Question: Note- Please solve it step by step as Finance is not my strength. Please do not skip any step . thanks 12.16 A company is

Note- Please solve it step by step as Finance is not my strength. Please do not skip any step . thanks

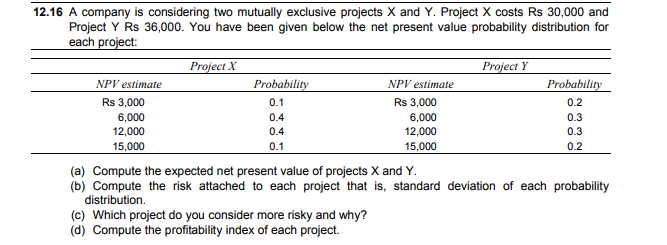

12.16 A company is considering two mutually exclusive projects X and Y. Project X costs Rs 30,000 and Project Y Rs 36,000. You have been given below the net present value probability distribution for each Project X Project Y NPV estimate Probability NPV estimate Rs 3,000 6,000 12,000 15,000 Rs 3,000 6,000 12,000 15,000 Probabilit 0.2 0.3 0.3 0.2 0.4 0.4 (a) Compute the expected net present value of projects X and Y (b) Compute the risk attached to each project that is, standard deviation of each probability distribution. (c) Which project do you consider more risky and why? (d) Compute the profitability index of each project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts