Question: note: I have completed Req b2 already. I only need help on help Req b1 Required information [The following information applies to the questions displayed

note: I have completed Req b2 already. I only need help on help Req b1

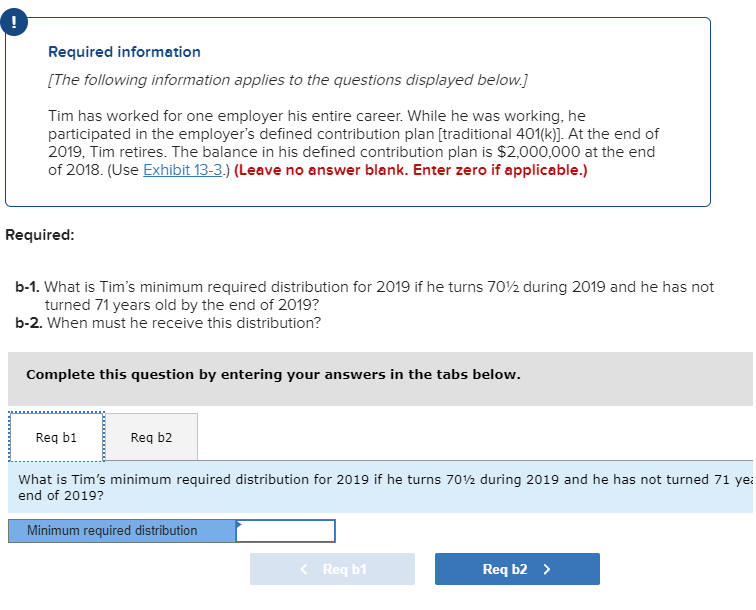

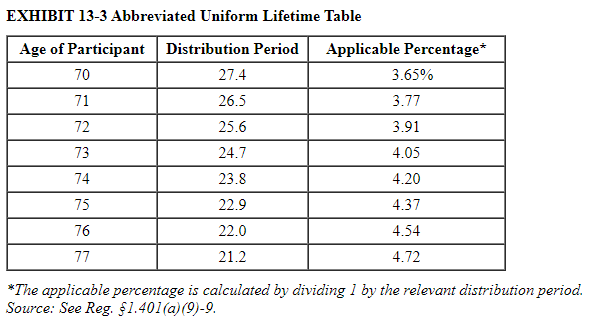

Required information [The following information applies to the questions displayed below.] Tim has worked for one employer his entire career. While he was working, he participated in the employer's defined contribution plan [traditional 401(k)]. At the end of 2019, Tim retires. The balance in his defined contribution plan is $2,00o0,000 at the end of 2018. (Use Exhibit 13-3.) (Leave no answer blank. Enter zero if applicable.) Required: b-1. What is Tim's minimum required distribution for 2019 if he turns 702 during 2019 and he has not turned 71 years old by the end of 2019? b-2. When must he receive this distribution? Complete this question by entering your answers in the tabs below. Reg b1 Reg b2 What is Tim's minimum required distribution for 2019 if he turns 702 during 2019 and he has not turned 71 yei end of 2019? Minimum required distribution EXHIBIT 13-3 Abbreviated Uniform Lifetime Table Age of Participant Distribution Period Applicable Percentage* 70 27.4 3.65% 71 26.5 3.77 72 25.6 3.91 4.05 73 24.7 74 23.8 4.20 75 22.9 4.37 4.54 76 22.0 21.2 77 4.72 *The applicable percentage is calculated by dividing 1 by the relevant distribution period. Source: See Reg. 1.401(a)(9)-9. Required information [The following information applies to the questions displayed below.] Tim has worked for one employer his entire career. While he was working, he participated in the employer's defined contribution plan [traditional 401(k)]. At the end of 2019, Tim retires. The balance in his defined contribution plan is $2,00o0,000 at the end of 2018. (Use Exhibit 13-3.) (Leave no answer blank. Enter zero if applicable.) Required: b-1. What is Tim's minimum required distribution for 2019 if he turns 702 during 2019 and he has not turned 71 years old by the end of 2019? b-2. When must he receive this distribution? Complete this question by entering your answers in the tabs below. Reg b1 Reg b2 What is Tim's minimum required distribution for 2019 if he turns 702 during 2019 and he has not turned 71 yei end of 2019? Minimum required distribution EXHIBIT 13-3 Abbreviated Uniform Lifetime Table Age of Participant Distribution Period Applicable Percentage* 70 27.4 3.65% 71 26.5 3.77 72 25.6 3.91 4.05 73 24.7 74 23.8 4.20 75 22.9 4.37 4.54 76 22.0 21.2 77 4.72 *The applicable percentage is calculated by dividing 1 by the relevant distribution period. Source: See Reg. 1.401(a)(9)-9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts