Question: note: correct answer shows 2.92. Please show me work so that I can learn how to put work into excel. thanks, At the beginning of

note: correct answer shows 2.92. Please show me work so that I can learn how to put work into excel.

thanks,

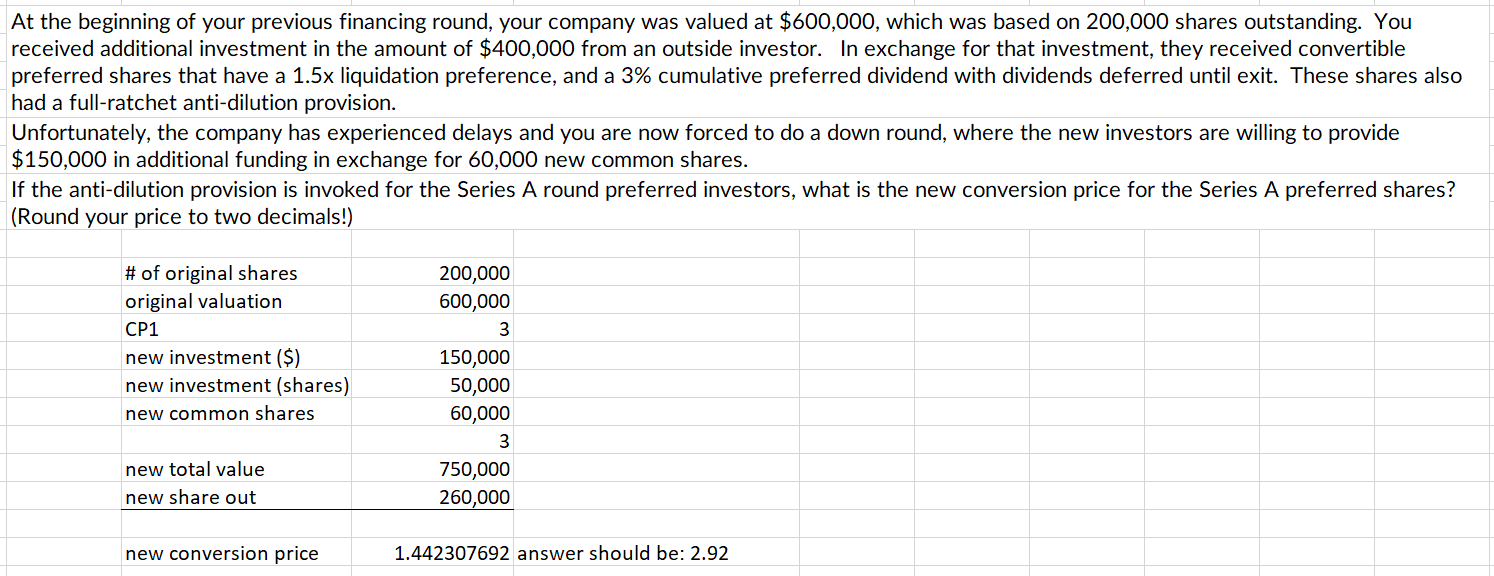

At the beginning of your previous financing round, your company was valued at $600,000, which was based on 200,000 shares outstanding. You received additional investment in the amount of $400,000 from an outside investor. In exchange for that investment, they received convertible preferred shares that have a 1.5x liquidation preference, and a 3% cumulative preferred dividend with dividends deferred until exit. These shares also had a full-ratchet anti-dilution provision. Unfortunately, the company has experienced delays and you are now forced to do a down round, where the new investors are willing to provide $150,000 in additional funding in exchange for 60,000 new common shares. If the anti-dilution provision is invoked for the Series A round preferred investors, what is the new conversion price for the Series A preferred shares? (Round your price to two decimals!)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts