Question: Note: For all problems where a risk-free rate or a dividend yield is given, assume that the interest rate and the dividend yield are annual

Note: For all problems where a risk-free rate or a dividend yield is given, assume that the interest rate and the dividend yield are annual and continuously compounded rates.

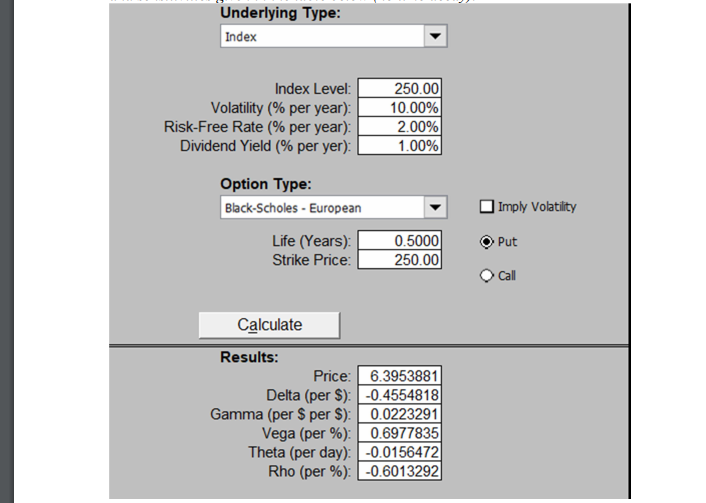

Using the information in the table below, derive your best estimate of the price of the put option if at the same time the index level decreases from 250 to 245, and the volatility decreases from 10% to 8%. Assume that the changes happen instantaneously after the computation of the price and sensitivities given in the table below (no time decay).

Underlying Type: Index Index Level: Volatility (% per year) Risk-Free Rate (% per year): Dividend Yield (% per yer): 250.00 10.00% 2.00% 1.00% Imply Volatility Option Type: Black-Scholes - European Life (Years): Strike Price: Put 0.5000 250.00 Call Calculate Results: Price: 6.3953881 Delta (per $): -0.4554818 Gamma (per $ per $): 0.0223291 Vega (per %): 0.6977835 Theta (per day): -0.0156472 Rho (per %): -0.6013292

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts