Question: NOTE: PLEASE DO NOT PROVIDE EXCEL ANSWER! NO EXCEL! Q1) COMPANY ABC WANTS TO DEFFER ITS TAXES BY DEPRECIATION METHOD AS A TEMPORARY DIFFRENCE.GIVEN THE

NOTE: PLEASE DO NOT PROVIDE EXCEL ANSWER! NO EXCEL!

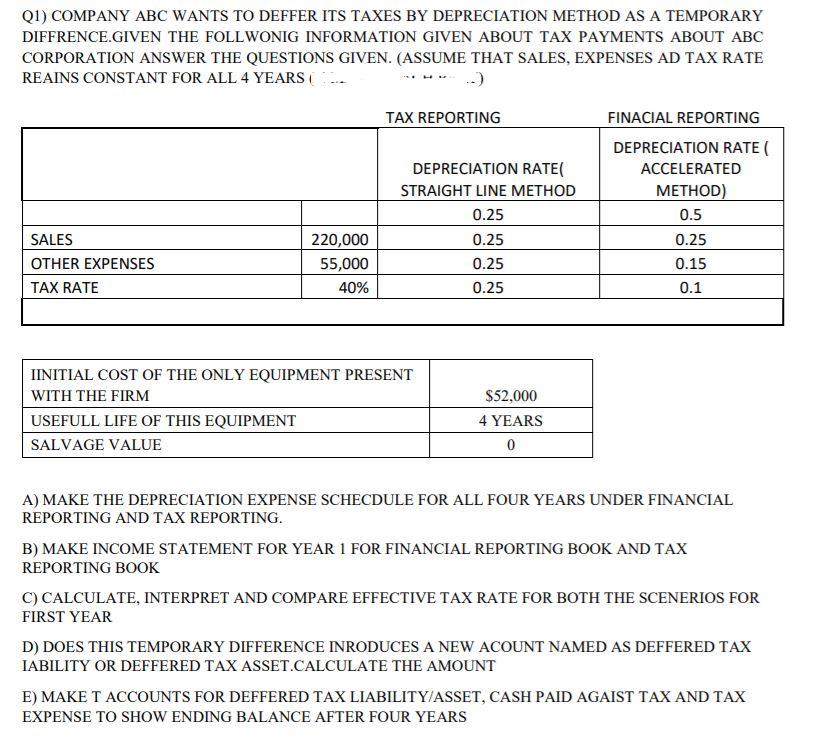

Q1) COMPANY ABC WANTS TO DEFFER ITS TAXES BY DEPRECIATION METHOD AS A TEMPORARY DIFFRENCE.GIVEN THE FOLLWONIG INFORMATION GIVEN ABOUT TAX PAYMENTS ABOUT ABC CORPORATION ANSWER THE QUESTIONS GIVEN. (ASSUME THAT SALES, EXPENSES AD TAX RATE REAINS CONSTANT FOR ALL 4 YEARS TAX REPORTING DEPRECIATION RATE STRAIGHT LINE METHOD 0.25 0.25 FINACIAL REPORTING DEPRECIATION RATE ACCELERATED METHOD) 0.5 0.25 0.15 0.1 SALES OTHER EXPENSES TAX RATE 220,000 55,000 40% 0.25 0.25 IINITIAL COST OF THE ONLY EQUIPMENT PRESENT WITH THE FIRM USEFULL LIFE OF THIS EQUIPMENT SALVAGE VALUE $52,000 4 YEARS 0 A) MAKE THE DEPRECIATION EXPENSE SCHECDULE FOR ALL FOUR YEARS UNDER FINANCIAL REPORTING AND TAX REPORTING. B) MAKE INCOME STATEMENT FOR YEAR 1 FOR FINANCIAL REPORTING BOOK AND TAX REPORTING BOOK C) CALCULATE, INTERPRET AND COMPARE EFFECTIVE TAX RATE FOR BOTH THE SCENERIOS FOR FIRST YEAR D) DOES THIS TEMPORARY DIFFERENCE INRODUCES A NEW ACOUNT NAMED AS DEFFERED TAX IABILITY OR DEFFERED TAX ASSET.CALCULATE THE AMOUNT E) MAKE T ACCOUNTS FOR DEFFERED TAX LIABILITY/ASSET, CASH PAID AGAIST TAX AND TAX EXPENSE TO SHOW ENDING BALANCE AFTER FOUR YEARS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts