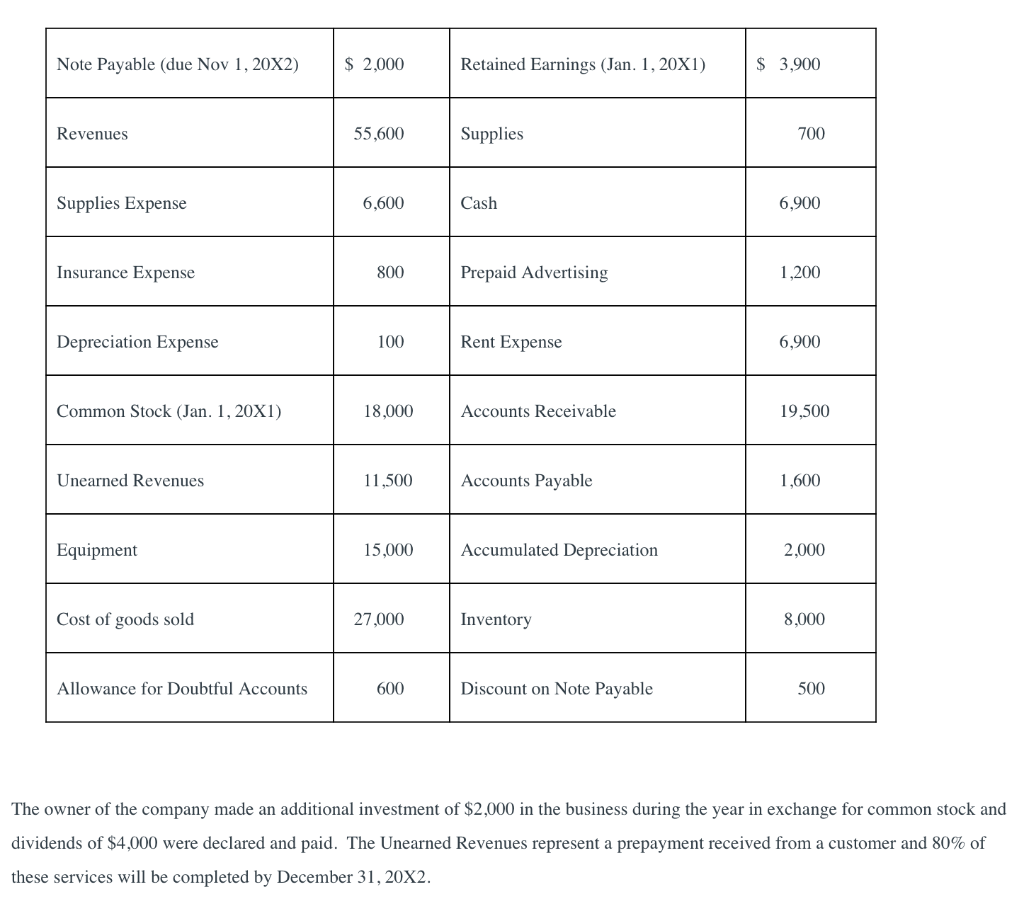

Question: Note Payable (due Nov 1, 20X2) $ 2,000 Retained Earnings (Jan. 1, 20X1) $ 3,900 Revenues 55,600 Supplies 700 Supplies Expense 6,600 Cash 6,900 Insurance

Note Payable (due Nov 1, 20X2) $ 2,000 Retained Earnings (Jan. 1, 20X1) $ 3,900 Revenues 55,600 Supplies 700 Supplies Expense 6,600 Cash 6,900 Insurance Expense 800 Prepaid Advertising 1,200 Depreciation Expense 100 Rent Expense 6,900 Common Stock (Jan. 1, 20X1) 18,000 Accounts Receivable 19,500 Unearned Revenues 11,500 Accounts Payable 1,600 Equipment 15,000 Accumulated Depreciation 2,000 Cost of goods sold 27,000 Inventory 8,000 Allowance for Doubtful Accounts 600 Discount on Note Payable 500 The owner of the company made an additional investment of $2,000 in the business during the year in exchange for common stock and dividends of $4,000 were declared and paid. The Unearned Revenues represent a prepayment received from a customer and 80% of these services will be completed by December 31, 20X2. Determine the Total Current Liabilities at December 31, 20X1: $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts