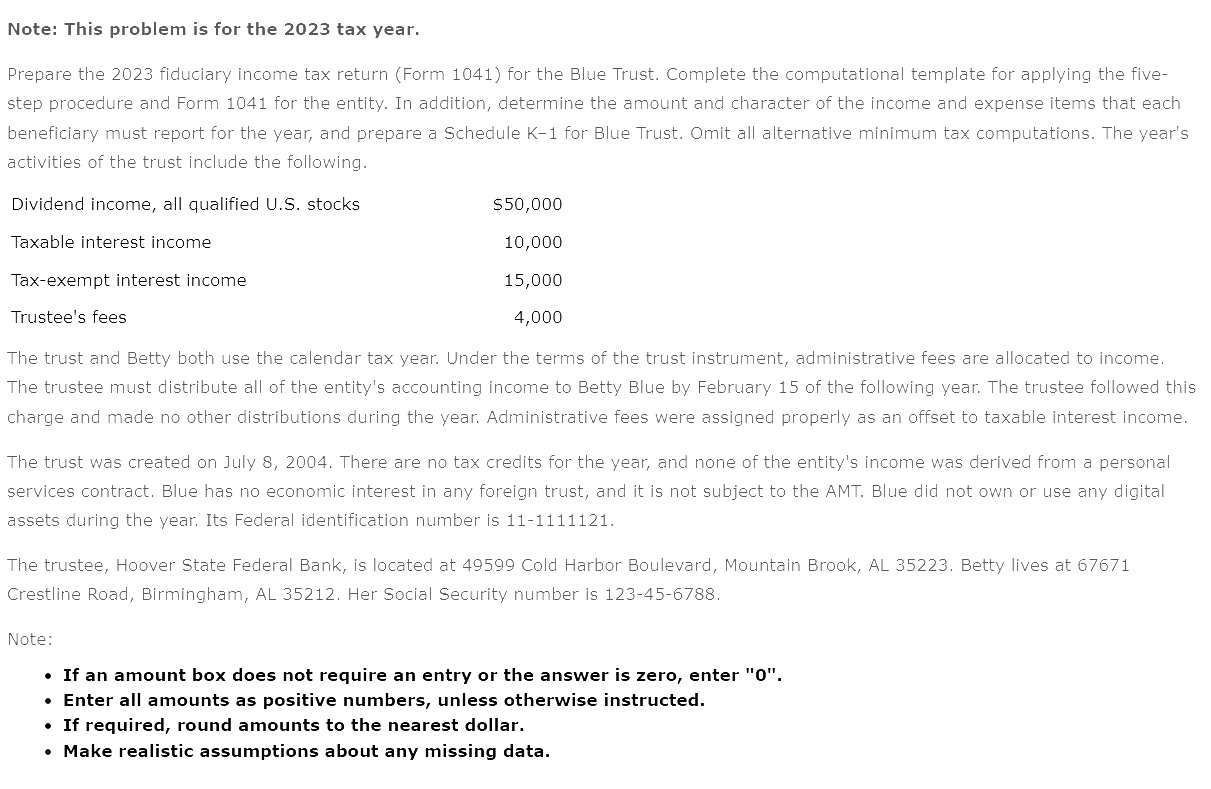

Question: Note: If an amount box does not require an entry or the answer is zero, enter 0 . Enter all amounts as positive

Note: If an amount box does not require an entry or the answer is zero, enter Enter all amounts as positive numbers, unless otherwise instructed. If required, round amounts to the nearest dollar. Make realistic assumptions about any missing data.

I need help with form line Income required to be distributed currently. What is this amount? How did you obtain it On form schedule G Other Information line Enter the amount of taxexempt interest income and exemptinterest dividends. What is this value, and how did you obtain it

On Schedule I attached to form Im stuck on part III, Alternative Minimum Tax. Where do Exemption Amount, Phaseout exemption amount, maximum amount subject to the rate, and Maximum amount subject to rates below come from? Thank you.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock