Question: (NOTE: ENTER YOUR ANSWER WITHOUT THE $ AND COMMA, ROUNDED TO THE NEAREST DOLLAR, for instance as 10023, not as $10,022.78. Make sure you include

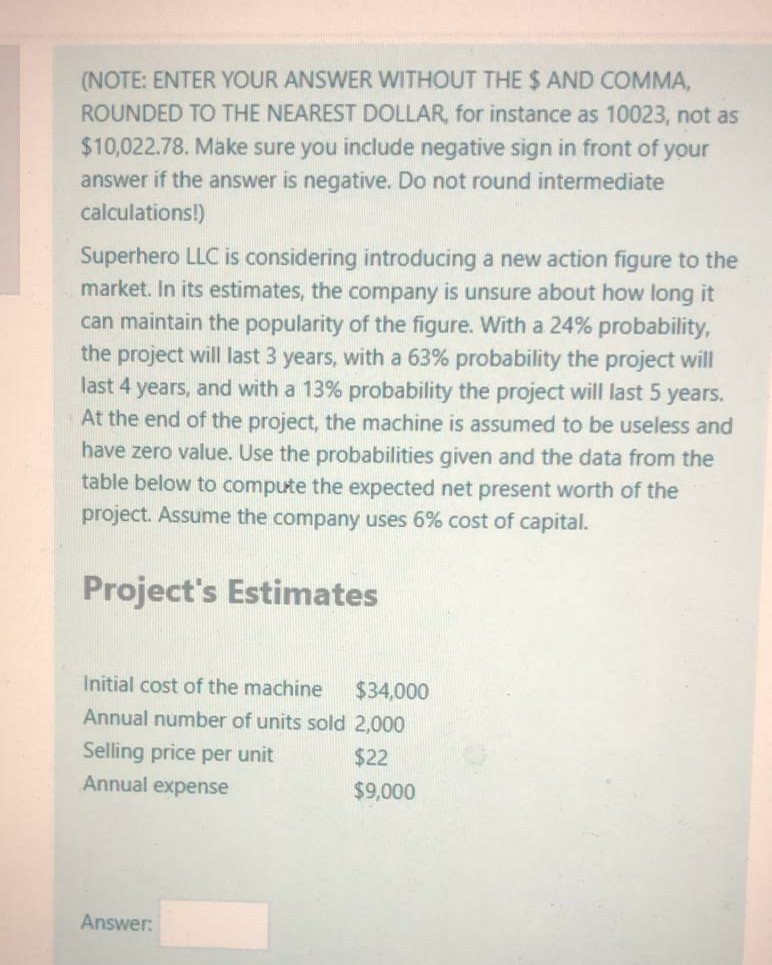

(NOTE: ENTER YOUR ANSWER WITHOUT THE $ AND COMMA, ROUNDED TO THE NEAREST DOLLAR, for instance as 10023, not as $10,022.78. Make sure you include negative sign in front of your answer if the answer is negative. Do not round intermediate calculations!) Superhero LLC is considering introducing a new action figure to the market. In its estimates, the company is unsure about how long it can maintain the popularity of the figure. With a 24% probability, the project will last 3 years, with a 63% probability the project will last 4 years, and with a 13% probability the project will last 5 years. At the end of the project, the machine is assumed to be useless and have zero value. Use the probabilities given and the data from the table below to compute the expected net present worth of the project. Assume the company uses 6% cost of capital. Project's Estimates Initial cost of the machine $34,000 Annual number of units sold 2,000 Selling price per unit $22 Annual expense $9,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts