Question: NOTE: Do not round until the final answer. List all final answers with 2 decimal points and proper rounding. Show your work for partial credit.

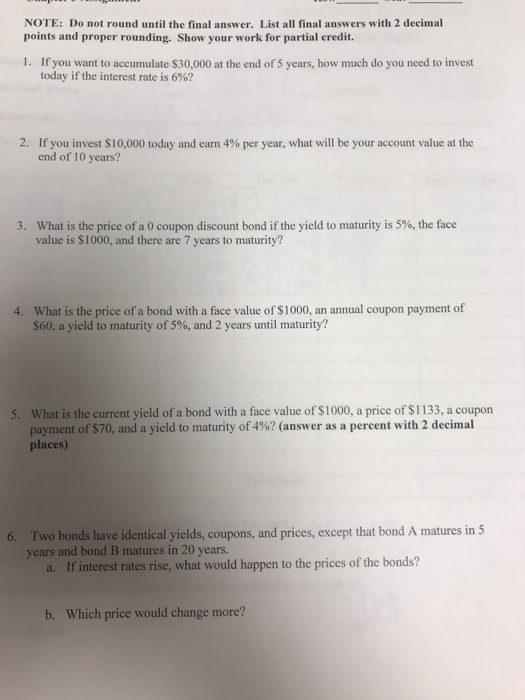

NOTE: Do not round until the final answer. List all final answers with 2 decimal points and proper rounding. Show your work for partial credit. 1. If you want to accumulate $30,000 at the end of 5 years, how much do you need to invest today if the interest rate is 6%? 2. If you invest $10,000 today and earn 4% per year, what will be your account value at the end of 10 years? what is the price of a 0 coupon discount bond if the yield to maturity is 5%, the face value is $1000, and there are 7 years to maturity? 3, 4. What is the price of a bond with a face value of $1000, an annual coupon payment of 60, a yield to maturity of 5%, and 2 years until maturity? What is the current yield of a bond with a face value of $1000, a price of $1133, a coupon payment of $70, and a yield to maturity of4%? (answer as a percent with 2 decimal places) 5. Two bonds have identical yields, coupons, and prices, except that bond A matures in 5 years and bond B matures in 20 years. 6. a. If interest rates rise, what would happen to the prices of the bonds? b. Which price would change more

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts