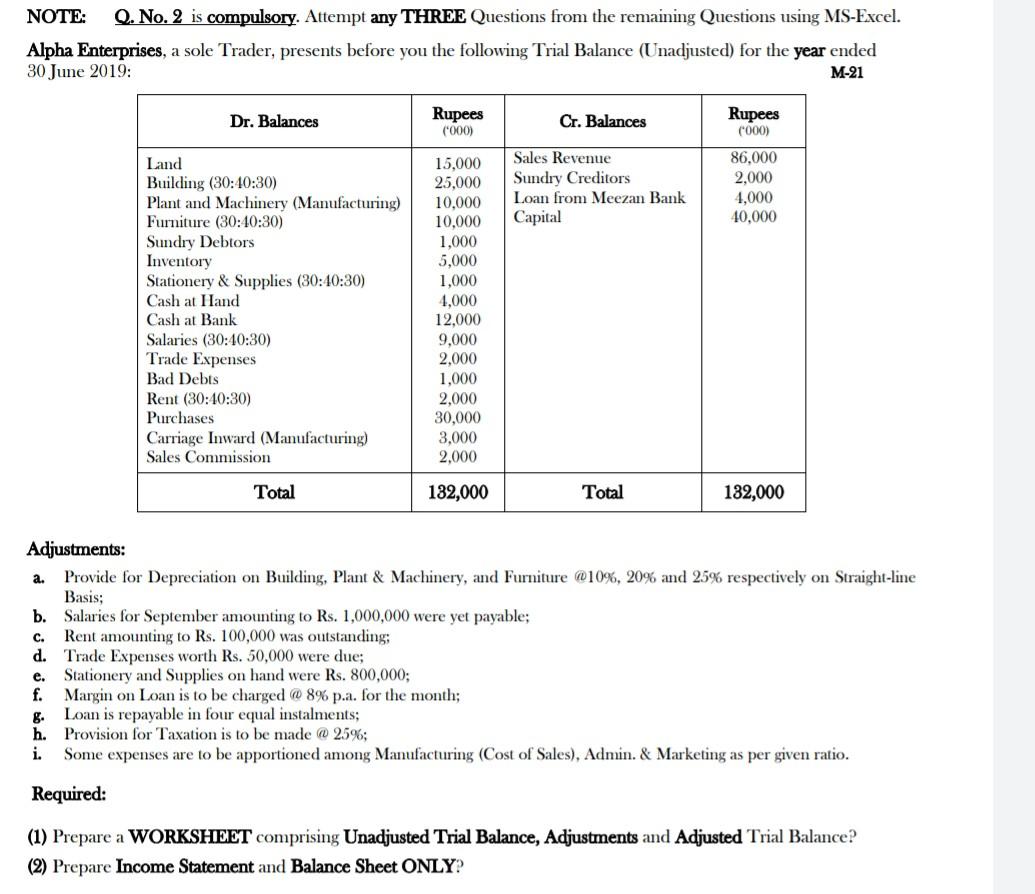

Question: NOTE: Q. No. 2 is compulsory. Attempt any THREE Questions from the remaining Questions using MS-Excel. Alpha Enterprises, a sole Trader, presents before you the

NOTE: Q. No. 2 is compulsory. Attempt any THREE Questions from the remaining Questions using MS-Excel. Alpha Enterprises, a sole Trader, presents before you the following Trial Balance (Unadjusted) for the year ended 30 June 2019: M-21 Dr. Balances Rupees ('000) Cr. Balances Rupees (000) Sales Revenue Sundry Creditors Loan from Meezan Bank Capital 86.000 2,000 4,000 40,000 Land Building (30:40:30) Plant and Machinery (Manufacturing) Furniture (30:10:30) Sundry Debtors Inventory Stationery & Supplies (30:40:30) Cash at Hand Cash at Bank Salaries (30:40:30) Trade Expenses Bad Debts Rent (30:40:30) Purchases Carriage Inward (Manufacturing) Sales Commission 15,000 25,000 10,000 10,000 1,000 5,000 1,000 4,000 12,000 9,000 2.000 1,000 2,000 30,000 3,000 2,000 Total 132,000 Total 132,000 a. Adjustments: Provide for Depreciation on Building, Plant & Machinery, and Furniture @10%, 20% and 25% respectively on Straight-line Basis; b. Salaries for September amounting to Rs. 1,000,000 were yet payable; c. Rent amounting to Rs. 100,000 was outstanding d. Trade Expenses worth Rs. 50,000 were due; e. Stationery and Supplies on hand were Rs. 800,000; f. Margin on Loan is to be charged @ 8% p.a. for the month; Loan is repayable in four equal instalments; h. Provision for Taxation is to be made @ 25%; i. Some expenses are to be apportioned among Manufacturing (Cost of Sales), Admin. & Marketing as per given ratio. Required: (1) Prepare a WORKSHEET comprising Unadjusted Trial Balance, Adjustments and Adjusted Trial Balance? (2) Prepare Income Statement and Balance Sheet ONLY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts