Question: Note: Round your answers for each question as instructed. But carry your unrounded values forward to the later parts of the question where required. Planet

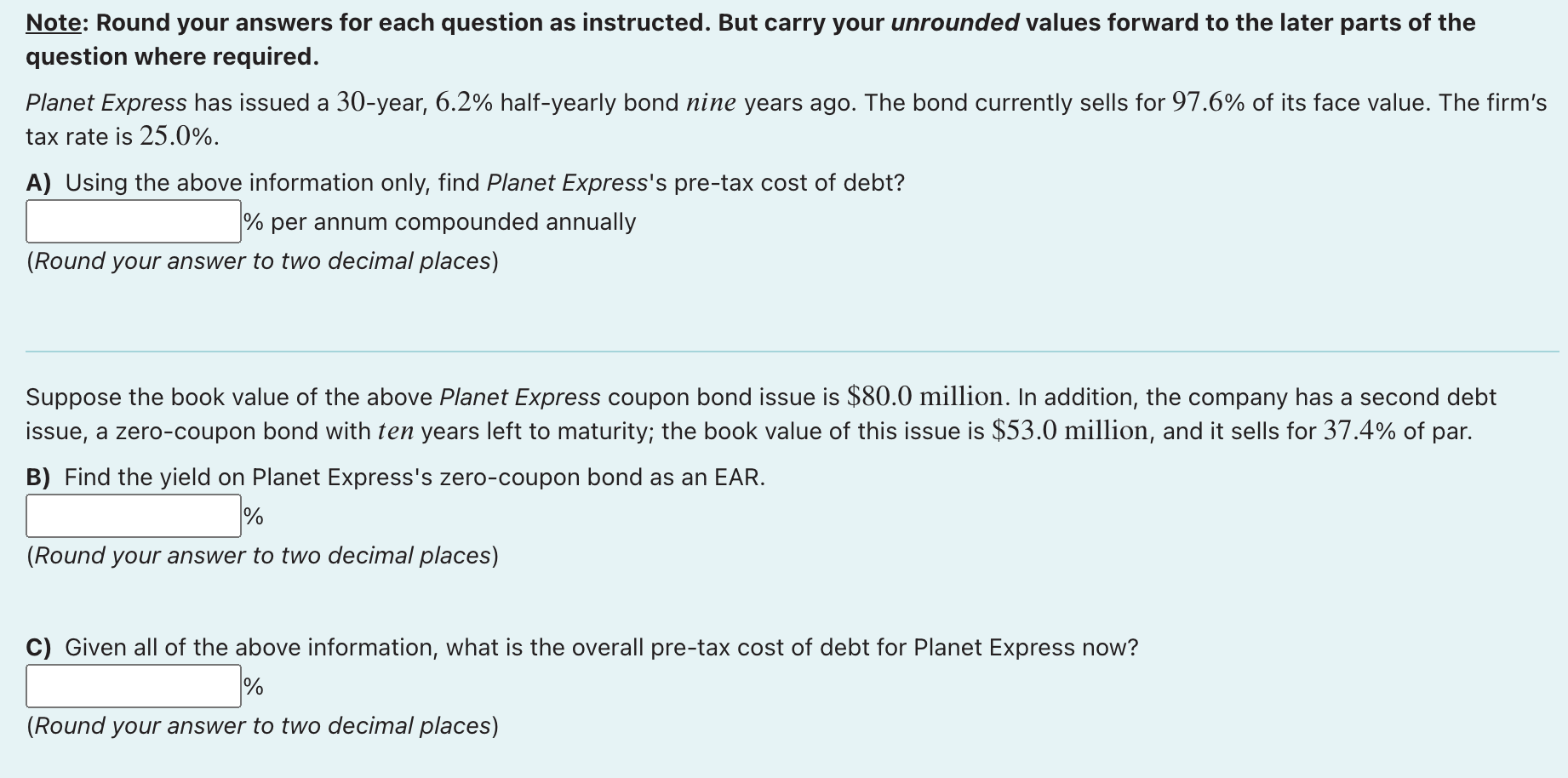

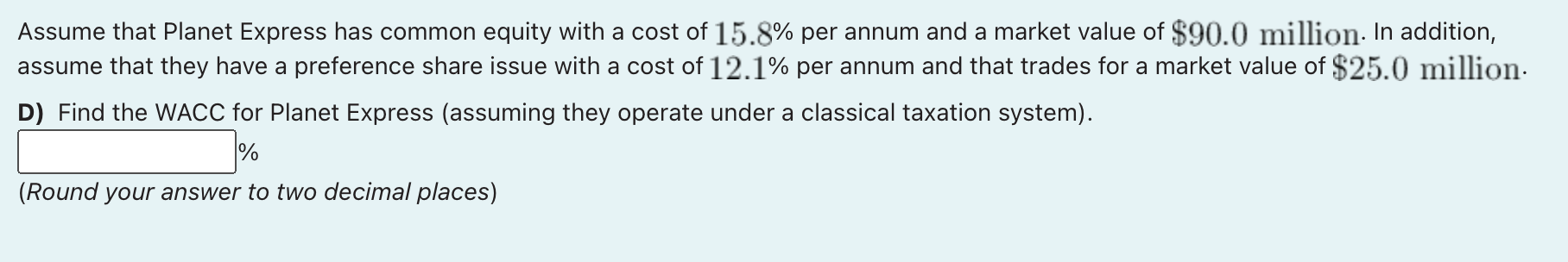

Note: Round your answers for each question as instructed. But carry your unrounded values forward to the later parts of the question where required. Planet Express has issued a 30-year, 6.2% half-yearly bond nine years ago. The bond currently sells for 97.6% of its face value. The firm's tax rate is 25.0%. A) Using the above information only, find Planet Express's pre-tax cost of debt? % per annum compounded annually (Round your answer to two decimal places) Suppose the book value of the above Planet Express coupon bond issue is $80.0 million. In addition, the company has a second debt issue, a zero-coupon bond with ten years left to maturity; the book value of this issue is $53.0 million, and it sells for 37.4% of par. B) Find the yield on Planet Express's zero-coupon bond as an EAR. % (Round your answer to two decimal places) C) Given all of the above information, what is the overall pre-tax cost of debt for Planet Express now? % (Round your answer to two decimal places) Assume that Planet Express has common equity with a cost of 15.8% per annum and a market value of $90.0 million. In addition, assume that they have a preference share issue with a cost of 12.1% per annum and that trades for a market value of $25.0 million. D) Find the WACC for Planet Express (assuming they operate under a classical taxation system). % (Round your answer to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts