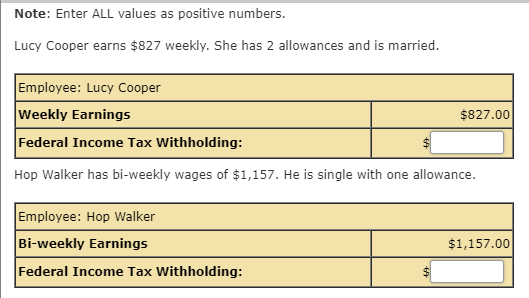

Question: Note: Enter ALL values as positive numbers. Lucy Cooper earns $827 weekly. She has 2 allowances and is married. Employee: Lucy Cooper Weekly Earnings Federal

Note: Enter ALL values as positive numbers. Lucy Cooper earns $827 weekly. She has 2 allowances and is married. Employee: Lucy Cooper Weekly Earnings Federal Income Tax Withholding: Hop Walker has bi-weekly wages of $1,157. He is single with one allowance. Employee: Hop Walker Bi-weekly Earnings Federal Income Tax Withholding: $827.00 $1,157.00 Note: Enter ALL values as positive numbers. Lucy Cooper earns $827 weekly. She has 2 allowances and is married. Employee: Lucy Cooper Weekly Earnings Federal Income Tax Withholding: Hop Walker has bi-weekly wages of $1,157. He is single with one allowance. Employee: Hop Walker Bi-weekly Earnings Federal Income Tax Withholding: $827.00 $1,157.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts