Question: Note: After the closing process was completed, David Spencer used Reversing Entries to bring his books back into line for the following month. Adjustments (

Note: After the closing process was completed, David Spencer used Reversing Entries to bring his books back into line for the following month. Adjustments e and f were accruals and so were reversed. Adjustment b was a deferral which was initially recorded in a temporary account so it was also reversed. This note is for information only. You do not need to do the reversing entries.

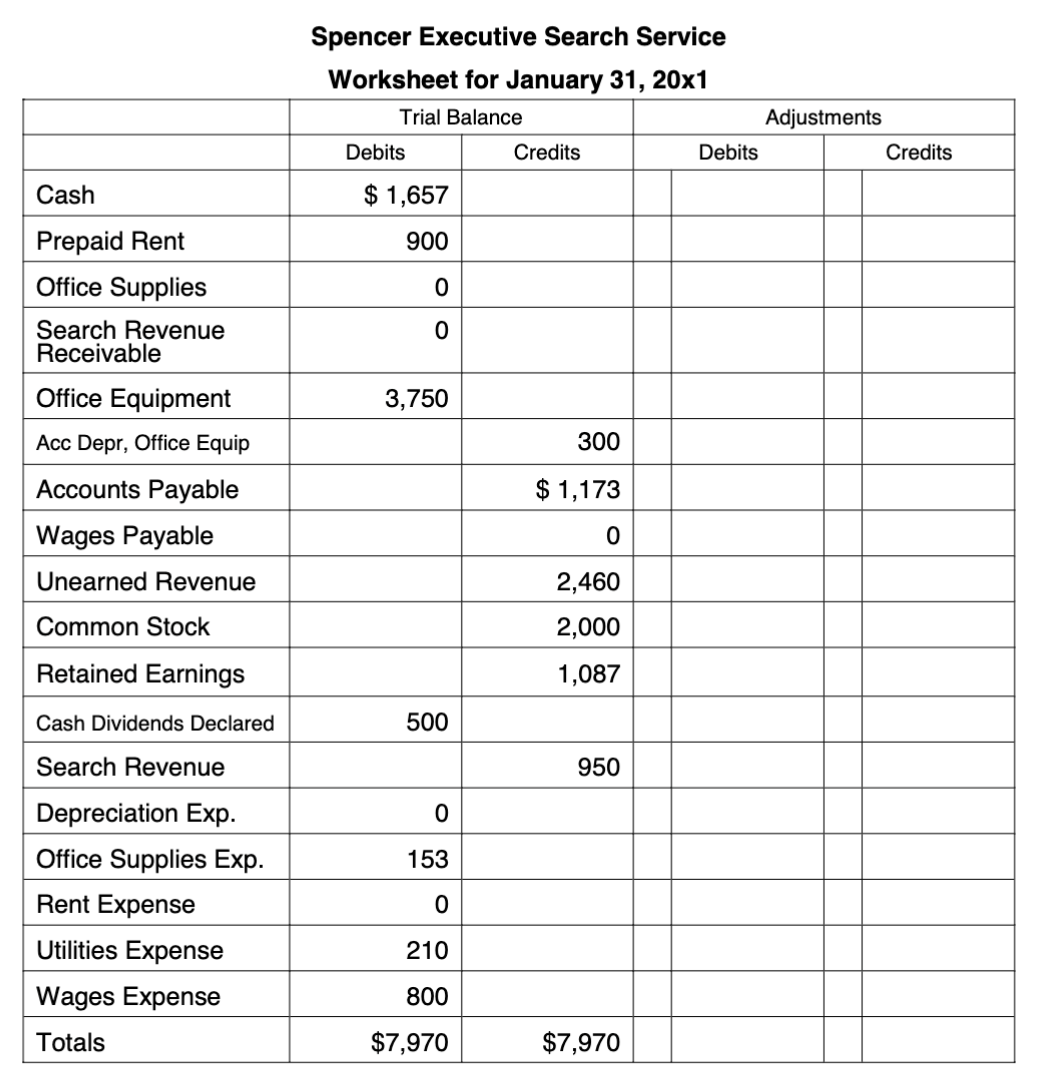

Using the information below, enter the adjustments into the proper debit and credit columns. Check your totals after each entry to be sure your transactions balance.

AOne months rent has been used up since the last worksheet was done.

B Inventory of unused office supplies, $

COne months depreciation of office equipment, $

DService rendered that had been paid for in advance from December has now been earned, $

EExecutive search services rendered during the month but not yet billed, $

FWages earned by employees but not yet paid, $

Each Journal and financial statement should have completed its self with the formulas and cell references you entered in Problem If you have cells with numbers instead of references or formulas, fix them now.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock