Question: Note: Require Plagiarism free answer Alex Kingsford is a mechanical engineer working for ABC Engineering in Melbourne. Alex owns a property in Dandenong, Victorian where

Note: Require Plagiarism free answer

Alex Kingsford is a mechanical engineer working for ABC Engineering in Melbourne. Alex owns a

property in Dandenong, Victorian where he and his family are residing. He also runs a home- based food catering business, preparing food for local residents and school canteens. Catering

business is well-structured. Alex works 15 days a month and earns a substantial income from the

catering services business. He is travelling from ABC Engineering workshop to his home- based business by car or sometimes Uber. When he lodged his tax return in July 2019, he has

requested a deduction for a substantial amount of travelling expenses between the ABC Engineering workshop and home-based food business. Alex is now seeking your advice. With reference to relevant legislation and case law discuss

whether Alexs travelling expenses between the ABC Engineering workshop and his home- based catering business is an allowable deduction.

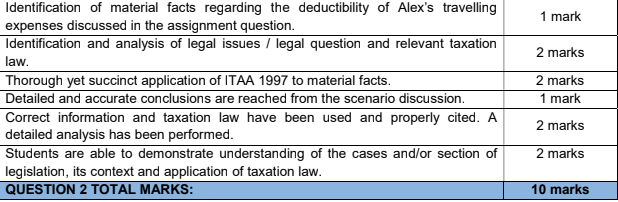

Marking criteria:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts