Question: note: only fill in the blanks without explanation 1. Projects Ss and LL have the following cash flows: WACC =r= 10% 0 SS LL 1

note: only fill in the blanks without explanation

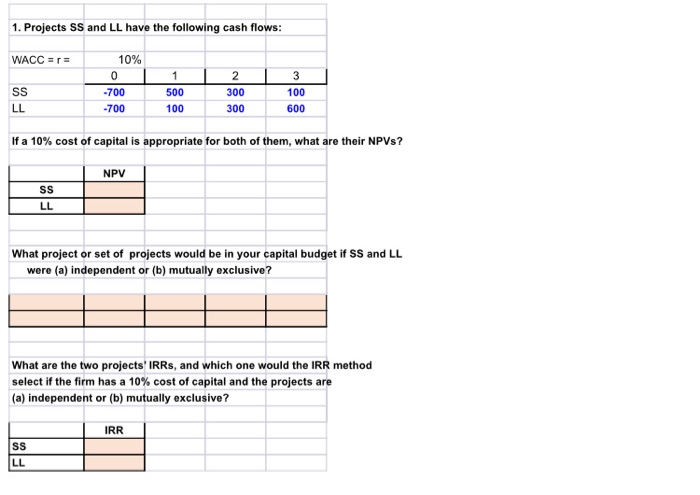

note: only fill in the blanks without explanation1. Projects Ss and LL have the following cash flows: WACC =r= 10% 0 SS LL 1 500 100 2 300 300 3 100 600 If a 10% cost of capital is appropriate for both of them, what are their NPVs? NPV What project or set of projects would be in your capital budget if SS and LL were (a) independent or (b) mutually exclusive? What are the two projects' IRRs, and which one would the IRR method select if the firm has a 10% cost of capital and the projects are (a) independent or (b) mutually exclusive? IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts