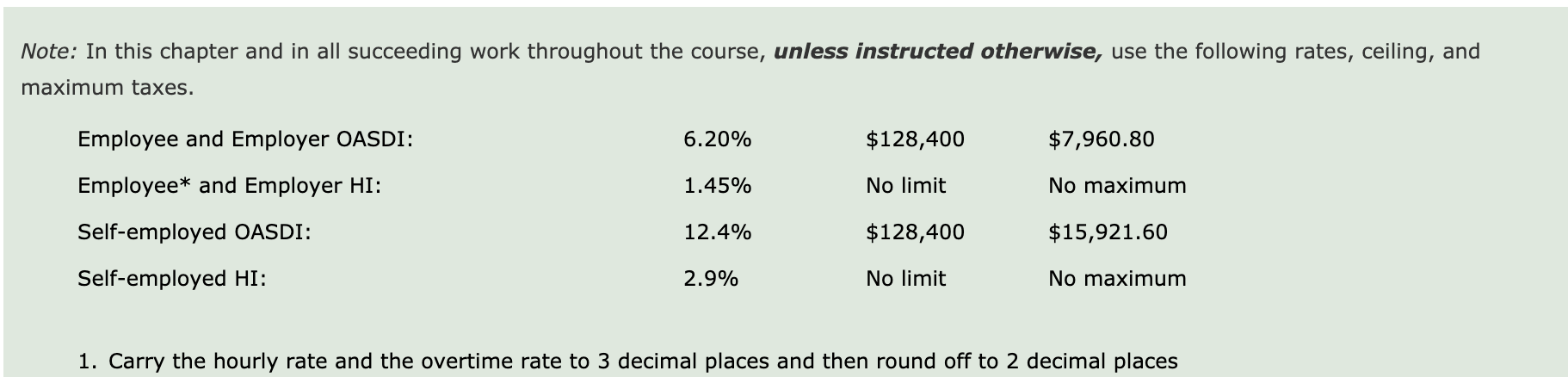

Question: Note: In this chapter and in all succeeding work throughout the course, unless instructed otherwise, use the following rates, ceiling, and maximum taxes. Employee and

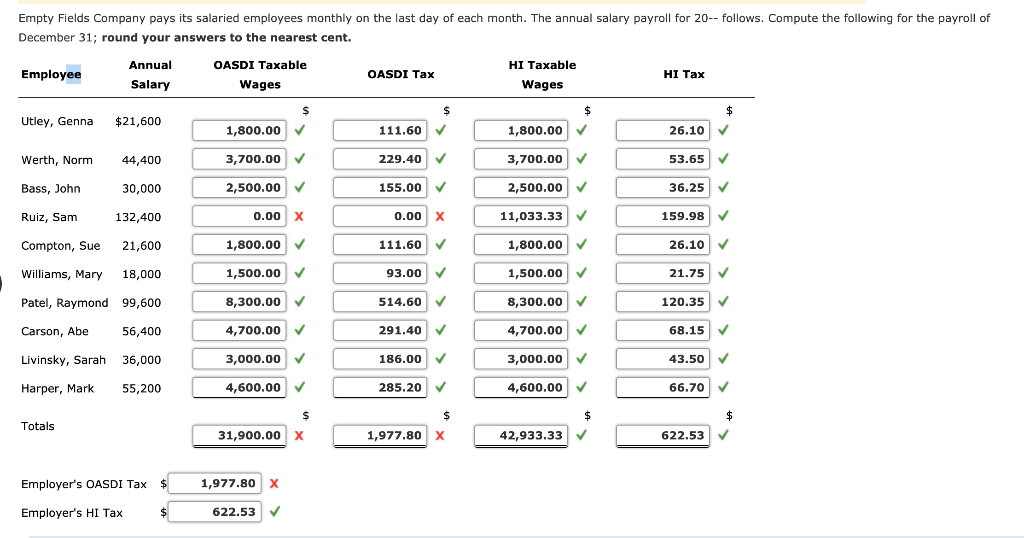

Note: In this chapter and in all succeeding work throughout the course, unless instructed otherwise, use the following rates, ceiling, and maximum taxes. Employee and Employer OASDI: 6.20% $128,400 $7,960.80 1.45% No limit No maximum Employee* and Employer HI: Self-employed OASDI: Self-employed HI: 12.4% $128,400 $15,921.60 2.9% No limit No maximum 1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimal places Empty Fields Company pays its salaried employees monthly on the last day of each month. The annual salary payroll for 20-- follows. Compute the following for the payroll of December 31; round your answers to the nearest cent. HI Taxable Employee Annual Salary OASDI Taxable Wages OASDI Tax I Wages $ Utley, Genna $21,600 111.60 229.40 ( Werth, Norm Bass, John 44,400 30,000 1,800.00 3,700.00 2,500.00 Ruiz, Sam 132,400 X x 11,033.33 Compton, Sue Williams, Mary . 21,600 18,000 1,800.00 3,700.00 2,500.00 0.00 1,800.00 1,500.00 8,300.00 4,700.00 3,000.00 4,600.00 26.10 53.65 36.25 159.98 26.10 21.75 120.35 68.15 43.50 Patel, Raymond 0.00 111.60 93.00 514.60 291.40 186.00 285.20 99,600 1,800.00 1,500.00 8,300.00 4,700.000 3,000.00 4,600.00 Carson, Abe 56,400 Livinsky, Sarah 36,000 Harper, Mark 55,200 66.70 $ Totals 31,900.00 1,977.80 x 42,933.33 622.53 Employer's OASDI Tax $ 1,977.80 Employer's HI Tax $ 622.53

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts