Question: note please show working ( no Excel) and thank you. QUESTION 5 Consider the following information on Southern Sugar Manufacturing (SSM): The company's bond (long-term

note please show working ( no Excel) and thank you.

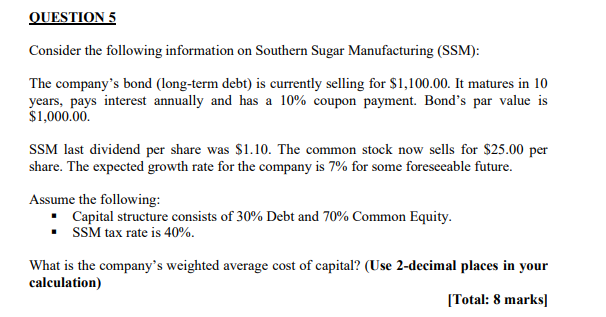

QUESTION 5 Consider the following information on Southern Sugar Manufacturing (SSM): The company's bond (long-term debt) is currently selling for $1,100.00. It matures in 10 years, pays interest annually and has a 10% coupon payment. Bond's par value is $1,000.00 SSM last dividend per share was $1.10. The common stock now sells for $25.00 per share. The expected growth rate for the company is 7% for some foreseeable future. Assume the following: Capital structure consists of 30% Debt and 70% Common Equity. SSM tax rate is 40%. What is the company's weighted average cost of capital? (Use 2-decimal places in your calculation) [Total: 8 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts