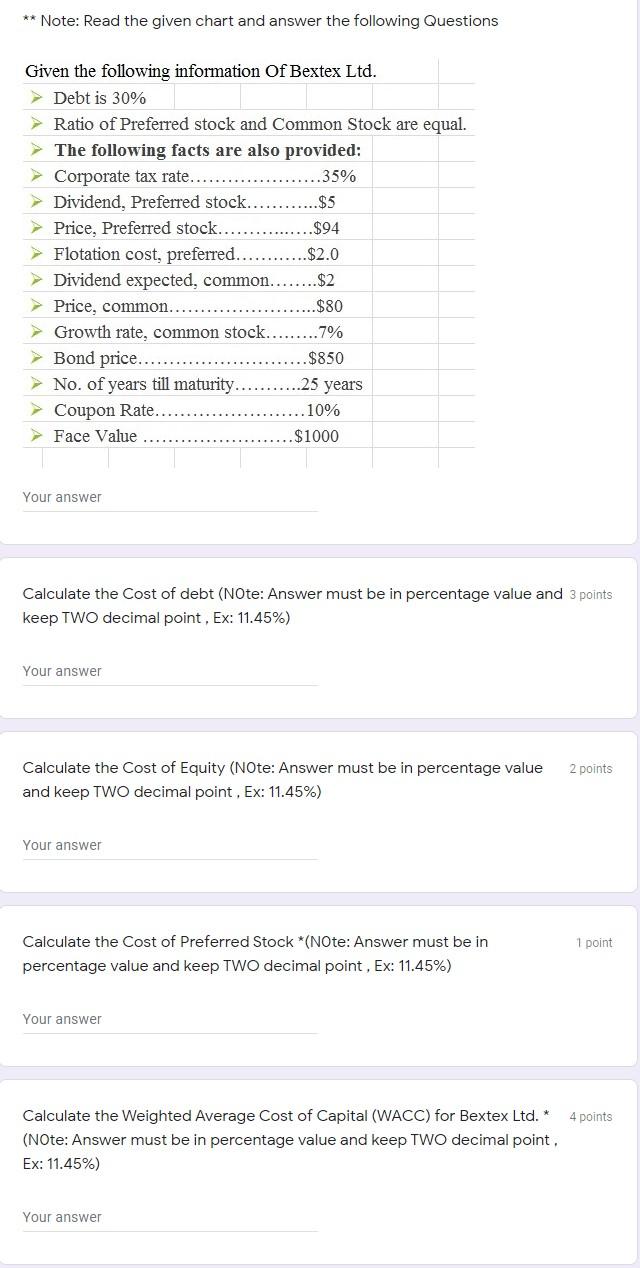

Question: ** Note: Read the given chart and answer the following Questions Given the following information Of Bextex Ltd. > Debt is 30% > Ratio of

** Note: Read the given chart and answer the following Questions Given the following information Of Bextex Ltd. > Debt is 30% > Ratio of Preferred stock and Common Stock are equal. > The following facts are also provided: Corporate tax rate.. .35% Dividend, Preferred stock. $5 Price, Preferred stock... $94 > Flotation cost, preferred. $2.0 Dividend expected, common... ...$2 > Price, common. $80 Growth rate, common stock. .7% > Bond price.... $850 No. of years till maturity. Coupon Rate. .10% Face Value $1000 .25 years Your answer Calculate the cost of debt (Note: Answer must be in percentage value and 3 points keep TWO decimal point, Ex: 11.45%) Your answer 2 points Calculate the cost of Equity (Note: Answer must be in percentage value and keep TWO decimal point. Ex: 11.45%) Your answer 1 point Calculate the cost of Preferred Stock *(NOte: Answer must be in percentage value and keep TWO decimal point, Ex: 11.45%) Your answer 4 points Calculate the Weighted Average Cost of Capital (WACC) for Bextex Ltd. * (Note: Answer must be in percentage value and keep TWO decimal point, Ex: 11.45%) Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts