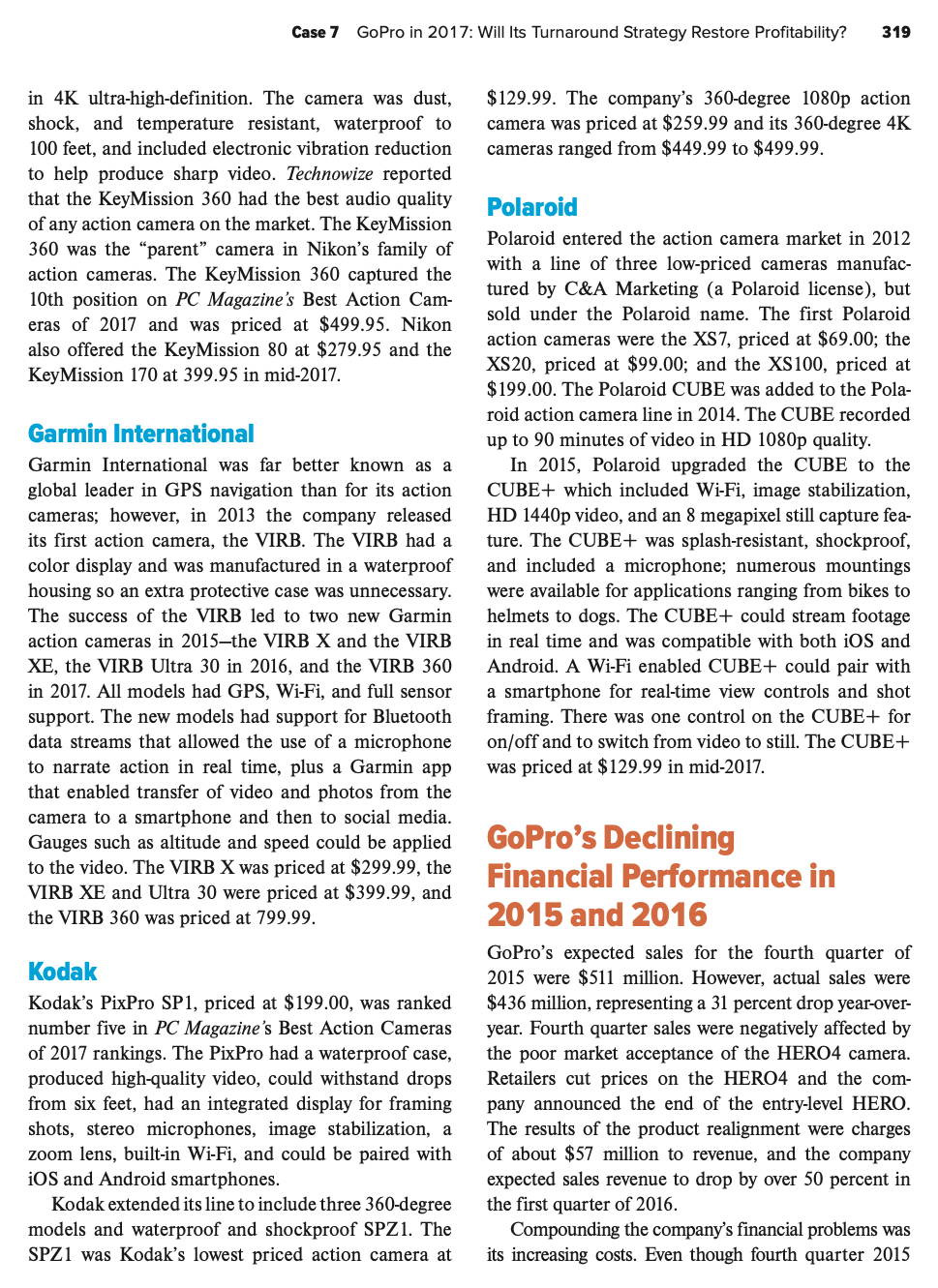

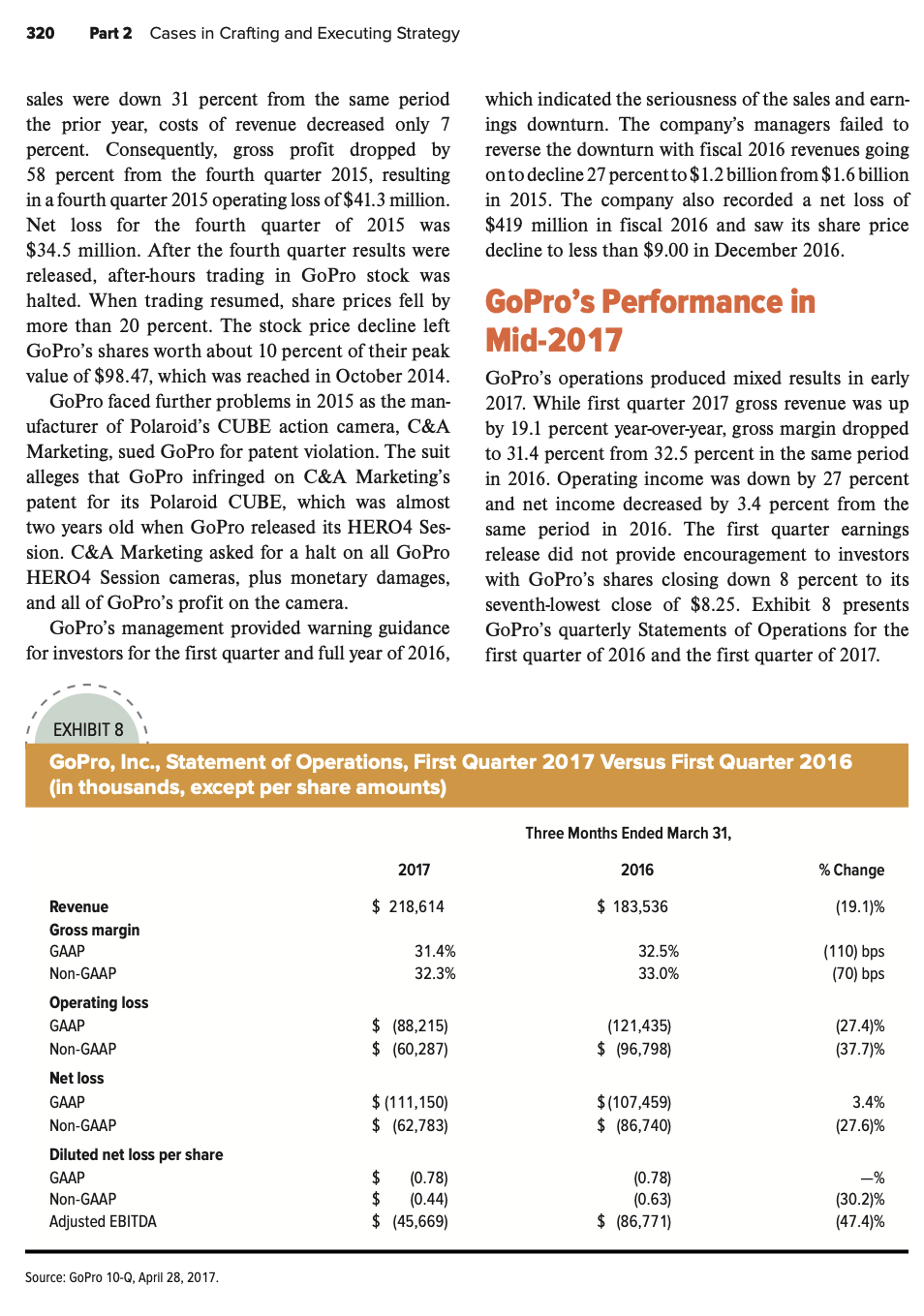

Gopro in 2017: Wi11 Its Turnaround Strategy Restore Profitability? contect DAVID L. TURNIPSEED University of South Alabama JOHN E. GAMBLE Texas A\&M University-Corpus Christi GoPro had been among the best examples of how The company launched a turnaround plan in a company could create a new market based upon early 2017 to reverse its decline, with its first quarter product innovations that customers understood and sales in 2017 increasing by 19 percent from the first demanded. However, by late-2015, the action camera quarter 2016 and its operating expenses declining by product niche appeared saturated. The company had $50 million. Its adjusted EBITDA improved from grown from a humble beginning as a homemade cam- a \$87 million loss in the first quarter of 2016 to a era tether and plastic case vendor in 2004 to an action $46 million loss in the first quarter of 2017. The camera vendor with $350,000 in sales in 2005 (its first improvement was driven by a trade-up program that full year of operation) to a global seller of consumer provided GoPro owners with $100 off a HERO5 electronics with revenue of $1.6 billion in 2015 . The Black or $50 off a HERO5 Session when they traded company's shares had traded as high as $98 in October in a previous generation GoPro camera and growth 2014, just months after its initial public offering (IPO) in international markets. The HERO5 Black was the in June 2014. In 2014, GoPro was ranked number best-selling digital image camera in the United States one most popular brand on YouTube with more than in the first quarter of 2017 and GoPro's drone Karma 640 million views, and an average of 845,000 views daily. with the HERO5 camera was the number-two selling In 2015, average daily views were up to 1.01 million. drone priced over $1,000 in the United States. DurAbruptly, in the third quarter of 2015, GoPro's ing first quarter of 2017, 60 percent of the company's magic disappeared and, by the fourth quarter of revenue was generated outside the United States and 2015 , its revenues dropped by 31 percent from between 70 percent and 90 percent of GoPro camera the prior year. In addition, its net income fell by users in international markets used cameras in their 128 percent to a net loss of $34.5 million. By the end local language. In addition, its Quik mobile video of December 2015, the stock traded at less than $20. editing app had been installed 5.2 million times in the The plummet continued, and by the end of Decem- first quarter of 2017 and its active users had increased ber 2016, revenues had dropped another 27 percent by 160 percent from the same period in 2016. to $1.2 billion from $1.6 billion in 2015 . In addition, Although the first quarter offered promising signs the company recorded a net loss of $419 million of a turnaround, it was far too early to know if the first in fiscal 2016, helping drive its share price to less quarter 2017 improvement was sustainable. Many than $9.00 in December 2016. A summary of the investors and industry observers viewed the action company's financial performance for 2011 through camera market as an overly saturated niche. In fact, the 2016 is presented in Exhibit 1. The performance of first quarter improvement in financial performance GoPro's shares from June 2014 through July 2017 is presented in Exhibit 2. (c) Copyright 2017 David L. Turnipseed and John E. Gamble. All rights Financial Summary for CoPro, Inc., 2011-2016 (in thousands, except per share amounts) Source: GoPro, Inc., 2016 10-K. had yet to reverse the company's downward trend in which failed, and subsequently started an online gamits stock price performance as of mid-2017. ing service, Funbug, that failed in the dot-com crash of 2001 , costing investors $3.9 million. Woodman consoled himself after the failure of Funbug with an extended surfing vacation in Indonesia and Australia. GoPro began as the result of business failures. While on vacation, he fashioned a wrist strap from a GoPro's founder, Nick Woodman, grew up in Silicon broken surfboard leash and rubber bands to attach a Valley, the son of wealthy parents (his father bro- disposable Kodak camera to his wrist while on the kered the purchase of Taco Bell by Pepsi). Woodman water. Woodman's friend and current GoPro creative started an online electronics store, EmpowerAll.com, director, Brad Schmidt, joined the vacation, worked Case 7 GoPro in 2017: Will Its Turnaround Strategy Restore Profitability? 309 with the camera strap, and observed that Woodman company) which enabled Woodman, his family, needed a camera that could withstand the sea. and some GoPro executives to take cash from the After his vacation, Woodman returned home and company. Also in 2011, GoPro acquired CineForm, focused on developing a comprehensive camera, cas- a small company that had developed a proprietary ing, and strap package for surfers. Originally incor- codex that quickly and easily converted digital video porated as Woodman Labs, the company began files among different formats. CineForm had used doing business in 2004 as GoPro. Woodman found this codex in several movies including Need for Speed a 35-mm camera made in China that cost \$3.05, and Slumdog Millionaire. As part of GoPro, Cineand sent his homemade plastic case and $5,000 to Form altered its 3-D footage tool into an editing an unknown company, Hotax. A few months later, program that became the company's first desktop Woodman received his renderings and a 3-D model application, GoPro Studio. from the company, and sold his first GoPro camera In December 2012 a Taiwanese manufacturing in September 2004, at an action-sports trade show. company, Foxconn (trading as Hone Hai Precision Also that year, GoPro hired its first employee, Neil Industry Co.), bought 8.8 percent of GoPro for Dana, who was Woodman's college roommate. $200 million, which brought the value of the priThe two-man company grossed $350,000 in 2005 , vately held company to about $2.25 billion, and the first full year of operation. Woodman wanted Forbes reported Woodman's personal net worth to be to keep the company private as long as possible: he about $1.73 billion. GoPro sold 2.3 million cameras invested $30,000 personally, his mother contributed and grossed $531 million in 2012; and in December $35,000, and his father added $200,000. In a for- of that year, GoPro replaced Sony as the highesttunate coincidence for GoPro, in fall 2006 Google selling camera brand at Best Buy. purchased a then-small company, YouTube, and in Sales of GoPro cameras at snow-sports retailers spring 2007 the GoPro HERO3 with VGA video was increased by 50 percent for the 2012-2013 ski sealaunched. According to Woodman, the competing son. GoPro almost doubled its revenues in each of name-brand cameras available at the time did not three consecutive years, from $234.2 million in have good video quality. The combination of GoPro's 2011 , to $525 million in 2012 , and $985 million in HERO3 video quality and the increasing popularity 2013, according to the U.S. Securities and Exchange of YouTube caused GoPro's sales to triple in 2007. Commission (SEC). Although revenues increased In 2007, although the company had revenues in 87 percent in 2013, in that year the decrease in revthe low seven figures, Woodman began to question enue growth became obvious. According to its IPO his ability to take the firm further. He negotiated a filing, as of December 2013 the company had not deal to turn the company over to a group of outside derived any revenue from the distribution of its coninvestors, but before the deal was finalized (which tent on the GoPro Network; however, it announced was at the beginning of the 2008 financial crisis), the plans to pursue new streams of revenue from the investors wanted to lower the valuation of the com- distribution of GoPro content. GoPro formed a pany. GoPro was profitable, and Woodman did not new software division in 2013. Also in that year, the believe that the company was having any ill effects National Academy of Television Arts and Sciences from the economy. He refused to negotiate the com- recognized the company with a Technology and pany's value down, and the company's sales were Engineering Emmy Award in the Inexpensive Small over $8 million that year. The company's growth con- Rugged HD Camera category. tinued and in 2010, Best Buy began carrying GoPro In June 2014, GoPro went public at an IPO price products, which was a clear indication that the com- of $24.00 which valued the company at $2.7 billion. pany was accepted in the market. The IPO included a lockup agreement that prevented In May 2011, GoPro received $88 million in the Woodmans from selling any shares of GoPro investments from five venture capital firms (includ- stock for six months; four months later on October 2 , ing Steamboat Ventures-Disney's venture capital 2014 , the Woodmans made a donation of 5.8 million shares of GoPro stock into the Jill and Nick Wood- people don't even watch their GoPro footage. He man Foundation. A press release about the founda- blamed the company for creating the problem by tion stated that details about its mission would be solving the capture side but leaving customers hangannounced at a later date, according to CNN. Share ing in postproduction. prices dropped 14 percent after the announcement In April 2016, the investment bank Piper Jaffray and angered investors. Also, GoPro failed to meet reported that GoPro was gaining market share in investors' expectations when it released its first earn- a declining market, and that action camera ownings report in August 2014. ership declined to 28 percent among teenage conGoPro increased emphasis on software and video sumers, down from 31 percent a year previous, and sharing in 2015. In that year, GoPro tied with Apple 40 percent in 2013. This trend clearly indicated the on the Google Brand Leaderboard, which measures need for GoPro to transform into something more the most popular brands on YouTube. According to than an action camera company. The GoPro brand Google, more than 4.6 years of content was uploaded and reputation had been made as a hardware comto YouTube in 2015 with GoPro in the title, an increase pany, and moving that reputation to a new market of 22 percent from 2014. Also in 2015, the company (i.e., software) would be difficult. Although GoPro launched the GoPro Channel on Amazon Fire TV created the market for wearable cameras, it found the and Fire TV Stick with a custom-designed streaming content-creation software field crowded. Plus, The channel that was a one-stop destination for delivering Verge (June 2, 2016) pointed out that the company on-demand GoPro videos to Amazon customers. had no clear way to monetize its software. AccordAnother 2015 development was the GoPro Chan- ing to Woodman, building the software team had nel on the PlayStation Network which allowed PlaySta- been the most time-consuming project the company tion owners to stream GoPro content on-demand, and had undertaken. He believed that the benefits of browse GoPro cameras and accessories. PlayStation success would be large because the amount of video joined GoPro's growing roster of distribution partners being consumed was huge, and the market research including Amazon Fire TV, Roku, Comcast Watch- company NPD Group reported that more than able, Sky, Vessel Entertainment, Xbox, LG, and Virgin 80 percent of smartphone users stream video. America. The GoPro Mobile App was downloaded Woodman also believed in the potential of Karma, 2.75 million times in the fourth quarter, totaling GoPro's camera drone, scheduled for release in almost 24 million cumulative downloads; Q4 installs early 2016. of GoPro Studio totaled nearly 1.7 million, totaling GoPro's third quarter 2016 performance produced over 15 million cumulative installs, with average daily large losses, with Woodman firing 15 percent of his video exports of over 49,000 in the fourth quarter. workforce. The company's president, Tony Bates, GoPro purchased Kolor, a French company announced plans to leave the company at year end with experience making software for capturing after little more than two years with the company. and displaying virtual reality in 2016, and acquired The Karma drone, which had been postponed several Replay and Splice, two leading mobile video edit- times, was eventually released in November 2016. ing apps. Replay was video editing software that Problems quickly became apparent with the droneGoPro rebranded as Quik, and Splice was an app it stopped flying and crashed-that required GoPro that promised desktop-level performance for editing to issue a recall and discontinue selling the product video on an iPhone. The Kolor group assisted in the until February 2017. Shortly after sales resumed, launch of a virtual reality social media platform that Woodman claimed that the drone was "exceeding functioned both on the web and as an app. Accord- our expectations" (Fortune, April 27, 2017). However, ing to The Verge (June 2, 2016), Woodman under- GoPro CFO, Brian McGee, said that the bulk of stood that "the hardware-first chapter of GoPro" Karma's sales had come from being bundled with the was coming to the end. He recognized that market HERO5 camera. According to McGee, GoPro made saturation had created the problem, explaining it more money from the sale of a camera than from the as "content guilt." According to Woodman, "Most sale of a drone. Case 7 GoPro in 2017: Will Its Turnaround Strategy Restore Profitability? 311 In early 2017, GoPro announced a new 360-degree EXHIBIT 3 camera, Fusion, but provided few details. The company planned a pilot release of Fusion in summer 2017, and a launch with a limited release at the end of 2017. According to Woodman, professional users would be the main market for Fusion, which was a much smaller market than the traditional consumers that had bought GoPro's other cameras. The Action Camera Industry from 2014 to 2017 Sales in the global action camera industry grew 44 percent in 2014 , reaching 7.6 million units, Source: Market Publishers Report Database, June 2017. and retail value of $3.2 billion. Camera unit sales increased by 38 percent in North America in 2014. However, the largest growth came from the Asia Pacific region, which was up by 114 percent. Sales of action cameras worldwide reached 10.5 million Another 2015 industry trend was price polarizain 2017, up from 8.4 million in 2015. Although the tion. Sales of low-end camera models priced under action camera market was expected to enjoy contin- $200.00 and high-end models (including GoPro's ued sales growth through at least 2019 , several fac- $499.00 HERO4 Black) experienced increasing tors, including lengthening replacement cycles, were growth. The action camera industry experienced expected to slow the growth rate. significant change in early 2015. A Futuresource Consumer sales, primarily for extreme sports, analyst reported that the 360-degree capture that had accounted for the largest part of global demand had recently become available would drive virtual up to mid-2015, but professional sales, primarily reality applications over the coming months, espedriven by TV production, security, and law enforce- cially for sports broadcasting. The company enviment, were expected to increase. In 2014, consum- sioned the percentage of 360-degree video action ers were responsible for 86 percent of action camera cameras growing from 1 percent in 2015 to 14 persales, with the remainder coming from professional cent by 2019 . In 2014, 95 percent of action camuses. Although GoPro dominated the action cam- eras sold could take high-definition video with at era industry in mid-2015, there was increased least 720p resolution, and approximately 85 percent competition from other companies, including Gar- of action cameras could take HD video in 1080p. min, TomTom, Canon, JVC, Ion America, Polaroid, About half of cameras sold could record video in and Sony. Other competitors were focusing on the ultra-high-definition 2160p, or 4K. adjacent market of wearable cameras for security In 2016, the action camera industry experienced and police officers. adjustments in usage: The demand for action cam- A defining characteristic of the action camera eras for professional applications had grown expoindustry in 2015 was the increase in the number of nentially due to the focus on better viewing of sports competitors. In early 2015 , the market was experienc- events. Action cameras were increasingly being used ing rapid growth and attracted many new entrants, for TV production and to record closer details of which had the expected effect on price (lower), qual- sports. The National Hockey League and Fishing ity (higher), and features (more). A list of produc- League Worldwide had signed major contracts with ers of action cameras in June 2017 is presented in iON, GoPro, and other vendors, and that profesExhibit 3. sional segment of the industry was expected to have a high growth rate. Also, Global Market Insights and numerous accessories) to increase demand for pointed out increasing popularity of action cameras cameras and accessories. Bundle packaging increased among all age groups and advanced product features demand by offering cost-effectiveness to customas other factors providing massive growth potential. ers because the bundling reduced or eliminated the The security industry was also finding increasing need to purchase additional equipment. Other indususage for action cameras in 2016, which added more try trends in 2017 were increasing numbers of new fuel to the industry growth. Action cameras and espe- entrants, which reduced prices, and increasing signifcially drone-mounted action cameras were expected icance of the smartphone with enhanced quality and to be used increasingly in security applications glob- features which depressed demand. The saturation ally. A leading vendor in the action camera-drones, of the action camera market niche and the declinLifeline Response, had developed a smartphone app ing prices contributed to the June 2017 bankruptcy that could fly a drone to a needed location in emer- filing of iON Worldwide, a major competitor in the gencies. According to Technavio Research, profes- industry. sional use of action cameras would exceed casual usage by 2020 . In addition to increased demand for action cam- eras for professional applications, the industry was expanding also due to demand from developing According to Gartner, the personal and commercial countries, with the largest growth in the Asia Pacific drone industry as measured by revenue increased region. Increasing disposable income, an increase by 35.6 percent between 2015 and 2016 to reach in social networking, and rapid growth in adven- $4.5 billion. Gartner projected industry revenue to ture sport tourism were factors increasing sales in increase an additional 34.3 percent between 2016 emerging countries. Several action camera vendors and 2017. Unit shipments in the industry increased sponsored extreme sporting events in various emerg- by 60.3 percent in 2016 when compared to 2015 shiping economies to promote their camera brands. ments and was projected to increase by 39.0 percent Although European growth was predicted to be between 2016 and 2017. The industry was expected to stable from 2016 to 2023, the global action camera grow to $11 billion in revenues by 2021 . market was projected to grow at an annual rate of The majority of personal drones were purchased 14.6 percent between 2017 and 2021 . for video and photography, while commercial drones The revenue growth rate in the action camera tended to be used for geographic information sysindustry was expected to be lower than the growth tem (GIS) mapping or delivery. The civilian drone rate in unit sales, due to a general price decline. The fleet was expected to grow from approximately one average action camera price is expected to decline million in 2016 to more than 3.5 million by 2011, to $226.00 by 2020 , depressed primarily by a global while the commercial drone fleet to increase from increase in supply. In the first quarter 2016, Tech- about 40,000 units in 2016 to 420,000 in 2021. navio forecast that the value, by revenue, of the global FAA regulations in 2017 limited commercial action camera industry, which was $2.35 billion drones to a select few industries and uses such as aerin 2015 , was expected to reach about $6 billion by ial surveying in the agriculture, mining, and oil and 2020. However, young consumers were increasingly gas sectors. However, emerging technologies such as choosing smartphone cameras over traditional, collision avoidance and geo-fencing would make drone which meant they were less likely to purchase an flying safer, and make regulators feel more comfortaction camera. able with larger numbers of drones taking to the skies. The popularity of social networking sites was a The military sector was expected to continue to lead major driver of the action camera industry in 2017 all other sectors in drone spending through 2024, due and price polarization continued as a crucial trend. to the high cost of military drones and the increasing Vendors began "bundling" their products (cameras number of countries seeking to acquire them. Case 7 GoPro in 2017: Will Its Turnaround Strategy Restore Profitability? 313 While holiday sales of drones priced $50 to $100 helped drive unit sales, drones priced over $300 GoPro's Business Model accounted for 84 percent of industry revenues and 40 percent of unit volume sales between 2016 and The action camera industry was a relatively young early 2017. Drones with premium features such as and evolving industry, and GoPro evolved within autopilot capabilities sold nearly five times more the industry. Although the company began as an quickly than basic feature drones. Among the most action camera company, it had rapidly evolved into popular drone features was autopilot functionality a diversified lifestyle company. The company's busithat allowed the drone to follow the user, with sales ness focus, as set out in its 2015 annual report, was to of such devices selling 19 times more quickly than develop product solutions that enabled consumers to entry-level drones. The average sales price for a capture, manage, share, and enjoy some of the most drone was more than $550 in April, which gave them important moments in their lives. In addition to sellone of the highest average retail prices of all technol- ing action cameras to capture live events, the comogy categories. pany developed GoPro Entertainment, and planned Several of the prominent early drone manufac- to diversify into a number of related businesses, turers were emerging from outside the U.S. mar- including software and drones. ket. Among the foreign manufacturers were the Reflecting awareness of the problems facing Canadian firm Aeryon, Switzerland-based senseFly the company and opportunities on the horizon, (owned by France-based Parrot), publicly traded GoPro set out its business strategy in its 2016 Swedish firm CybAero, Shenzhen, China-based DJI, Annual Report. The core of the business was helpand Korea-based Gryphon. DJI had become the ing consumers capture and share experiences, and number-one selling drone brand through its commit- it was committed to developing solutions that crement to innovation and partnerships with Sony for ated an easy experience for consumers to capture, camera components and Apple for distribution in create, and enjoy personal content. The company Apple Stores. Parrot abandoned drone manufactur- believed that when consumers used GoPro products ing in mid-2017 to focus on drone software. Exhibit and services, they enabled authentic content that 4 presents the drone industry's leading brands in increased awareness for the company, and drove a units sold in April 2017. self-reinforcing demand for its products. Revenue growth was expected to be driven by the introduction of new cameras, drones, accessories, and software applications. Key components of GoPro's growth strategy for 2017 and beyond included the following: 1. Drive profitability through improved efficiency, Top-Selling Drone Brands Ranked lower costs, and better execution. The company by Percentage of Shipments, April 2017 pointed out that it had incurred material operating losses in 2016 and future success depended in part upon its ability to manage operating expenses effectively. 2. Make the smartphone central to the GoPro experience. The company sought to eliminate the pain point of managing content, and make it a near automatic process for its users to stay engaged in an activity without having to pause to Source: The NPD Group/Retail Tracking Service, 12 months ending April 2017. document their experience. 314 Part 2 Cases in Crafting and Executing Strategy 3. Market the improved GoPro experience to their from 48 percent in 2015 to 45 percent in 2016. A extended community. The company believed small number of distributors and retailers accounted that the global market for enabling people to for a large portion of GoPro's revenue: the 10 largself-capture compelling photo and video content est customers (by revenue) contributed 50,52 , and of their everyday life was large. 52 percent of revenues in fiscal 2016, 2015, and 4. Grow the business internationally. GoPro believed 2014, respectively. that international markets represented a signifi- Direct Sales GoPro sold directly to large and cant growth opportunity. small retailers in the United States, Europe, the Middle 5. Expand the GoPro experience for advanced East, and Africa, and directly to consumers throughout users. The company intended to continue pursu- the world through its e-commerce channels. The coming its goal of developing the world's most versa- pany believed that diverse direct sales channels were a tile cameras, drones, and stabilization products. key differentiator for the company and it segregated its GoPro also increased its focus on solutions products among those channels. GoPro used independesigned to simplify organizing, editing, and sharing dent specialty retailers who generally carried highercontent, and planned release of a content manage- end products, and targeted its customers who were ment platform for 2017-the GoPro for Desktop- believed to be the early adopters of new technology. Bigwhich would facilitate offloading, accessing, and box retailers with a national presence such as Amazon, editing content. The company focused on product Walmart, Target, and Best Buy were a second compoleadership and innovation in its cameras, and also in nent of the direct sales channel. These retailers carried mounts, accessories, and batteries. a variety of GoPro products and targeted its particular GoPro's management envisioned the company end user. GoPro felt that this allowed the company to as an entertainment brand. The distribution of con- maintain in-store product differentiation between its tent originally produced by GoPro was referred to as sales channels and protected its brand image in the GoPro Entertainment, and the company attempted specialty retail markets. Amazon accounted for 11 perto leverage the sale of its cameras through GoPro cent and 12 percent of GoPro's total revenues in 2016 Entertainment. The company continued to invest in and 2015, respectively, compared to Best Buy with GoPro Entertainment by developing, distributing, 17 percent and 14 percent of GoPro's sales in 2016 and and promoting GoPro Entertainment programming 2015, respectively. on its own and partner platforms. Mid-market retailers with a large regional or New products for 2017 included the company's national presence were also part of GoPro's direct next-generation capture device, the HERO5, the GoPro sales channel. Retailers focusing on sporting goods, drone Karma, and devices to enable virtual reality consumer electronics, hunting, fishing, and motor content capture. In April 2017, NPD Group reported sports carried a small subset of GoPro products tarthat the Karma was the second best-selling drone over geted toward its end users. The full line of GoPro $1,000 in the United States based upon unit sales. products were sold directly to consumers through the company's online store, gopro.com. The company Sales Channels marketed its e-commerce channel through online and At the end of 2016, GoPro products were sold offline advertising. GoPro felt that its e-commerce through direct sales channels in sales provided insight into its customers' shopping tries and over 40,000 behavior and provided a platform from which the retail outlets. The company company could inform and educate its customers on the GoPro brand, products, and services. nel. The direct sales channel had gained slightly in 2016, providing 55 percent of revenue, compared to Indirect Sales/Distributors GoPro sold to 52 percent in 2015 . GoPro distributors accounted over 50 distributors who resold its products to retailfor the difference, with indirect sales decreasing ers in international markets and to some mid-market Case 7 GoPro in 2017: Will Its Turnaround Strategy Restore Profitability? 315 vertical retailers in the United States. The company create and share content with their consumers and provided a sales support staff to help the distribu- fans. The company worked directly with its lifestyle tors with planning product mix, marketing, in-store partners to create content that was leveraged to their merchandising, development of marketing materials, mutual benefit across the GoPro Network. order assistance, and education about the GoPro products. During 2015, GoPro converted part of its CoPro's Financial Performance distributor sales into direct sales. GoPro's 2016 revenues of $1.19 billion repreMerchandising, Marketing, sented a 27 percent decrease from 2015 revenues of GoPro's merchandising strategy focused on point-of- prices in 2016 were about the same as in 2015. The purchase displays that were provided to retailers at company reported that it did not experience any notano cost. The POP displays showed GoPro content ble pricing pressure during 2016 in the average selling on a large video monitor, with GoPro's cameras price of its individual cameras shopped during the and accessories arranged around the video monitor year. The company reported a gross margin of about screen. At the end of 2016 , the company had over 39 percent for 2016 , down from 42 percent in 2015. 29,000 displays in retail outlets. The company's GoPro's operating expenses were up by $216.4 marketing and advertising efforts were focused on million to $835 million in 2016 (70 percent of net consumer engagement by exposing them to GoPro revenue) compared to $618 million (38 percent of content, believing that this approach enhanced the net revenue) in 2015. The company attributed the brand while demonstrating the performance, versatil- increased operating expenses primarily to higher ity, and durability of its products. GoPro's marketing advertising and promotion costs, restructuring costs, and advertising programs spanned a wide range of and increased labor costs due to a 25 percent growth consumer interests and attempted to leverage tradi- in employees in 2016. The company undertook tional consumer and lifestyle marketing. cost cutting in the first and fourth quarters of 2016 Social media were the core of GoPro's consumer by reducing the global workforce as well as other marketing. The company's customers captured and restructuring activities to reduce operation expenses. shared personal GoPro content on social media plat- GoPro's Consolidated Statements of Operations forms such as YouTube, Twitter, Facebook, Pinterest, for 2014 to 2016 are presented in Exhibit 5. Its baland Instagram. User-generated content and GoPro ance sheets for 2015 and 2016 are shown in Exhibit 6. originally produced content were integrated into GoPro's sales were predominately from the advertising campaigns across billboards, print, televi- Americas, with Europe, the Middle East, and Africa sion commercials, online, and other home advertis- a distance second-see Exhibit 7. Revenue from outing, and at consumer and trade shows. The company side the United States was 53 percent, 52 percent, and estimated that social media views of GoPro con- 43 percent of the company's revenues for fiscal 2016 , tent reached approximately 238 million, up over 2015, and 2014, respectively; and GoPro expected 40 percent year-over-year, driven by an estimated this portion to continue to be a significant part of rev160 percent year-over-year increase in Facebook enues. Although there were no clear trends in the comviews. In 2016, GoPro gained almost 6 million position of sales revenue in the Americas, Europe, the new followers to its social accounts, an estimated Middle East, and Africa, there was an upward trend 30 percent increase over 2015 , and a total of approxi- of revenue from outside the United States and from mately 25.5 million followers. the Asia Pacific region. GoPro's supply chain partners GoPro's lifestyle marketing emphasized expansion had operations in Singapore, China, Czech Republic, of its brand awareness by engaging consumers through the Netherlands, and Brazil. The company intended to relationships with influential athletes, entertainers, expand operations in these, and perhaps other, counbrands, and celebrities who used GoPro products to tries as it increased its international presence. 316 Part 2 Cases in Crafting and Executing Strategy GoPro, Inc., Consolidated Statements of Operations, 2014-2016 (in thousands, except per share data) Source: GoPro, Inc. 2015 10-K. EXHIBIT 6 CoPro, Inc., Consolidated Balance Sheets, 20152016 (in thousands, except par values) Case 7 GoPro in 2017: Will Its Turnaround Strategy Restore Profitability? 317 Source: GoPro, Inc., 2015 10-K. Source: GoPro, Inc. 2016 10-K. According to NPD market research, in 2015, on a action camera list. Also, GoPro reported in April 2017 dollar sales basis, GoPro held 6 of the top 10 products, that NPD data indicated that the HERO line of camincluding the number-one spot, in the digital camera/ eras occupied the top three of the top five spots, on a camcorder category, and was number one in accessory unit basis, in the digital image industry in the United unit sales with 6 of the top 10 selling accessories. In States in the first quarter of 2017. Non-U.S. markets the fourth quarter 2015 , on a unit sales basis, GoPro generated 60 percent of GoPro's first quarter revenue. had 6 of the top 10 action cameras in Europe, includ- Between 70 and 90 percent of the HERO5 camera ing all of the top five spots in December. Global sales users in China, Germany, Spain, Italy, France, and were more than 50 percent of fiscal 2015 revenue, and Japan were using their cameras in their local language. combined Asian and European revenue increased 49 percent from 2014. China remained a top 10 market for GoPro in the fourth quarter. CoPro Product Offerings in 2017 Despite GoPro's struggles, its camera managed to In 2017, GoPro's action camera offerings comprised hold on to the top four spots in PC Mag's 2017 best three models: HERO Session, HERO5 Session, and 318 Part 2 Cases in Crafting and Executing Strategy HERO5 Black. The HERO Session had one-button Other products in the GoPro line in 2017 included: controls, was waterproof to 10 meters without a sepa- - GoPro Plus: a cloud-based storage solution that rate housing, and would automatically capture video enabled subscribers to access, edit, and share and photos right-side-up even if mounted upside down. The HERO Session was small, the lightest of content. HERO5 cameras could automatically all GoPro cameras, and could record up to two hours upload new photos and videos to subscribers' on a charged battery. The Session was ranked as the GoPro cloud accounts. fourth (of the 10 ranked) best action camera by PC - Quik: GoPro's primary mobile editing app that Magazine in 2017 and sold for $149.99 in mid-2017. simplified smartphone edits. The HERO5 Session was a very small camera - Capture: a mobile app that allowed users to that could be operated with simple voice commands. preview and play back shots, control their GoPro It could record in 4K video, with 10MP photos in cameras and share content using smartphones. single, burst, or time-lapse modes. The HERO5 Ses- - Karma Grip: a handheld or body-mountable sion was waterproof to 10 meters, featured advanced camera stabilizer that helped achieve zero-shake video stabilization, and had one-button control. Own- ers could purchase a GoPro Plus subscription and - Accessories: GoPro offered a large line of mountupload their photos and videos directly to the cloud able, wearable, and voice-activated accessories. and review, edit, and share their content on the go. The HERO5 Session placed third on PC Magazine's 2017 list and sold for $299.99 in mid-2017. GoPro's HERO5 Black was the company's most Profiles of Select Rivals advanced camera. The HERO5 Black had advanced in hhe tcion cameralhdusts video stabilization, was waterproof to 10 meters, had time-lapse capability, built-in Wi-Fi and Bluetooth, a in 2017 smart remote that allowed multiple camera control Sony up to 600 feet, enhanced low-light capability, and Sony competed in the action camera market with a could capture high-fidelity sound. The HERO5 Black lineup of nine cameras ranging in price from $199.99 sold for $399.99. to $599.99. The Sony X1000VR was the company's The Karma drone went on sale in October 2016 top of the line and was a 4K camera with a 170 after numerous delays. Purchasers immediately wide-angle lens and professional quality output. The noticed that the drone experienced battery overheat- camera recorded at a high rate to give better resoluing and flight failure. Two and a half weeks after tion and better low-light pictures. Sony's AS20 and GoPro began selling the Karma, the company halted AS50 were the company's entry-level products and sales and announced a recall of the drone. Purchas- produced high-definition video and still images, and ers were given full refunds, plus, as an apology, included SteadyShot stabilization, low-light capabiliGoPro provided purchasers a HERO5 Black camera. ties, and a panoramic lens. Other models included According to Nick Woodman, a defective battery was built-in stereo microphones, high-speed data transfer not secured in its hanger. The problem was corrected to capture fast action, HDMI output for sharing video and Karma was released again in February 2017. on TVs, and wireless uploading to smartphones or In mid-2017, the Karma was priced at $799.99 or tablets. $1,099.99 with a HERO5 included. GoPro's Omni was a virtual reality system, operated with six cameras. Video footage from the cameras could be put together to create a 360-degree Camera giant Nikon announced in January 2016 video. The Omni was priced at $4,999.00 (which that it was entering the action camera market. The included 6 HERO4 Black cameras), or $1,199.99 for company's first in its line of action cameras was the purchasers who already owned the cameras. KeyMission 360, which recorded 360-degree video Case 7 GoPro in 2017: Will Its Turnaround Strategy Restore Profitability? 319 in 4K ultra-high-definition. The camera was dust, $129.99. The company's 360-degree 1080p action shock, and temperature resistant, waterproof to camera was priced at $259.99 and its 360 -degree 4K 100 feet, and included electronic vibration reduction cameras ranged from $449.99 to $499.99. to help produce sharp video. Technowize reported that the KeyMission 360 had the best audio quality of any action camera on the market. The KeyMission Polsoid 360 was the "parent" camera in Nikon's family of Polaroid entered the action camera market in 2012 action cameras. The KeyMission 360 captured the with a line of three low-priced cameras manufac10th position on PC Magazine's Best Action Cam- tured by C\&A Marketing (a Polaroid license), but eras of 2017 and was priced at $499.95. Nikon sold under the Polaroid name. The first Polaroid also offered the KeyMission 80 at $279.95 and the action cameras were the XS 7 , priced at $69.00; the KeyMission 170 at 399.95 in mid-2017. XS20, priced at $99.00; and the XS100, priced at $199.00. The Polaroid CUBE was added to the Polaroid action camera line in 2014 . The CUBE recorded Carmin International up to 90 minutes of video in HD 1080p quality. Garmin International was far better known as a In 2015, Polaroid upgraded the CUBE to the global leader in GPS navigation than for its action CUBE+ which included Wi-Fi, image stabilization, cameras; however, in 2013 the company released HD 1440p video, and an 8 megapixel still capture feaits first action camera, the VIRB. The VIRB had a ture. The CUBE+ was splash-resistant, shockproof, color display and was manufactured in a waterproof and included a microphone; numerous mountings housing so an extra protective case was unnecessary. were available for applications ranging from bikes to The success of the VIRB led to two new Garmin helmets to dogs. The CUBE+ could stream footage action cameras in 2015-the VIRB X and the VIRB in real time and was compatible with both iOS and XE, the VIRB Ultra 30 in 2016 , and the VIRB 360 Android. A Wi-Fi enabled CUBE+ could pair with in 2017. All models had GPS, Wi-Fi, and full sensor a smartphone for real-time view controls and shot support. The new models had support for Bluetooth framing. There was one control on the CUBE+ for data streams that allowed the use of a microphone on/off and to switch from video to still. The CUBE+ to narrate action in real time, plus a Garmin app was priced at $129.99 in mid-2017. that enabled transfer of video and photos from the camera to a smartphone and then to social media. Gauges such as altitude and speed could be applied Co:ros Dechilio to the video. The VIRB X was priced at $299.99, the VIRB XE and Ultra 30 were priced at $399.99, and the VIRB 360 was priced at 799.99. 2015 and 2016 Godals GoPro's expected sales for the fourth quarter of Kodak 2015 were $511 million. However, actual sales were Kodak's PixPro SP1, priced at $199.00, was ranked $436 million, representing a 31 percent drop year-overnumber five in PC Magazine's Best Action Cameras year. Fourth quarter sales were negatively affected by of 2017 rankings. The PixPro had a waterproof case, the poor market acceptance of the HERO4 camera. produced high-quality video, could withstand drops Retailers cut prices on the HERO4 and the comfrom six feet, had an integrated display for framing pany announced the end of the entry-level HERO. shots, stereo microphones, image stabilization, a The results of the product realignment were charges zoom lens, built-in Wi-Fi, and could be paired with of about $57 million to revenue, and the company iOS and Android smartphones. expected sales revenue to drop by over 50 percent in Kodak extended its line to include three 360-degree the first quarter of 2016. models and waterproof and shockproof SPZ1. The Compounding the company's financial problems was SPZ1 was Kodak's lowest priced action camera at its increasing costs. Even though fourth quarter 2015 sales were down 31 percent from the same period which indicated the seriousness of the sales and earnthe prior year, costs of revenue decreased only 7 ings downturn. The company's managers failed to percent. Consequently, gross profit dropped by reverse the downturn with fiscal 2016 revenues going 58 percent from the fourth quarter 2015, resulting on to decline 27 percent to $1.2 billion from $1.6 billion in a fourth quarter 2015 operating loss of $41.3 million. in 2015 . The company also recorded a net loss of Net loss for the fourth quarter of 2015 was $419 million in fiscal 2016 and saw its share price $34.5 million. After the fourth quarter results were decline to less than $9.00 in December 2016 . released, after-hours trading in GoPro stock was halted. When trading resumed, share prices fell by copro's Performance in more than 20 percent. The stock price decline left GoPro's shares worth about 10 percent of their peak vid-2017 value of $98.47, which was reached in October 2014. GoPro's operations produced mixed results in early GoPro faced further problems in 2015 as the man- 2017. While first quarter 2017 gross revenue was up ufacturer of Polaroid's CUBE action camera, C\&A by 19.1 percent year-over-year, gross margin dropped Marketing, sued GoPro for patent violation. The suit to 31.4 percent from 32.5 percent in the same period alleges that GoPro infringed on C\&A Marketing's in 2016. Operating income was down by 27 percent patent for its Polaroid CUBE, which was almost and net income decreased by 3.4 percent from the two years old when GoPro released its HERO4 Ses- same period in 2016. The first quarter earnings sion. C\&A Marketing asked for a halt on all GoPro release did not provide encouragement to investors HERO4 Session cameras, plus monetary damages, with GoPro's shares closing down 8 percent to its and all of GoPro's profit on the camera. seventh-lowest close of $8.25. Exhibit 8 presents GoPro's management provided warning guidance GoPro's quarterly Statements of Operations for the for investors for the first quarter and full year of 2016, first quarter of 2016 and the first quarter of 2017. EXHIBIT 8 GoPro, Inc., Statement of Operations, First Quarter 2017 Versus First Quarter 2016 (in thousands, except per share amounts) Source: GoPro 10-Q, April 28, 2017. Case 7 GoPro in 2017: Will Its Turnaround Strategy Restore Profitability? 321 The NPD Group's Retail Tracking Service cutting would make it difficult for GoPro to compete reported that in the United States, in the first quarter given its cost structure and poor financial condition. 2017, GoPro had three of the top five-including the GoPro offered guidance for the second quarter top three spots-on a unit basis in the digital image of 2017, which included revenue of $270 million, category. The HERO5 Black was the top-selling +/$10 million and gross margins of 33.5 percent, digital image camera in the United States in the first +/1 percent. The company intended to continue quarter on both a unit and dollar basis. According to focus on expense reduction, and forecast second to NPD, in March 2017, the Karma drone with a quarter operating expenses at $122 million to $126 HERO5 camera, was the second best-selling drone million. The adjusted EBITDA was forecast to range over $1,000 in the United States on a unit basis. from a $15 million to $5 million. Despite the Although the Karma drone was achieving early mar- financial weaknesses, GoPro remained the leader in ket success in mid-2017, analysts were cautious about the action camera industry in mid-2017. The ability what contribution its sales would make to GoPro's of its top management to craft and execute strategies overall financial situation. Although the hobby market to sustain its market leadership in action cameras, for drones was large, Chinese DJI had a commanding gain market share in drone applications, and develop lead in the industry and was known to aggressively future innovations would determine the success of its cut its prices to defend its market position. Such price turnaround. What are the strategically relevant factors in GoPro's macro-environment? What does a PESTE analysis reveal about the action camera in 2017? Does the external environment of the drone industry present attractive opportunities to GoPro? What is your assessment of GoPro's business model and competitive strategy? Does its approach to delivering customer value contribute to a sustainable competitive advantage? What are GoPro's key resources and competitive capabilities? What is the competitive power o its most important competitive assets? What is your assessment of GoPro's financial performance the past three years? (Use the financial ratios in the Appendix of the text as a guide in doing your financial analysis.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock