Question: Note: I will not be grading answers but your thought process to see how you combine everything we have learned so far in this course

Note: I will not be grading answers but your thought process to see how you combine everything we have learned so far in this course to come up with an estimate of the stock's fair value. Please organize your solution with MS Excel

Case Study : FirmEquity Valuation points

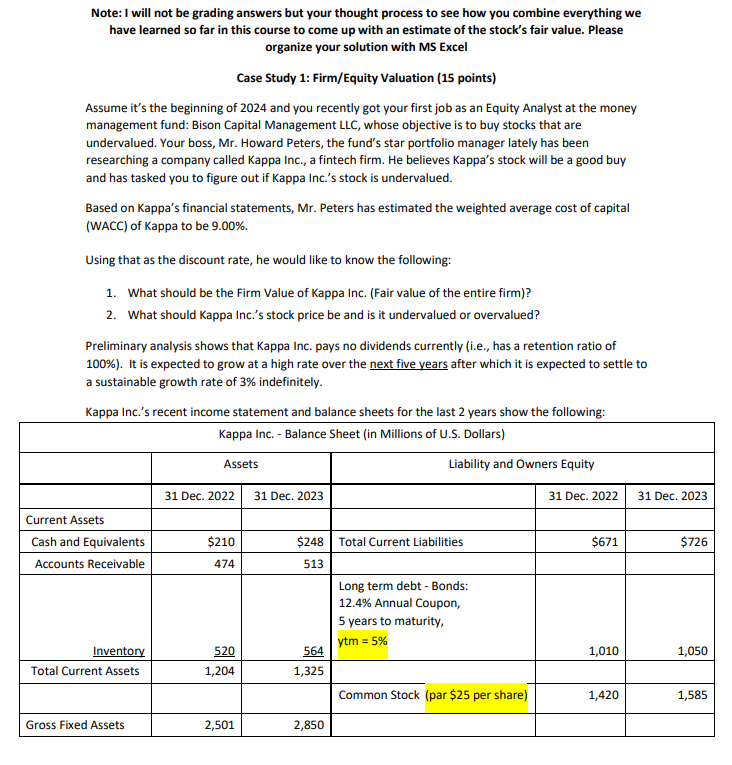

Assume it's the beginning of and you recently got your first job as an Equity Analyst at the money management fund: Bison Capital Management LLC whose objective is to buy stocks that are undervalued. Your boss, Mr Howard Peters, the fund's star portfolio manager lately has been researching a company called Kappa Inc., a fintech firm. He believes Kappa's stock will be a good buy and has tasked you to figure out if Kappa Inc.s stock is undervalued.

Based on Kappa's financial statements, Mr Peters has estimated the weighted average cost of capital WACC of Kappa to be

Using that as the discount rate, he would like to know the following:

What should be the Firm Value of Kappa Inc. Fair value of the entire firm

What should Kappa Inc.s stock price be and is it undervalued or overvalued?

Preliminary analysis shows that Kappa Inc. pays no dividends currently ie has a retention ratio of It is expected to grow at a high rate over the next five years after which it is expected to settle to a sustainable growth rate of indefinitely.

Kappa Inc.s recent income statement and balance sheets for the last years show the following:

begintabularcccccc

hline multicolumncKappa Inc. Balance Sheet in Millions of US Dollars

hline & multicolumncAssets & multicolumnlLiability and Owners Equity

hline & Dec. & Dec. & & Dec. & Dec.

hline multicolumnlCurrent Assets

hline Cash and Equivalents & $ & $ & Total Current Liabilities & $ & $

hline Accounts Receivable & & & & &

hline Inventory & underline & & begintabularl

Long term debt Bonds:

Annual Coupon,

years to maturity,

ytm

endtabular & &

hline Total Current Assets & & & & &

hline & & & Common Stock par $ per share & &

hline Gross Fixed Assets & & & & &

hline

endtabular

Mr Peters gathered the following relevant stock information to calculate the WACC We will cover in a subsequent chapter how to estimate WACC. For now, it's been calculated for you:

Current stock price: $

Stock's Beta

Risk free rate is

Market Risk Premium is

Marginal tax rate is

Since your boss will be travelling overseas and will not have time to meet with you to discuss your valuation, he would like you to use the following steps to ease his understanding of your work to receive any credit please show your work: Use the following Steps:

Calculate the expected high growth rate for the first years.

Note: ROE net incomeBook Value of Common Equity

Find the Firm's Initial FCF ie FCFF at the end of beginning of FCFF

Now that you have FCFFo, estimate the future cash flows and find the fair value of the firm.

What should be the market value of the entire firm's equity if the market value of the firm's debt is $ million?

What should be the price per share if there are million shares outstanding Note: Shares outstanding BV Common Equity$ par per share

Is the stock price undervalued or overvalued?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock