Question: Note: In this chapter and in all succeeding work throughout the course, unless instructed otherwise, calculate hourly rates and overtime rates as follows: Carry the

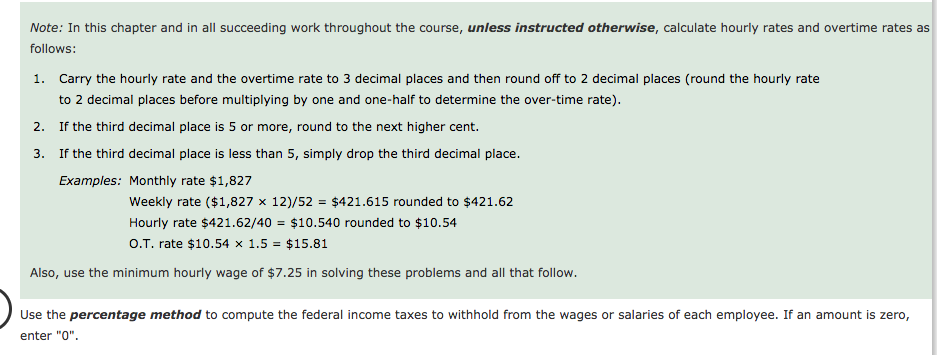

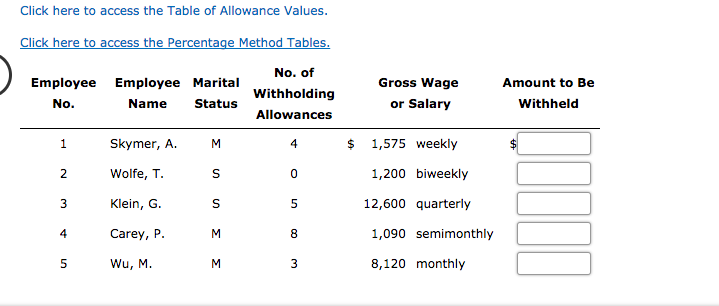

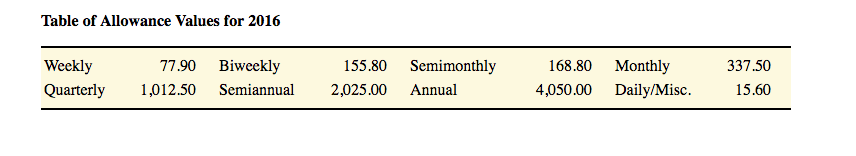

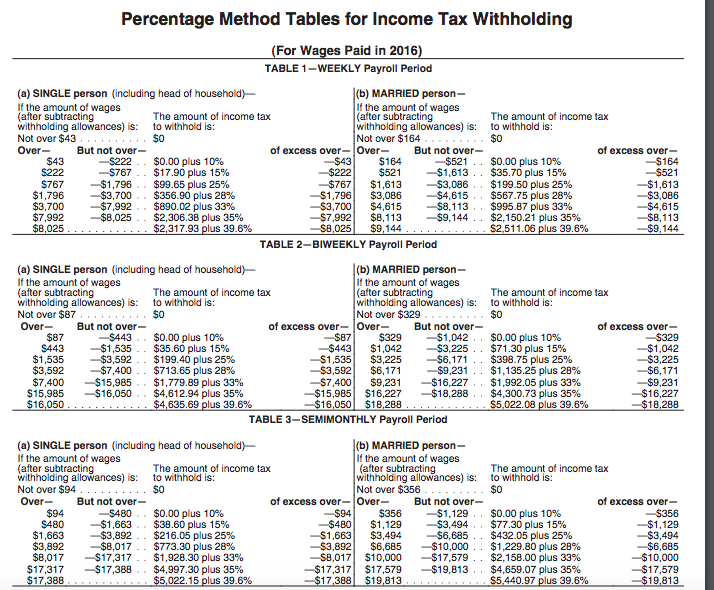

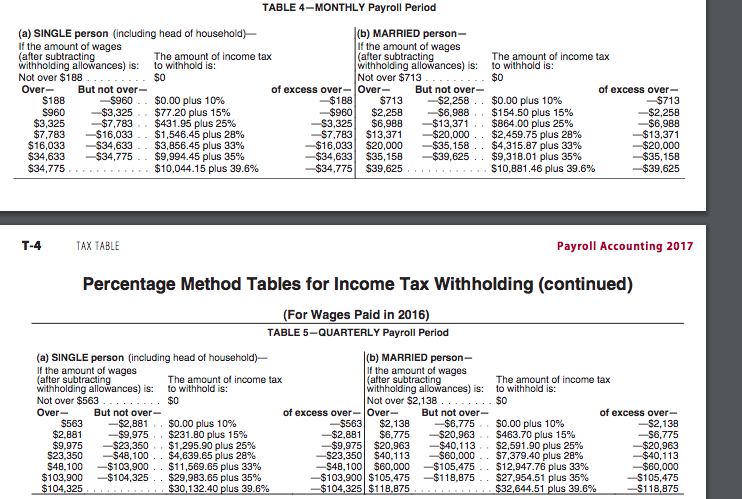

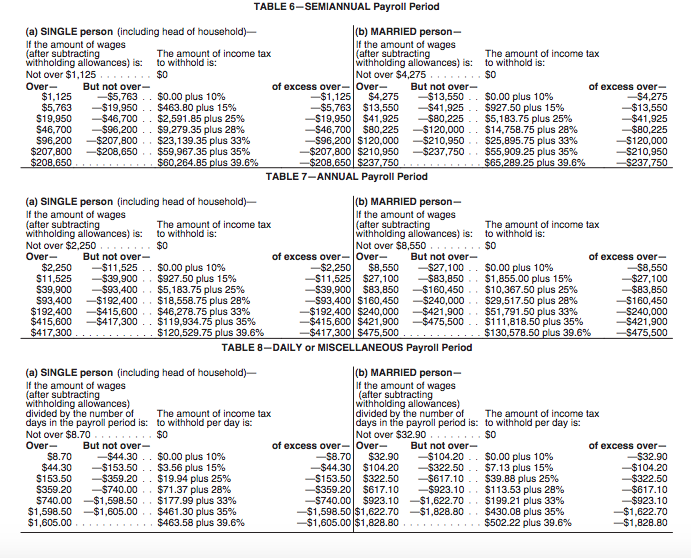

Note: In this chapter and in all succeeding work throughout the course, unless instructed otherwise, calculate hourly rates and overtime rates as follows: Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimal places (round the hourly rate to 2 decimal places before multiplying by one and one-half to determine the over-time rate). If the third decimal place is 5 or more, round to the next higher cent. If the third decimal place is less than 5, simply drop the third decimal place. Examples: Monthly rate $1,827 1. 2. 3. weekly rate ($1,827 x 12)/52 = $421.615 rounded to $421.62 Hourly rate $421.62/40 = $10.540 rounded to $10.54 o.T. rate $10.54 x 1.5-$15.81 Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow. Use the percentage method to compute the federal income taxes to withhold from the wages or salaries of each employee. If an amount is zero enter "O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts