Question: Note :- Please solve in such a way that i can get full marks Topic: Credit Risk Analysis Suppose you are a Credit and Risk

Note :- Please solve in such a way that i can get full marks

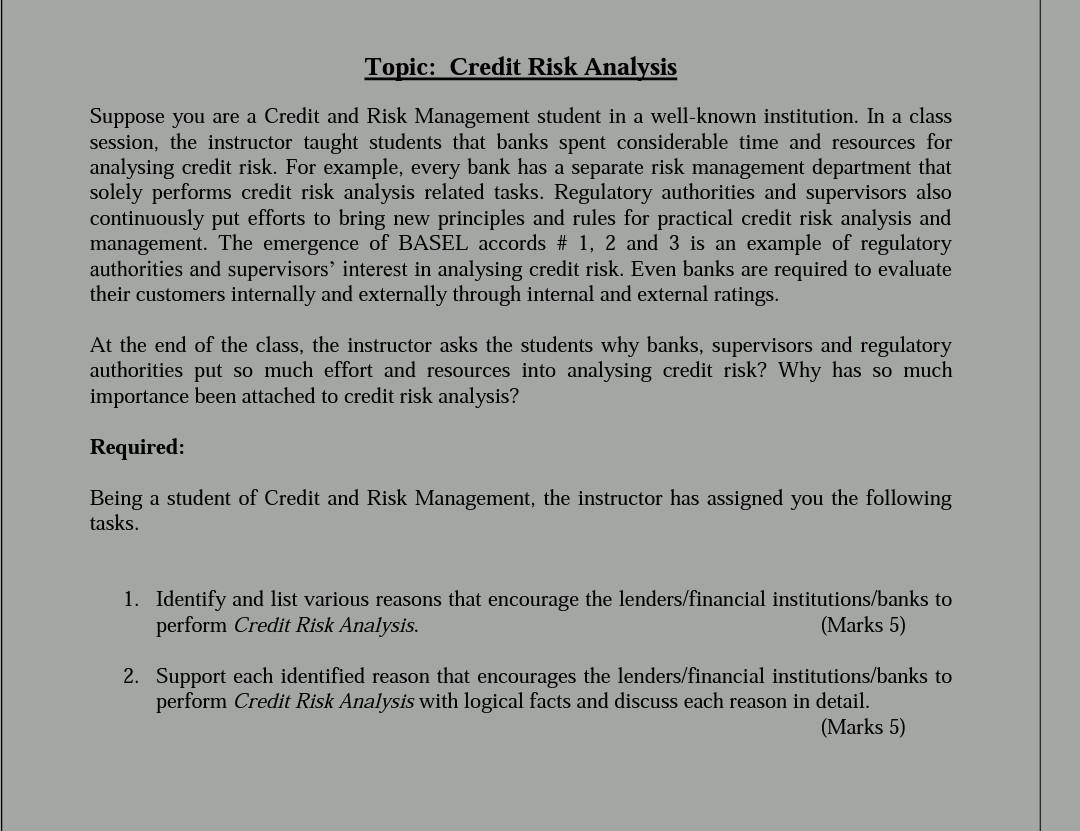

Topic: Credit Risk Analysis Suppose you are a Credit and Risk Management student in a well-known institution. In a class session, the instructor taught students that banks spent considerable time and resources for analysing credit risk. For example, every bank has a separate risk management department that solely performs credit risk analysis related tasks. Regulatory authorities and supervisors also continuously put efforts to bring new principles and rules for practical credit risk analysis and management. The emergence of BASEL accords # 1, 2 and 3 is an example of regulatory authorities and supervisors' interest in analysing credit risk. Even banks are required to evaluate their customers internally and externally through internal and external ratings. At the end of the class, the instructor asks the students why banks, supervisors and regulatory authorities put so much effort and resources into analysing credit risk? Why has so much importance been attached to credit risk analysis? Required: Being a student of Credit and Risk Management, the instructor has assigned you the following tasks. 1. Identify and list various reasons that encourage the lenders/financial institutions/banks to perform Credit Risk Analysis. (Marks 5) 2. Support each identified reason that encourages the lenders/financial institutions/banks to perform Credit Risk Analysis with logical facts and discuss each reason in detail. (Marks 5)Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock