Question: Note: (Please Type Answer and Formulas used) 5. (35 pts) There are two stocks: A and B and Treasury Bill (TB). The parameters of these

Note: (Please Type Answer and Formulas used)

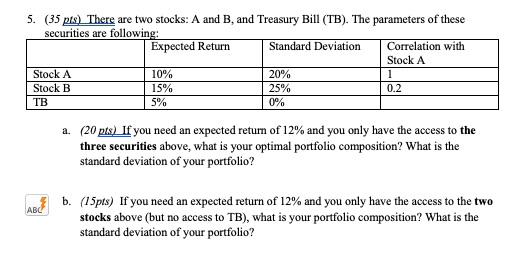

5. (35 pts) There are two stocks: A and B and Treasury Bill (TB). The parameters of these securities are following: Expected Return Standard Deviation Correlation with Stock A Stock A 10% 20% Stock B 15% 25% | 0.2 5% 0% a. (20 pts) If you need an expected return of 12% and you only have the access to the three securities above, what is your optimal portfolio composition? What is the standard deviation of your portfolio? b. (15pts) If you need an expected return of 12% and you only have the access to the two stocks above (but no access to TB), what is your portfolio composition? What is the standard deviation of your portfolio? 5. (35 pts) There are two stocks: A and B and Treasury Bill (TB). The parameters of these securities are following: Expected Return Standard Deviation Correlation with Stock A Stock A 10% 20% Stock B 15% 25% | 0.2 5% 0% a. (20 pts) If you need an expected return of 12% and you only have the access to the three securities above, what is your optimal portfolio composition? What is the standard deviation of your portfolio? b. (15pts) If you need an expected return of 12% and you only have the access to the two stocks above (but no access to TB), what is your portfolio composition? What is the standard deviation of your portfolioStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock