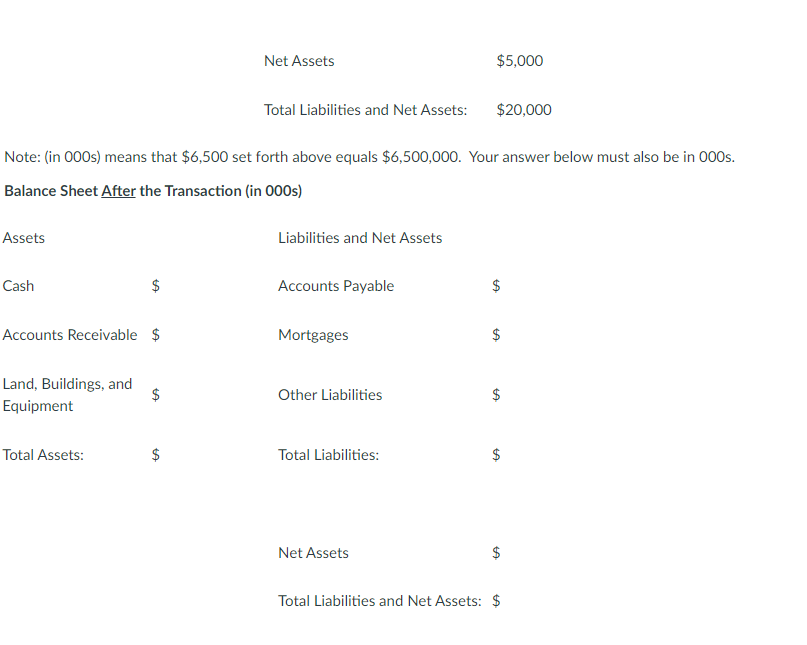

Question: Note: (in 000 s) means that $6,500 set forth above equals $6,500,000. Your answer below must also be in 000 s. Balance Sheet After the

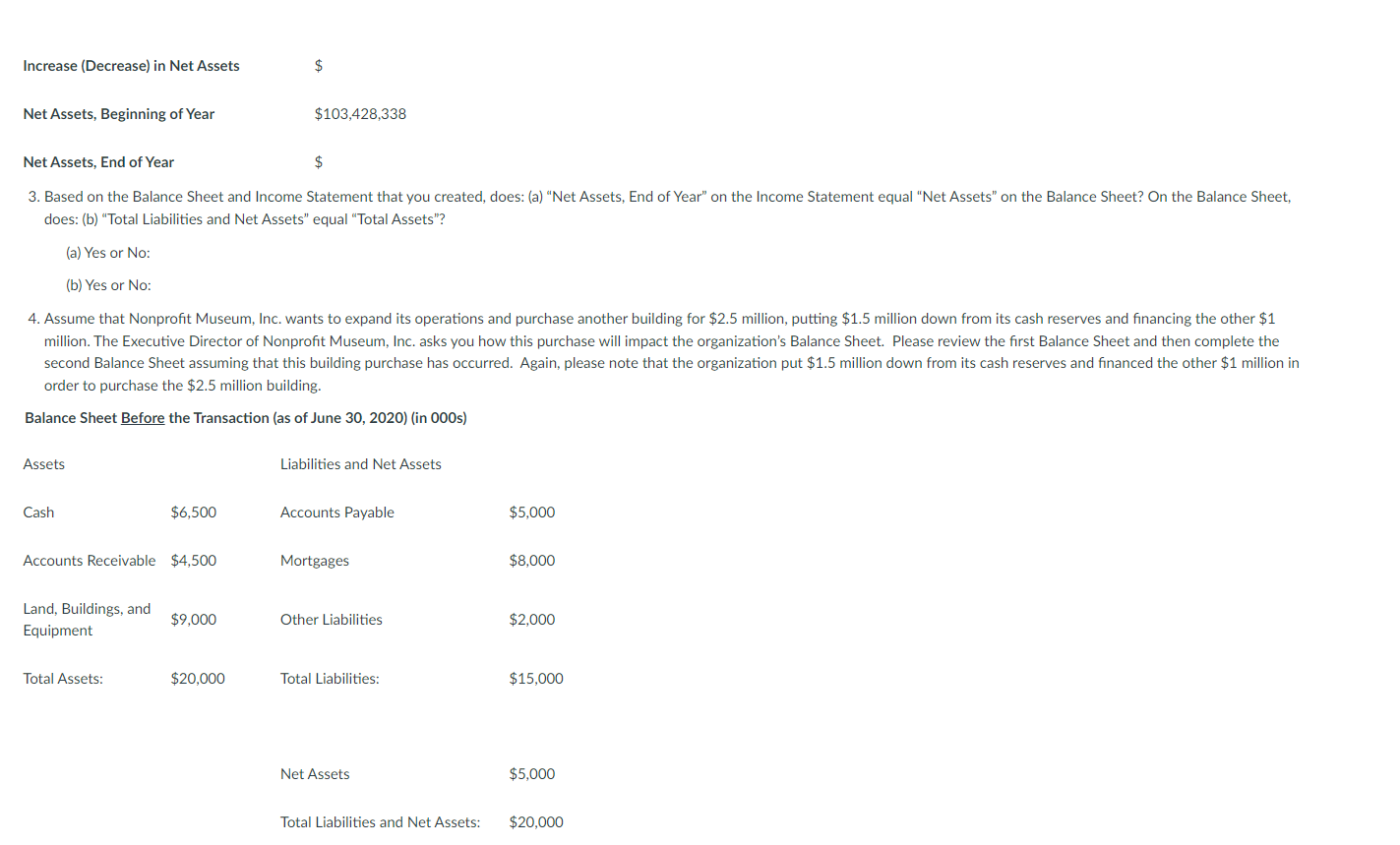

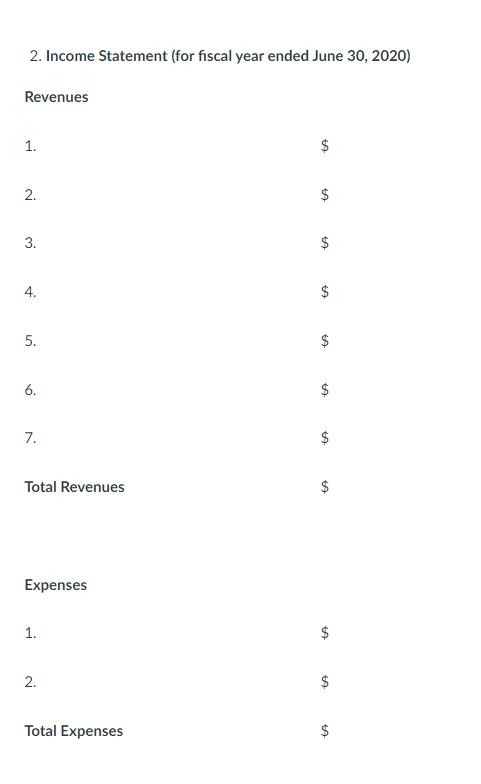

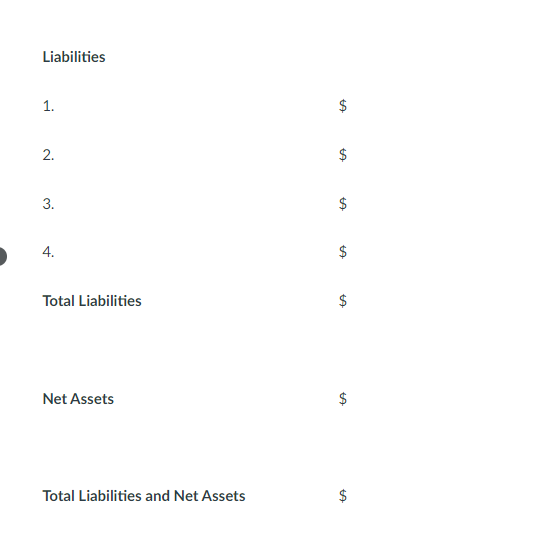

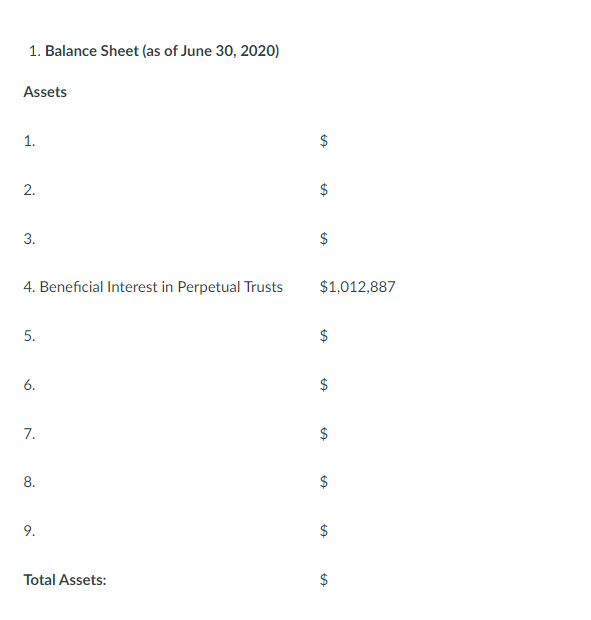

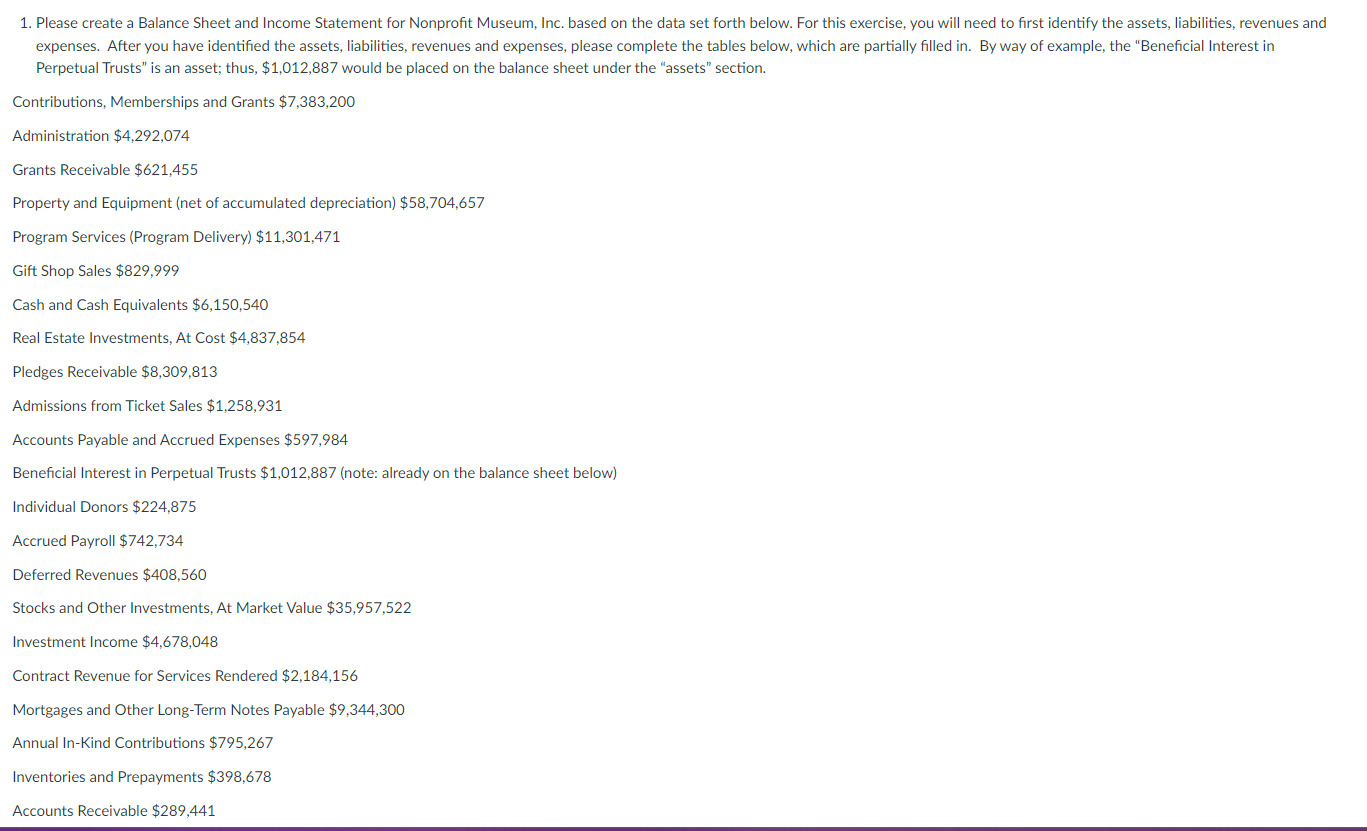

Note: (in 000 s) means that $6,500 set forth above equals $6,500,000. Your answer below must also be in 000 s. Balance Sheet After the Transaction (in 000s) 1. Balance Sheet (as of June 30,2020 ) Assets 1. $ 2. $ 3. $ 4. Beneficial Interest in Perpetual Trusts $1,012,887 5. $ 6. $ 7. $ 8. $ 9. $ Total Assets: $ Perpetual Trusts" is an asset; thus, $1,012,887 would be placed on the balance sheet under the "assets" section. Contributions, Memberships and Grants $7,383,200 Administration $4,292,074 Grants Receivable $621,455 Property and Equipment (net of accumulated depreciation) $58,704,657 Program Services (Program Delivery) \$11,301,471 Gift Shop Sales $829,999 Cash and Cash Equivalents $6,150,540 Real Estate Investments, At Cost $4,837,854 Pledges Receivable $8,309,813 Admissions from Ticket Sales $1,258,931 Accounts Payable and Accrued Expenses \$597,984 Beneficial Interest in Perpetual Trusts $1,012,887 (note: already on the balance sheet below) Individual Donors $224,875 Accrued Payroll $742,734 Deferred Revenues $408,560 Stocks and Other Investments, At Market Value $35,957,522 Investment Income $4,678,048 Contract Revenue for Services Rendered \$2,184,156 Mortgages and Other Long-Term Notes Payable \$9,344,300 Annual In-Kind Contributions \$795,267 Inventories and Prepayments $398,678 Accounts Receivable $289,441 Net Assets 1) 3. Based on the Balance Sheet and Income Statement that you created, does: (a) "Net Assets, End of Year" on the Income Statement equal "Net Assets" on the Balance Sheet? On the Balance Sheet, does: (b) "Total Liabilities and Net Assets" equal "Total Assets"? (a) Yes or No: (b) Yes or No: 4. Assume that Nonprofit Museum, Inc. wants to expand its operations and purchase another building for $2.5 million, putting $1.5 million down from its cash reserves and financing the other $1 million. The Executive Director of Nonprofit Museum, Inc. asks you how this purchase will impact the organization's Balance Sheet. Please review the first Balance Sheet and then complete the second Balance Sheet assuming that this building purchase has occurred. Again, please note that the organization put $1.5 million down from its cash reserves and financed the other $1 million in order to purchase the $2.5 million building. Balance Sheet Before the Transaction (as of June 30, 2020) (in 000s) Note: (in 000 s) means that $6,500 set forth above equals $6,500,000. Your answer below must also be in 000 s. Balance Sheet After the Transaction (in 000s) 1. Balance Sheet (as of June 30,2020 ) Assets 1. $ 2. $ 3. $ 4. Beneficial Interest in Perpetual Trusts $1,012,887 5. $ 6. $ 7. $ 8. $ 9. $ Total Assets: $ Perpetual Trusts" is an asset; thus, $1,012,887 would be placed on the balance sheet under the "assets" section. Contributions, Memberships and Grants $7,383,200 Administration $4,292,074 Grants Receivable $621,455 Property and Equipment (net of accumulated depreciation) $58,704,657 Program Services (Program Delivery) \$11,301,471 Gift Shop Sales $829,999 Cash and Cash Equivalents $6,150,540 Real Estate Investments, At Cost $4,837,854 Pledges Receivable $8,309,813 Admissions from Ticket Sales $1,258,931 Accounts Payable and Accrued Expenses \$597,984 Beneficial Interest in Perpetual Trusts $1,012,887 (note: already on the balance sheet below) Individual Donors $224,875 Accrued Payroll $742,734 Deferred Revenues $408,560 Stocks and Other Investments, At Market Value $35,957,522 Investment Income $4,678,048 Contract Revenue for Services Rendered \$2,184,156 Mortgages and Other Long-Term Notes Payable \$9,344,300 Annual In-Kind Contributions \$795,267 Inventories and Prepayments $398,678 Accounts Receivable $289,441 Net Assets 1) 3. Based on the Balance Sheet and Income Statement that you created, does: (a) "Net Assets, End of Year" on the Income Statement equal "Net Assets" on the Balance Sheet? On the Balance Sheet, does: (b) "Total Liabilities and Net Assets" equal "Total Assets"? (a) Yes or No: (b) Yes or No: 4. Assume that Nonprofit Museum, Inc. wants to expand its operations and purchase another building for $2.5 million, putting $1.5 million down from its cash reserves and financing the other $1 million. The Executive Director of Nonprofit Museum, Inc. asks you how this purchase will impact the organization's Balance Sheet. Please review the first Balance Sheet and then complete the second Balance Sheet assuming that this building purchase has occurred. Again, please note that the organization put $1.5 million down from its cash reserves and financed the other $1 million in order to purchase the $2.5 million building. Balance Sheet Before the Transaction (as of June 30, 2020) (in 000s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts