Question: Note: must use every single space in the transaction journal. If there are room for 3 accounts, 3 accounts must be used, no less. On

Note: must use every single space in the transaction journal. If there are room for 3 accounts, 3 accounts must be used, no less.

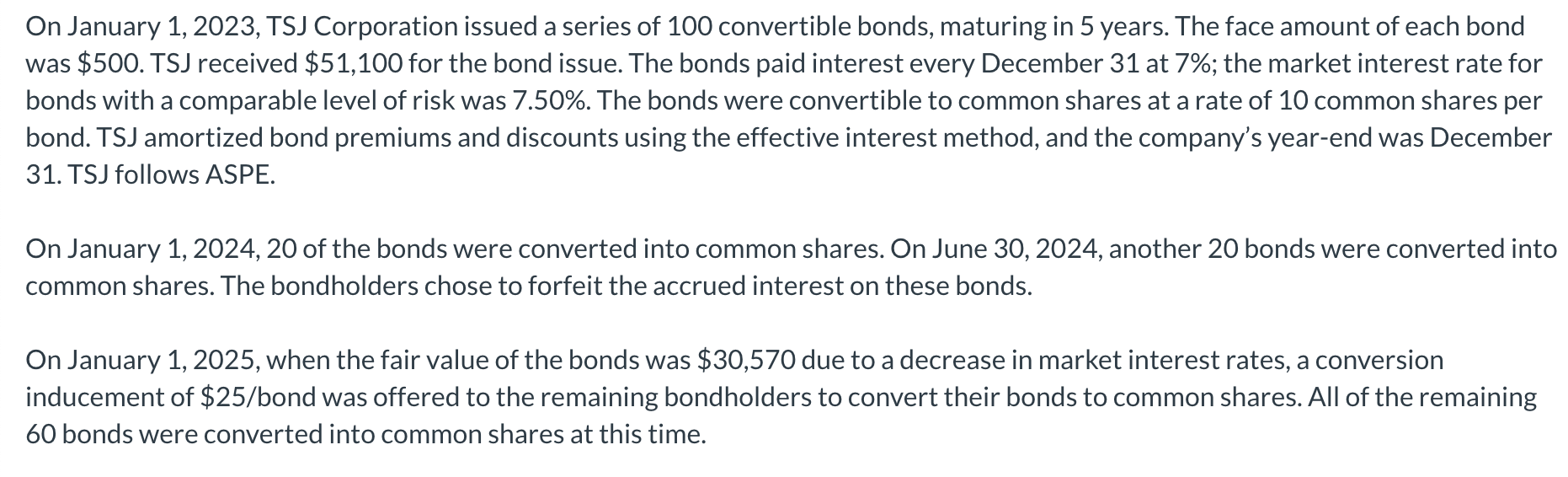

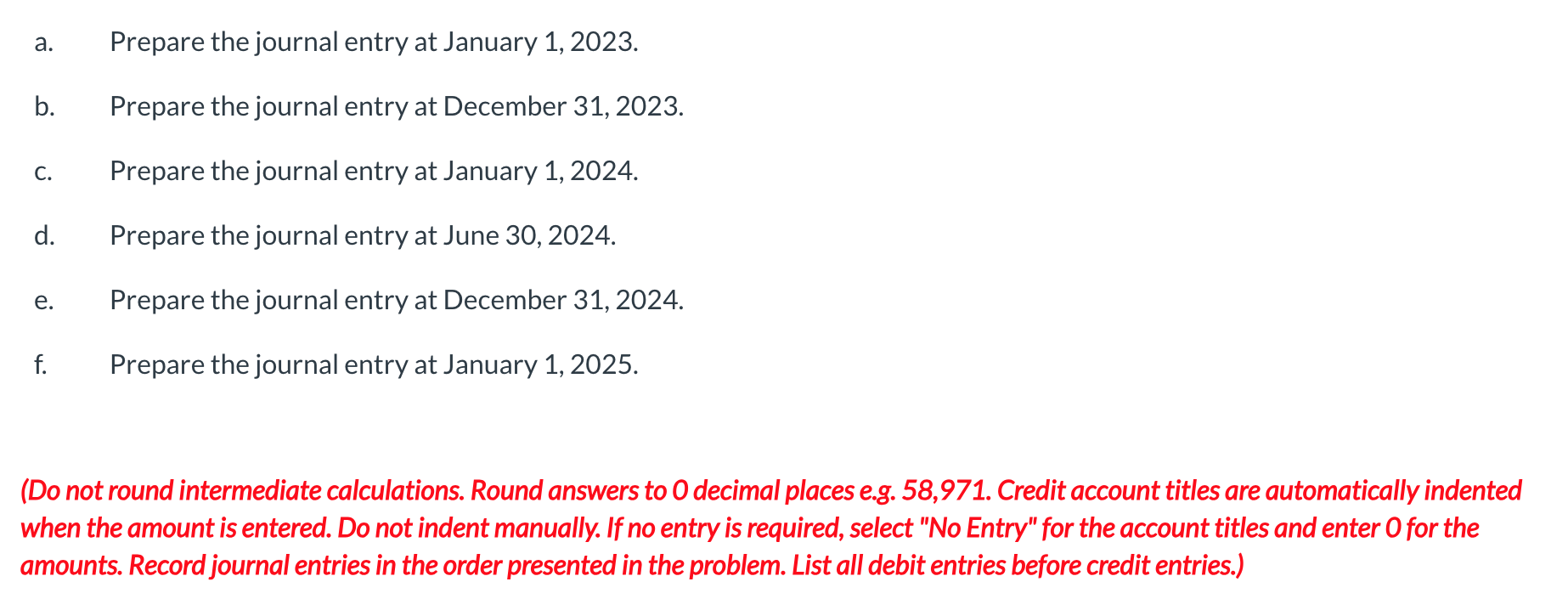

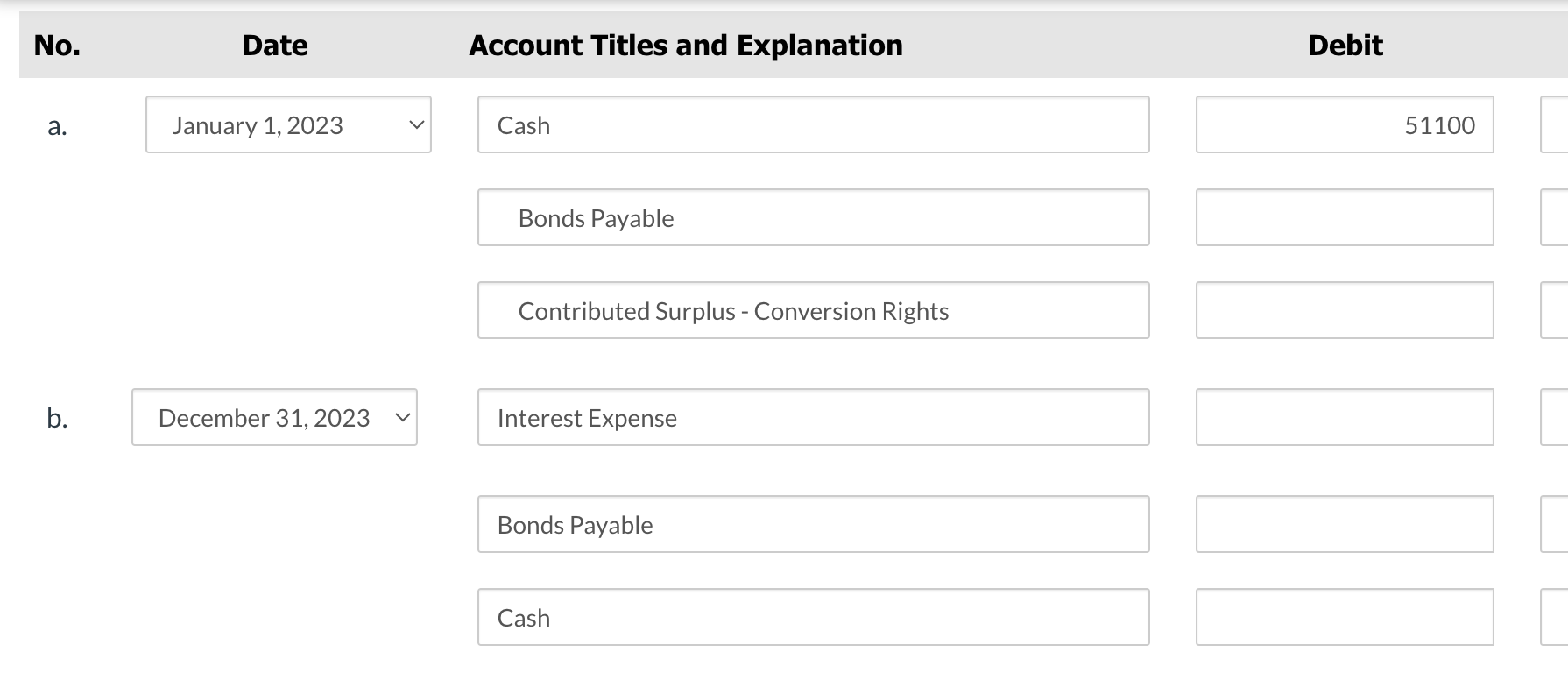

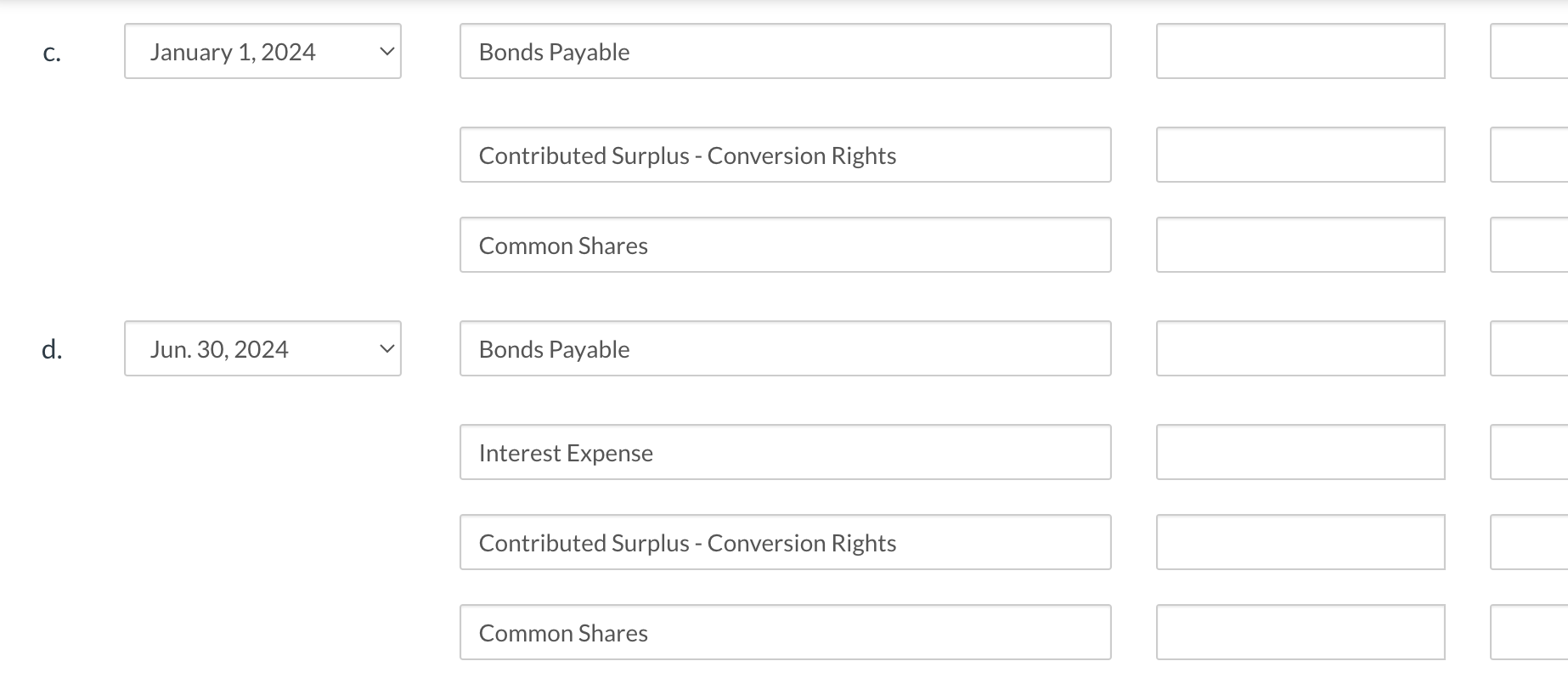

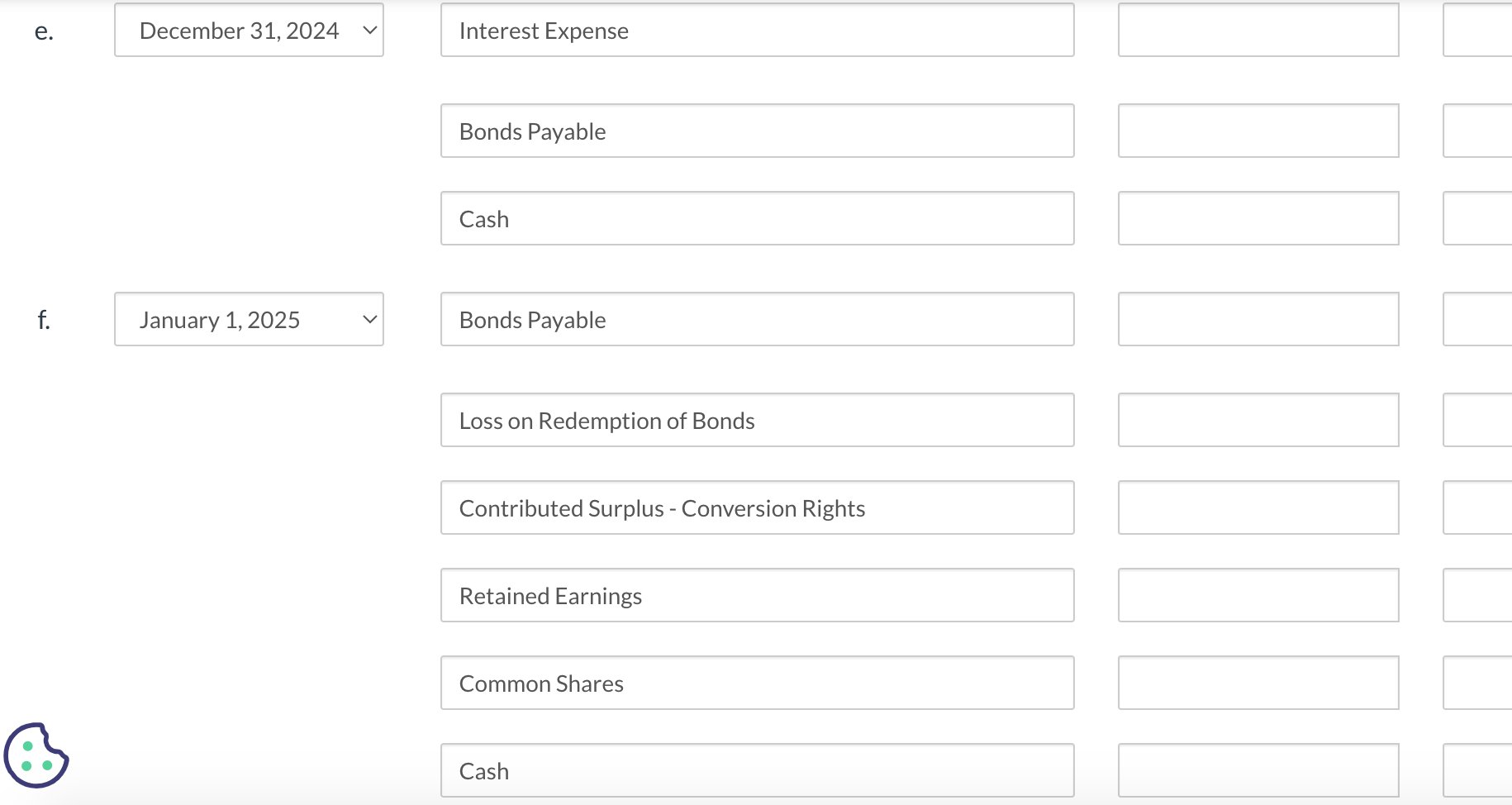

On January 1, 2023, TSJ Corporation issued a series of 100 convertible bonds, maturing in 5 years. The face amount of each bond was $500. TSJ received $51,100 for the bond issue. The bonds paid interest every December 31 at 7%; the market interest rate for bonds with a comparable level of risk was 7.50%. The bonds were convertible to common shares at a rate of 10 common shares per bond. TSJ amortized bond premiums and discounts using the effective interest method, and the company's year-end was December 31. TSJ follows ASPE. On January 1, 2024, 20 of the bonds were converted into common shares. On June 30, 2024, another 20 bonds were converted into common shares. The bondholders chose to forfeit the accrued interest on these bonds. On January 1, 2025, when the fair value of the bonds was $30,570 due to a decrease in market interest rates, a conversion inducement of $25/ bond was offered to the remaining bondholders to convert their bonds to common shares. All of the remaining 60 bonds were converted into common shares at this time. a. Prepare the journal entry at January 1, 2023. b. Prepare the journal entry at December 31, 2023. c. Prepare the journal entry at January 1, 2024. d. Prepare the journal entry at June 30, 2024 . e. Prepare the journal entry at December 31, 2024. f. Prepare the journal entry at January 1, 2025. (Do not round intermediate calculations. Round answers to 0 decimal places e.g. 58,971. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) No. a. January 1, 2023 January 1, 2023 b. December 31, 2023 v Account Titles and Explanation Cash Bonds Payable Contributed Surplus - Conversion Rights Interest Expense Bonds Payable Cash Debit 51100 C. January 1, 2024 d. Jun. 30, 2024 Bonds Payable Contributed Surplus - Conversion Rights Common Shares Bonds Payable Interest Expense Contributed Surplus - Conversion Rights Common Shares e. December 31, 2024 v f. January 1, 2025 Interest Expense Bonds Payable Cash Bonds Payable Loss on Redemption of Bonds Contributed Surplus - Conversion Rights Retained Earnings Common Shares Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts