Question: Note, I can't provide typed data, since there is a limit to number of letters 1.what it is effective annual required return for PEC 2.Using

Note, I can't provide typed data, since there is a limit to number of letters

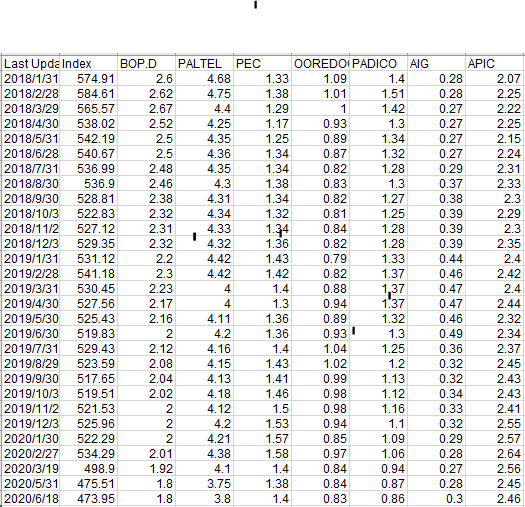

1.what it is effective annual required return for PEC

2.Using the constant growth model and taking into consideration that PEC paid $0.15 in dividends last year and its dividends are expected to grow at an annual rate of 2%, what is the intrinsic value of PEC stock?

- Last Upda Index BOP.D PALTEL PEC 2018/1/31 574.91 2.6 4.68 1.33 2018/2/28 584.61 2.62 4.75 1.38 2018/3/29 565.57 2.67 4.4 1.29 2018/4/30 538.02 2.52 4.25 1.17 2018/5/31 542.19 2.5 4.35 1.25 2018/6/28 540.67 2.5 4.36 1.34 2018/7/31 536.99 2.48 4.35 1.34 2018/8/30 536.9 2.46 4.3 1.38 2018/9/30 528.81 2.38 4.31 1.34 2018/10/3 522.83 2.32 4.34 1.32 2018/11/2 527.12 2.31 4.33 1.34 2018/12/3 529.35 2.32 4.32 1.36 2019/1/31 531.12 2.2 4.42 1.43 2019/2/28 541.18 2.3 4.42 1.42 2019/3/31 530.45 2.23 4 1.4 2019/4/30 527.56 2.17 4 1.3 2019/5/30 525.43 2.16 4.11 1.36 2019/6/30 519.83 2 4.2 1.36 2019/7/31 529.43 2.12 4.16 1.4 2019/8/29 523.59 2.08 4.15 1.43 2019/9/30 517.65 2.04 4.13 1.41 2019/10/3 519.51 2.02 4.18 1.46 2019/11/2 521.53 2 4.12 1.5 2019/12/3 525.96 2 4.2 1.53 2020/1/30 522.29 2 4.21 1.57 2020/2/27 534.29 2.01 4.38 1.58 2020/3/19 498.9 1.92 4.1 1.4 2020/5/31 475.51 1.8 3.75 1.38 2020/6/18 473.95 1.8 3.8 1.4 OOREDO PADICO AIG 1.09 1.4 1.01 1.51 1 1.42 0.93 1.3 0.89 1.34 0.87 1.32 0.82 1.28 0.83 1.3 0.82 1.27 0.81 1.25 0.84 1.28 0.82 1.28 0.79 1.33 0.82 1.37 0.88 1,37 0.94 1.37 0.89 1.32 0.93 1.3 1.04 1.25 1.02 1.2 0.99 1.13 0.98 1.12 0.98 1.16 0.94 1.1 0.85 1.09 0.97 1.06 0.84 0.94 0.84 0.87 0.83 0.86 APIC 0.28 2.07 0.28 2.25 0.27 2.22 0.27 2.25 0.27 2.15 0.27 2.24 0.29 2.31 0.37 2.33 0.38 2.3 0.39 2.29 0.39 2.3 0.39 2.35 0.44 2.4 0.46 2.42 0.47 2.4 0.47 2.44 0.46 2.32 0.49 2.34 0.36 2.37 0.32 2.45 0.32 2.43 0.34 2.43 0.33 2.41 0.32 2.55 0.29 2.57 0.28 2.64 0.27 2.56 0.28 2.45 0.3 2.46 1 - Last Upda Index BOP.D PALTEL PEC 2018/1/31 574.91 2.6 4.68 1.33 2018/2/28 584.61 2.62 4.75 1.38 2018/3/29 565.57 2.67 4.4 1.29 2018/4/30 538.02 2.52 4.25 1.17 2018/5/31 542.19 2.5 4.35 1.25 2018/6/28 540.67 2.5 4.36 1.34 2018/7/31 536.99 2.48 4.35 1.34 2018/8/30 536.9 2.46 4.3 1.38 2018/9/30 528.81 2.38 4.31 1.34 2018/10/3 522.83 2.32 4.34 1.32 2018/11/2 527.12 2.31 4.33 1.34 2018/12/3 529.35 2.32 4.32 1.36 2019/1/31 531.12 2.2 4.42 1.43 2019/2/28 541.18 2.3 4.42 1.42 2019/3/31 530.45 2.23 4 1.4 2019/4/30 527.56 2.17 4 1.3 2019/5/30 525.43 2.16 4.11 1.36 2019/6/30 519.83 2 4.2 1.36 2019/7/31 529.43 2.12 4.16 1.4 2019/8/29 523.59 2.08 4.15 1.43 2019/9/30 517.65 2.04 4.13 1.41 2019/10/3 519.51 2.02 4.18 1.46 2019/11/2 521.53 2 4.12 1.5 2019/12/3 525.96 2 4.2 1.53 2020/1/30 522.29 2 4.21 1.57 2020/2/27 534.29 2.01 4.38 1.58 2020/3/19 498.9 1.92 4.1 1.4 2020/5/31 475.51 1.8 3.75 1.38 2020/6/18 473.95 1.8 3.8 1.4 OOREDO PADICO AIG 1.09 1.4 1.01 1.51 1 1.42 0.93 1.3 0.89 1.34 0.87 1.32 0.82 1.28 0.83 1.3 0.82 1.27 0.81 1.25 0.84 1.28 0.82 1.28 0.79 1.33 0.82 1.37 0.88 1,37 0.94 1.37 0.89 1.32 0.93 1.3 1.04 1.25 1.02 1.2 0.99 1.13 0.98 1.12 0.98 1.16 0.94 1.1 0.85 1.09 0.97 1.06 0.84 0.94 0.84 0.87 0.83 0.86 APIC 0.28 2.07 0.28 2.25 0.27 2.22 0.27 2.25 0.27 2.15 0.27 2.24 0.29 2.31 0.37 2.33 0.38 2.3 0.39 2.29 0.39 2.3 0.39 2.35 0.44 2.4 0.46 2.42 0.47 2.4 0.47 2.44 0.46 2.32 0.49 2.34 0.36 2.37 0.32 2.45 0.32 2.43 0.34 2.43 0.33 2.41 0.32 2.55 0.29 2.57 0.28 2.64 0.27 2.56 0.28 2.45 0.3 2.46 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts