Question: Note: please solve it in 30-40 minutes both questions. I have really really short time and it's tooo urgently required. Q. 01. Use the Black-Scholes-Merton

Note: please solve it in 30-40 minutes both questions. I have really really short time and it's tooo urgently required.

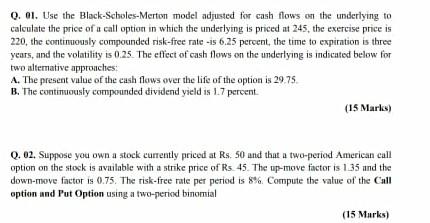

Q. 01. Use the Black-Scholes-Merton model adjusted for cash flows on the underlying to calculate the price of a call option in which the underlying is priced at 245, the exercise price is 220, the continuously compounded risk-free rate-15 6.25 percent, the time to expiration is three years, and the volatility is 0.25. The effect of cash flows on the underlying is indicated below for two alternative approaches A. The present value of the cash flows over the life of the option is 29.75 B. The continuously compounded dividend yield is 1.7 percent (15 Marks) Q. 02. Suppose you own a stock currently priced at Rs. 50 and that a two-period American call option on the stock is available with a strike price of Rs 45. The up-move factor is 135 and the down-move factor is 0.75. The risk-free rate per period is 8% Compute the value of the Call option and Put Option using a two-pericul binomial (15 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts