Question: Note: Do not calculate anything. Just set everything up please! Van der LInde Inc. is considering investing $1114 in new equipment that will fall into

Note: Do not calculate anything. Just set everything up please!

Van der LInde Inc. is considering investing $1114 in new equipment that will fall into the 7-year MACRS class. The equipment would be installed in an empty building the firm purchased two years ago for $1000 that it was planning to sell for $1200. Assume that the vacant building has been depreciated on a straight-line basis over a 10-year horizon to a salvage value of $0 and that this years depreciation has already been recognized. If Van der LInde buys the equipment, it will no longer sell the building. The new equipment is expected to generate revenues of $5144 one year from today and revenues would grow at an annual rate of 8%. Variable costs would equal 75% of sales and fixed costs will equal $1071 per year beginning a year from today. If Van der LInde invests in the new equipment, the working capital associated with the new equipment will be as shown below. If Van der LIndes corporate tax rate equals 21%, set up the equations and plug in the relevant numbers needed to calculate the firms unlevered net income and free cash flow today and three years from today if it invests in the new equipment.

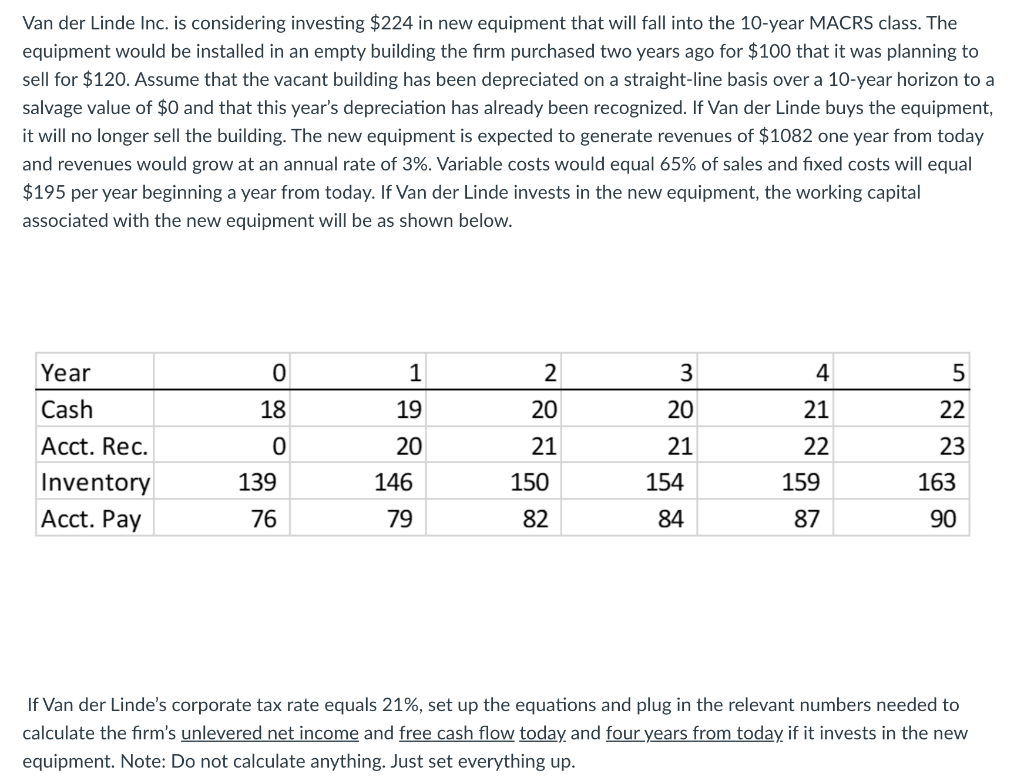

Van der Linde Inc. is considering investing $224 in new equipment that will fall into the 10-year MACRS class. The equipment would be installed in an empty building the firm purchased two years ago for $100 that it was planning to sell for $120. Assume that the vacant building has been depreciated on a straight-line basis over a 10-year horizon to a salvage value of $0 and that this year's depreciation has already been recognized. If Van der Linde buys the equipment, it will no longer sell the building. The new equipment is expected to generate revenues of $1082 one year from today and revenues would grow at an annual rate of 3%. Variable costs would equal 65% of sales and fixed costs will equal $195 per year beginning a year from today. If Van der Linde invests in the new equipment, the working capital associated with the new equipment will be as shown below. 0 2 3 4 5 1 19 18 20 20 21 22 Year Cash Acct. Rec. Inventory Acct. Pay 0 21 20 146 21 154 22 159 23 163 139 150 76 79 82 84 87 90 If Van der Linde's corporate tax rate equals 21%, set up the equations and plug in the relevant numbers needed to calculate the firm's unlevered net income and free cash flow today and four years from today if it invests in the new equipment. Note: Do not calculate anything. Just set everything up. Van der Linde Inc. is considering investing $224 in new equipment that will fall into the 10-year MACRS class. The equipment would be installed in an empty building the firm purchased two years ago for $100 that it was planning to sell for $120. Assume that the vacant building has been depreciated on a straight-line basis over a 10-year horizon to a salvage value of $0 and that this year's depreciation has already been recognized. If Van der Linde buys the equipment, it will no longer sell the building. The new equipment is expected to generate revenues of $1082 one year from today and revenues would grow at an annual rate of 3%. Variable costs would equal 65% of sales and fixed costs will equal $195 per year beginning a year from today. If Van der Linde invests in the new equipment, the working capital associated with the new equipment will be as shown below. 0 2 3 4 5 1 19 18 20 20 21 22 Year Cash Acct. Rec. Inventory Acct. Pay 0 21 20 146 21 154 22 159 23 163 139 150 76 79 82 84 87 90 If Van der Linde's corporate tax rate equals 21%, set up the equations and plug in the relevant numbers needed to calculate the firm's unlevered net income and free cash flow today and four years from today if it invests in the new equipment. Note: Do not calculate anything. Just set everything up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts