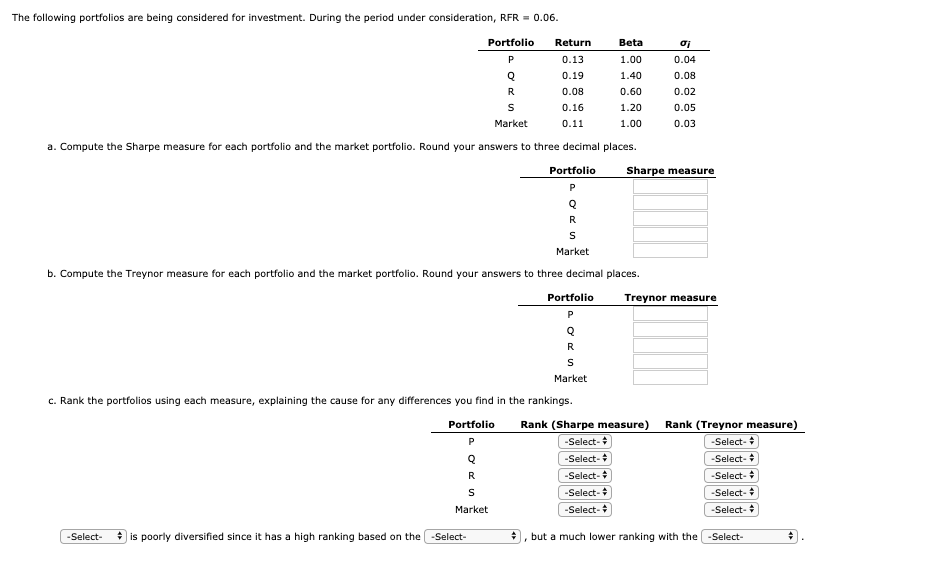

Question: Note: Select options for Chart are 1,2, 3, 4, 5 Select options in last line are portfolio P, Q, R S treynor measure/ sharpe measure

Note: Select options for Chart are "1,2, 3, 4, 5"

Select options in last line are "portfolio P, Q, R S"

"treynor measure/ sharpe measure" for the last two selection options.

The following portfolios are being considered for investment. During the period under consideration, RFR -0.06. Portfolio oi Return 0.13 0.19 0.08 0.16 0.11 Beta 1.00 1.40 0.60 1.20 1.00 0.04 0.08 0.02 0.05 0.03 Market a. Compute the Sharpe measure for each portfolio and the market portfolio. Round your answers to three decimal places. Portfolio Sharpe measure Market b. Compute the Treynor measure for each portfolio and the market portfolio. Round your answers to three decimal places. Portfolio Treynor measure Market c. Rank the portfolios using each measure, explaining the cause for any differences you find in the rankings. Portfolio Rank (Sharpe measure) Rank (Treynor measure) -Select- -Select- -Select- -Select- -Select- -Select- -Select- -Select- -Select- -Select- Market -Select is poorly diversified since it has a high ranking based on the Select , but a much lower ranking with the -Select- )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts