Question: Note: For E6-4B: for FIFO/LIFO/Weighted Avarage inventory methods 1. Calculate the ending inventory value 2. calculate the cots of goods sold 3. calculate gross profit

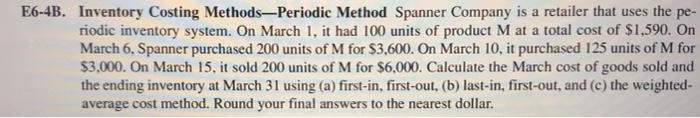

E6-4B. Inventory Costing Methods-Periodic Method Spanner Company is a retailer that uses the pe- riodic inventory system. On March 1, it had 100 units of product M at a total cost of $1,590. On March 6. Spanner purchased 200 units of M for $3,600. On March 10, it purchased 125 units of M for $3.000. On March 15, it sold 200 units of M for $6,000. Calculate the March cost of goods sold and the ending inventory at March 31 using (a) first-in, first-out, (b) last-in, first-out, and (c) the weighted- average cost method. Round your final answers to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts