Question: note: Please solve in (IFRS) principles method not (FASB) Question eight: (7 points) Levers Company's bank statement for the month of December showed a balance

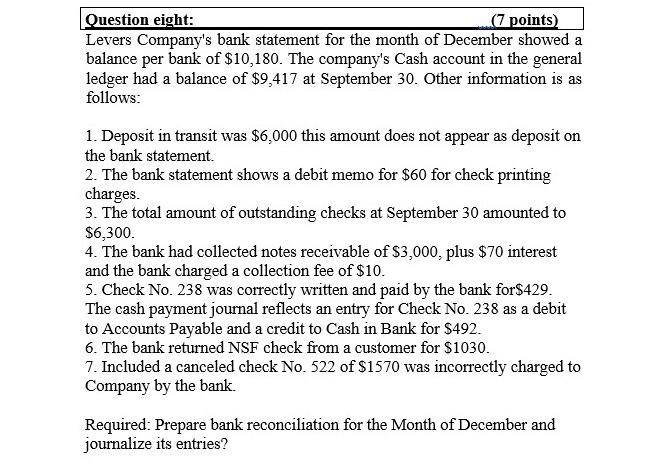

Question eight: (7 points) Levers Company's bank statement for the month of December showed a balance per bank of $10,180. The company's Cash account in the general ledger had a balance of $9,417 at September 30. Other information is as follows: 1. Deposit in transit was $6,000 this amount does not appear as deposit on the bank statement 2. The bank statement shows a debit memo for $60 for check printing charges. 3. The total amount of outstanding checks at September 30 amounted to $6,300. 4. The bank had collected notes receivable of $3,000, plus $70 interest and the bank charged a collection fee of $10. 5. Check No. 238 was correctly written and paid by the bank for$429. The cash payment journal reflects an entry for Check No. 238 as a debit to Accounts Payable and a credit to Cash in Bank for $492. 6. The bank returned NSF check from a customer for $1030. 7. Included a canceled check No. 522 of $1570 was incorrectly charged to Company by the bank. Required: Prepare bank reconciliation for the Month of December and journalize its entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts