Question: Note: Fer each calculatien step ( lecluding intermediate stepsl. retain tiwe decimal places without rounding. Frovide your final answers with twe decimal places, witheot rounding.

Note: Fer each calculatien step lecluding intermediate stepsl. retain tiwe decimal places without rounding. Frovide your final answers with twe decimal places, witheot rounding. Fleave note that no credit will be given Rer approsimate answers derived frem calculations that do net adhere to the fwodecimalplace rule.

a NorkJK Southem int recenly hired you as a consultant to estimate the companys whicc. You hurve obtained the Following imformation. The firms noncallable bonds mature in years, have an w innuat coupon, it pur walut of $ and a market price of $ The companys tax rate is k The riskfree rate is Wh the market rask common equity The firm unes the CAPM to estimate the cost of equicy and it does not eapect to issue ary new tornenin? stokk. What is its wacct Dc not round your intermediate calculations.

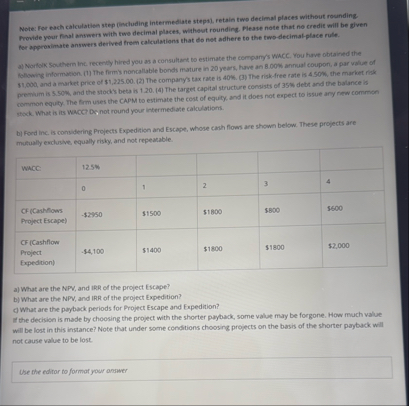

b Ford Inc, is consudering Projects Expedition and Escapt, whose cath flows are shown below. These propects are mutually esclusive, equally risky, and not repeamable.

tableWACC:CF Canhflows Project Excape$$CF Cashflow Project Expedion$$$

a What are the NPV and IRR of the project Escape?

b What are the NPV and IRR of the project Expedition?

d What are the payback periods for Project Escape and Eapedition?

the decision is made by choosing the project with the shorter payback, some value may be forgone. How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost.

Use the editor to format your ansaver

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock