Question: (Note: if without additional information, assume annual compounding) 1. You are expecting to receive a cash flow $1,000 in year 4. Assume the interest rate

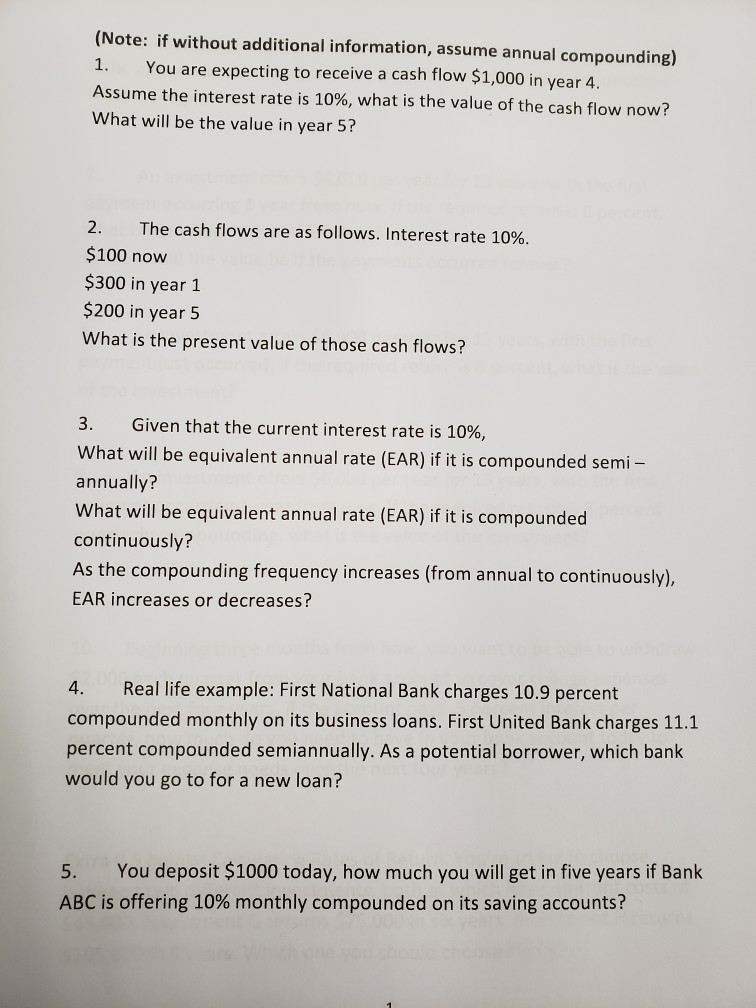

(Note: if without additional information, assume annual compounding) 1. You are expecting to receive a cash flow $1,000 in year 4. Assume the interest rate is 10%, what is the value of the cash flow now? What will be the value in year 5? 2. The cash flows are as follows. Interest rate 10%. $100 now $300 in year 1 $200 in year 5 What is the present value of those cash flows? 3. Given that the current interest rate is 10%, What will be equivalent annual rate (EAR) if it is compounded semi- annually? What will be equivalent annual rate (EAR) if it is compounded continuously? As the compounding frequency increases (from annual to continuously), EAR increases or decreases? 4. Real life example: First National Bank charges 10.9 percent compounded monthly on its business loans. First United Bank charges 11.1 percent compounded semiannually. As a potential borrower, which bank would you go to for a new loan? 5. You deposit $1000 today, how much you will get in five years if Bank ABC is offering 10% monthly compounded on its saving accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts