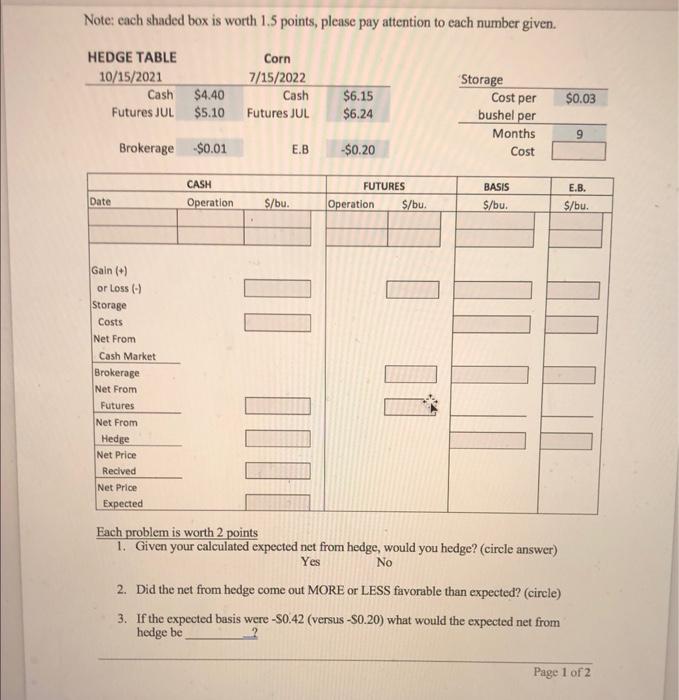

Question: Note: each shaded box is worth 1.5 points, please pay attention to each number given. HEDGE TABLE 10/15/2021 Cash $4.40 Futures JUL $5.10 Corn 7/15/2022

Note: each shaded box is worth 1.5 points, please pay attention to each number given. HEDGE TABLE 10/15/2021 Cash $4.40 Futures JUL $5.10 Corn 7/15/2022 Cash Futures JUL $6.15 $6.24 $0.03 'Storage Cost per bushel per Months Cost 9 Brokerage $0.01 E.B $0.20 CASH Date $/bu. FUTURES Operation $/bu. BASIS $/bu. Operation E.B. $/bu. Gain (+) or Loss (-) Storage Costs Net From Cash Market Brokerage Net From Futures Net From Hedge Net Price Recived Net Price Expected DOLO IO ULLI Each problem is worth 2 points 1. Given your calculated expected net from hedge, would you hedge? (circle answer) Yes No 2. Did the net from hedge come out MORE or LESS favorable than expected? (circle) 3. If the expected basis were -S0.42 (versus -S0.20) what would the expected net from hedge be Page 1 of 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts