Question: Note: I have share the same question multiple times and still I ckuld not get the right answer showing detailed steps. Please solve the question

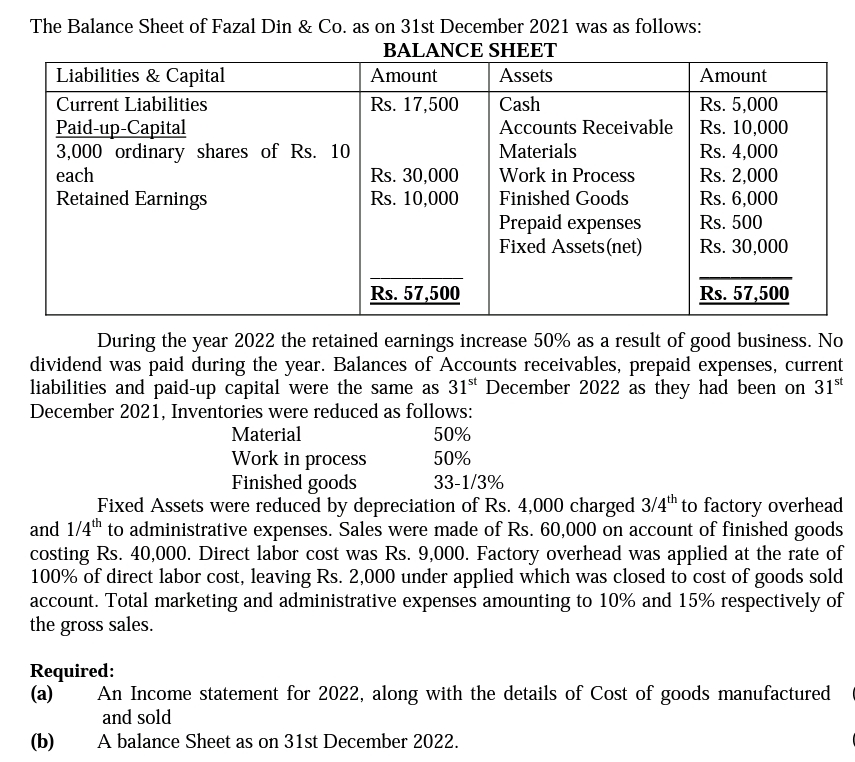

Note: I have share the same question multiple times and still I ckuld not get the right answer showing detailed steps. Please solve the question in the picture and please also comment of how Rs will be adjusted. Please get it solve by financial accounting expert. The Balance Sheet of Fazal Din & Co as on st December was as follows:

BALANCE SHEET

During the year the retained earnings increase as a result of good business. No dividend was paid during the year. Balances of Accounts receivables, prepaid expenses, current liabilities and paidup capital were the same as text st December as they had been on text st December Inventories were reduced as follows:

Fixed Assets were reduced by depreciation of Rs charged text th to factory overhead and text th to administrative expenses. Sales were made of Rs on account of finished goods costing Rs Direct labor cost was Rs Factory overhead was applied at the rate of of direct labor cost, leaving Rs under applied which was closed to cost of goods sold account. Total marketing and administrative expenses amounting to and respectively of the gross sales.

Required:

a An Income statement for along with the details of Cost of goods manufactured and sold

b A balance Sheet as on st December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock