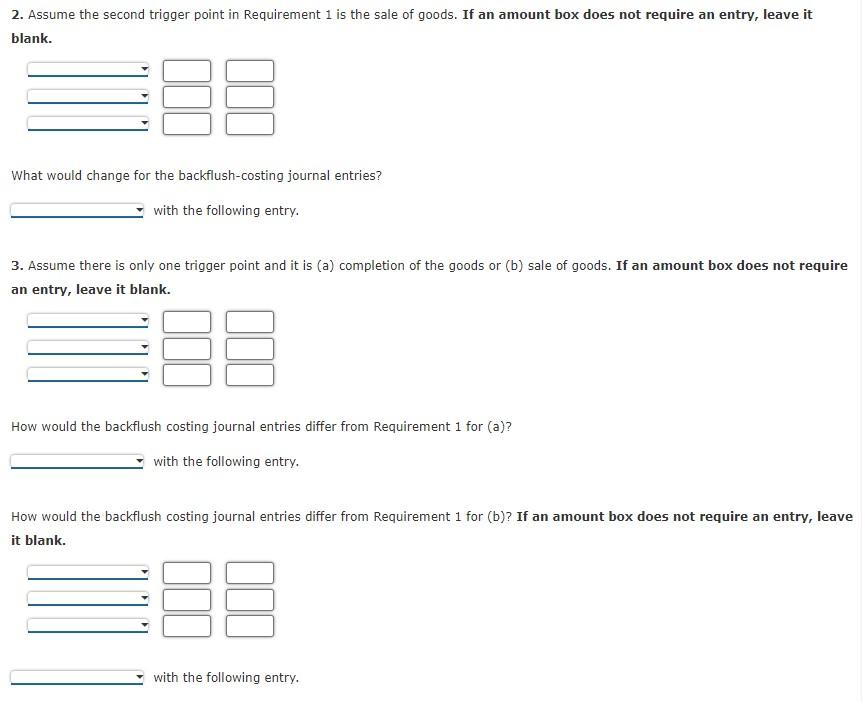

Question: NOTE: For Question 2: What would change for the backflush-costing journal entries? 3 Choices: ([Entries 6 and 7 are replaced in req 1.] / [No

![entries? 3 Choices: ([Entries 6 and 7 are replaced in req 1.]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67180775369e8_02067180774a628f.jpg)

NOTE: For Question 2: What would change for the backflush-costing journal entries? 3 Choices: ([Entries 6 and 7 are replaced in req 1.] / [No entry for transaction 1, transaction 6 is replaced in req 1.] / No entry for transaction 1, transaction 7 is replaced in req 1.) with the following entry?

NOTE: For Question 3: How would the backflush costing journal entries differ from Requirement 1 for (a)? 3 Choices: ([Nor entry for transaction 1, transaction 6 and 7 are replaced in req 1.] / [No entry for transaction 1, transaction 6 is replaced in req 1.] / No entry for transaction 1, transaction 7 is replaced in req 1.) with the following entry?

NOTE: For Question 3 continued: 3 Choices: ([Nor entry for transaction 1, transaction 6 and 7 are replaced in req 1.] / [No entry for transaction 1, transaction 6 is replaced in req 1.] / No entry for transaction 1, transaction 7 is replaced in req 1.) with the following entry?

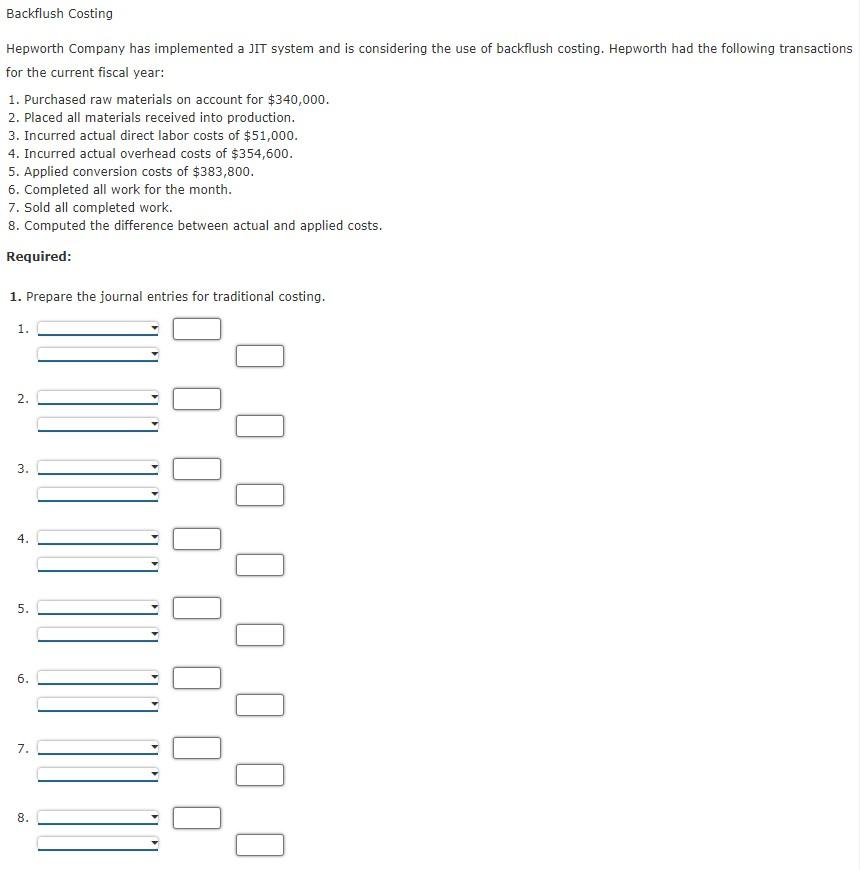

Backflush Costing Hepworth Company has implemented a JIT system and is considering the use of backflush costing. Hepworth had the following transactions for the current fiscal year: 1. Purchased raw materials on account for $340,000. 2. Placed all materials received into production. 3. Incurred actual direct labor costs of $51,000. 4. Incurred actual overhead costs of $354,600. 5. Applied conversion costs of $383,800. 6. Completed all work for the month. 7. Sold all completed work. 8. Computed the difference between actual and applied costs. Required: 19. Prepare the journal entries for backflush costing. Assume there are two trigger points: (1) the purchase of raw materials and (2) the 2. Assume the second trigger point in Requirement 1 is the sale of goods. If an amount box does not require an entry, leave it blank. What would change for the backflush-costing journal entries? with the following entry. 3. Assume there is only one trigger point and it is (a) completion of the goods or (b) sale of goods. If an amount box does not require an entry, leave it blank. How would the backflush costing journal entries differ from Requirement 1 for (a)? with the following entry. How would the backflush costing journal entries differ from Requirement 1 for (b)? If an amount box does not require an entry, leave it blank. with the following entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts