Question: Note: Correct answer to calculations-based questions will only be awarded full mark if clearly stated numerical formula (including the left-hand side of the equation) is

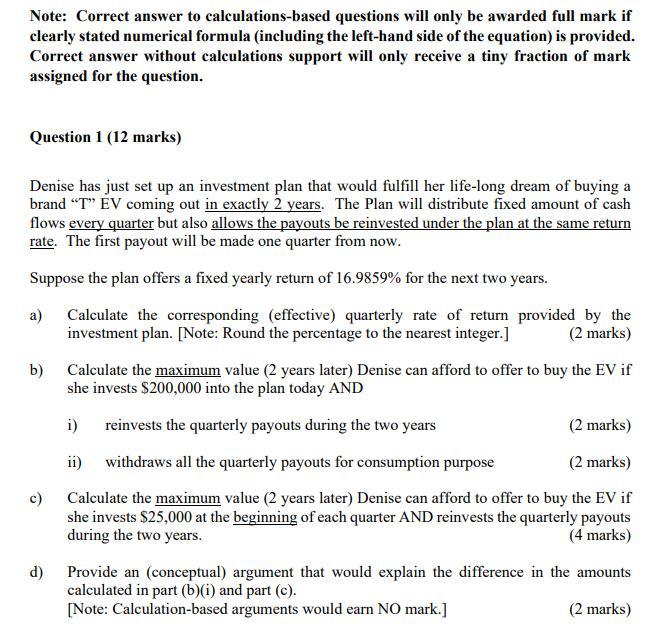

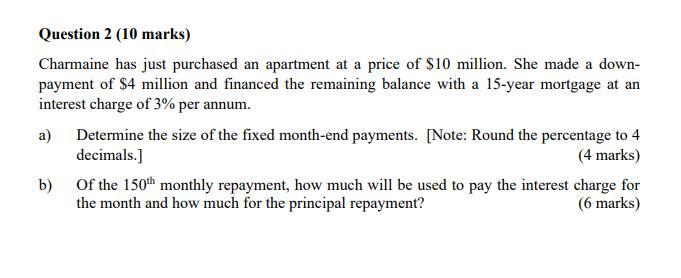

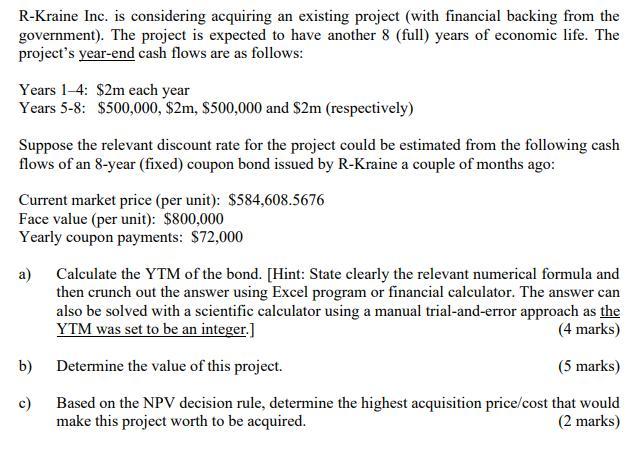

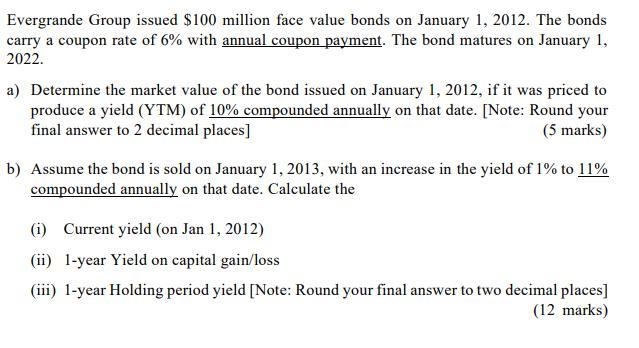

Note: Correct answer to calculations-based questions will only be awarded full mark if clearly stated numerical formula (including the left-hand side of the equation) is provided. Correct answer without calculations support will only receive a tiny fraction of mark assigned for the question. Question 1 (12 marks) Denise has just set up an investment plan that would fulfill her life-long dream of buying a brand "T" EV coming out in exactly 2 years. The Plan will distribute fixed amount of cash flows every quarter but also allows the payouts be reinvested under the plan at the same return rate. The first payout will be made one quarter from now. Suppose the plan offers a fixed yearly return of 16.9859% for the next two years. a) Calculate the corresponding (effective) quarterly rate of return provided by the investment plan. [Note: Round the percentage to the nearest integer.] (2 marks) b) Calculate the maximum value (2 years later) Denise can afford to offer to buy the EV if she invests $200,000 into the plan today AND i) reinvests the quarterly payouts during the two years (2 marks) ii) withdraws all the quarterly payouts for consumption purpose (2 marks) c) Calculate the maximum value (2 years later) Denise can afford to offer to buy the EV if she invests $25,000 at the beginning of each quarter AND reinvests the quarterly payouts during the two years. (4 marks) d) Provide an (conceptual) argument that would explain the difference in the amounts calculated in part (b)(i) and part (c). [Note: Calculation-based arguments would earn NO mark.] (2 marks) Question 2 (10 marks) Charmaine has just purchased an apartment at a price of $10 million. She made a down- payment of $4 million and financed the remaining balance with a 15-year mortgage at an interest charge of 3% per annum. a) Determine the size of the fixed month-end payments. [Note: Round the percentage to 4 decimals.] (4 marks) b) of the 150th monthly repayment, how much will be used to pay the interest charge for the month and how much for the principal repayment? (6 marks) R-Kraine Inc. is considering acquiring an existing project (with financial backing from the government). The project is expected to have another 8 (full) years of economic life. The project's year-end cash flows are as follows: Years 1-4: $2m each year Years 5-8: $500,000, $2m, $500,000 and $2m (respectively) Suppose the relevant discount rate for the project could be estimated from the following cash flows of an 8-year (fixed) coupon bond issued by R-Kraine a couple of months ago: Current market price (per unit): $584,608.5676 Face value (per unit): $800,000 Yearly coupon payments: $72,000 a) Calculate the YTM of the bond. [Hint: State clearly the relevant numerical formula and then crunch out the answer using Excel program or financial calculator. The answer can also be solved with a scientific calculator using a manual trial-and-error approach as the YTM was set to be an integer.] (4 marks) Determine the value of this project. (5 marks) Based on the NPV decision rule, determine the highest acquisition price/cost that would make this project worth to be acquired. (2 marks) b) c) Evergrande Group issued $100 million face value bonds on January 1, 2012. The bonds carry a coupon rate of 6% with annual coupon payment. The bond matures on January 1, 2022. a) Determine the market value of the bond issued on January 1, 2012, if it was priced to produce a yield (YTM) of 10% compounded annually on that date. [Note: Round your final answer to 2 decimal places] (5 marks) b) Assume the bond is sold on January 1, 2013, with an increase in the yield of 1% to 11% compounded annually on that date. Calculate the (1) Current yield (on Jan 1, 2012) (ii) 1-year Yield on capital gain/loss (iii) 1-year Holding period yield [Note: Round your final answer to two decimal places] (12 marks) Note: Correct answer to calculations-based questions will only be awarded full mark if clearly stated numerical formula (including the left-hand side of the equation) is provided. Correct answer without calculations support will only receive a tiny fraction of mark assigned for the question. Question 1 (12 marks) Denise has just set up an investment plan that would fulfill her life-long dream of buying a brand "T" EV coming out in exactly 2 years. The Plan will distribute fixed amount of cash flows every quarter but also allows the payouts be reinvested under the plan at the same return rate. The first payout will be made one quarter from now. Suppose the plan offers a fixed yearly return of 16.9859% for the next two years. a) Calculate the corresponding (effective) quarterly rate of return provided by the investment plan. [Note: Round the percentage to the nearest integer.] (2 marks) b) Calculate the maximum value (2 years later) Denise can afford to offer to buy the EV if she invests $200,000 into the plan today AND i) reinvests the quarterly payouts during the two years (2 marks) ii) withdraws all the quarterly payouts for consumption purpose (2 marks) c) Calculate the maximum value (2 years later) Denise can afford to offer to buy the EV if she invests $25,000 at the beginning of each quarter AND reinvests the quarterly payouts during the two years. (4 marks) d) Provide an (conceptual) argument that would explain the difference in the amounts calculated in part (b)(i) and part (c). [Note: Calculation-based arguments would earn NO mark.] (2 marks) Question 2 (10 marks) Charmaine has just purchased an apartment at a price of $10 million. She made a down- payment of $4 million and financed the remaining balance with a 15-year mortgage at an interest charge of 3% per annum. a) Determine the size of the fixed month-end payments. [Note: Round the percentage to 4 decimals.] (4 marks) b) of the 150th monthly repayment, how much will be used to pay the interest charge for the month and how much for the principal repayment? (6 marks) R-Kraine Inc. is considering acquiring an existing project (with financial backing from the government). The project is expected to have another 8 (full) years of economic life. The project's year-end cash flows are as follows: Years 1-4: $2m each year Years 5-8: $500,000, $2m, $500,000 and $2m (respectively) Suppose the relevant discount rate for the project could be estimated from the following cash flows of an 8-year (fixed) coupon bond issued by R-Kraine a couple of months ago: Current market price (per unit): $584,608.5676 Face value (per unit): $800,000 Yearly coupon payments: $72,000 a) Calculate the YTM of the bond. [Hint: State clearly the relevant numerical formula and then crunch out the answer using Excel program or financial calculator. The answer can also be solved with a scientific calculator using a manual trial-and-error approach as the YTM was set to be an integer.] (4 marks) Determine the value of this project. (5 marks) Based on the NPV decision rule, determine the highest acquisition price/cost that would make this project worth to be acquired. (2 marks) b) c) Evergrande Group issued $100 million face value bonds on January 1, 2012. The bonds carry a coupon rate of 6% with annual coupon payment. The bond matures on January 1, 2022. a) Determine the market value of the bond issued on January 1, 2012, if it was priced to produce a yield (YTM) of 10% compounded annually on that date. [Note: Round your final answer to 2 decimal places] (5 marks) b) Assume the bond is sold on January 1, 2013, with an increase in the yield of 1% to 11% compounded annually on that date. Calculate the (1) Current yield (on Jan 1, 2012) (ii) 1-year Yield on capital gain/loss (iii) 1-year Holding period yield [Note: Round your final answer to two decimal places] (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts