Question: *Note: can you give me a detailed Excel calculation (command included ) , thank you very much Questions: 1. Diamond Inc. is considering a proposal

*Note: can you give me a detailed Excel calculation (command included ) , thank you very much

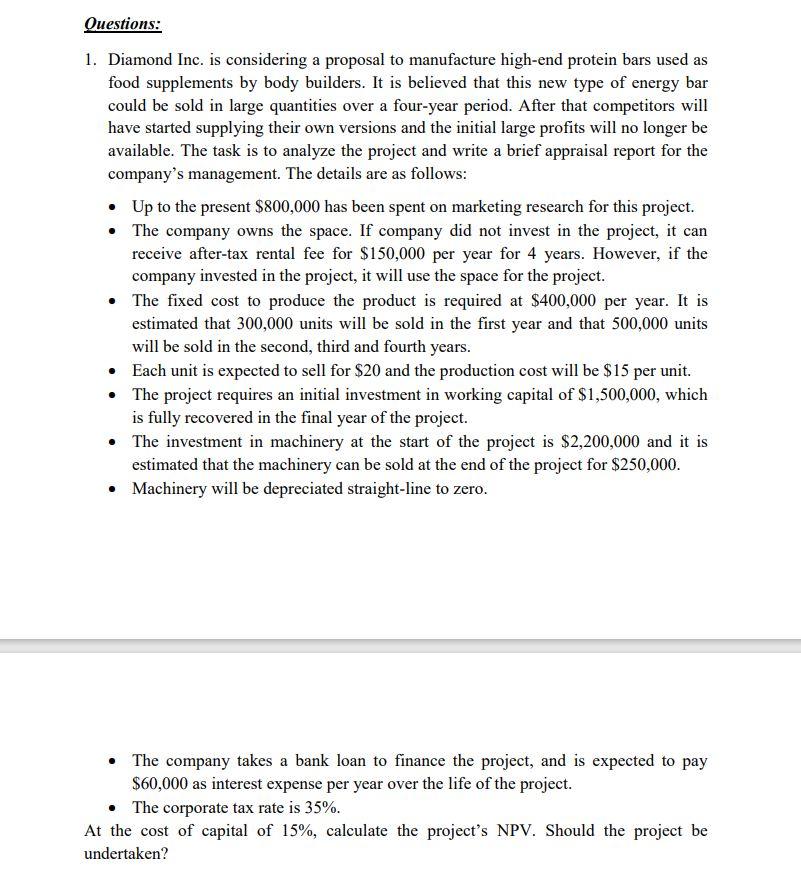

Questions: 1. Diamond Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. It is believed that this new type of energy bar could be sold in large quantities over a four-year period. After that competitors will have started supplying their own versions and the initial large profits will no longer be available. The task is to analyze the project and write a brief appraisal report for the company's management. The details are as follows: Up to the present $800,000 has been spent on marketing research for this project. The company owns the space. If company did not invest in the project, it can receive after-tax rental fee for $150,000 per year for 4 years. However, if the company invested in the project, it will use the space for the project. The fixed cost to produce the product is required at $400,000 per year. It is estimated that 300,000 units will be sold in the first year and that 500,000 units will be sold in the second third and fourth years. Each unit is expected to sell for $20 and the production cost will be $15 per unit. The project requires an initial investment in working capital of $1,500,000, which is fully recovered in the final year of the project. The investment in machinery at the start of the project is $2,200,000 and it is estimated that the machinery can be sold at the end of the project for $250,000. Machinery will be depreciated straight-line to zero. The company takes a bank loan to finance the project, and is expected to pay $60,000 as interest expense per year over the life of the project. The corporate tax rate is 35%. At the cost of capital of 15%, calculate the project's NPV. Should the project be undertaken

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts