Question: NOTE: SHOW A TIME LINE AND THE PRESENT VALUE OR FUTURE VALUE FORMULA USED TO SOLVE EACH PROBLEM. 1. 2. 3. Suppose you deposit $2,500

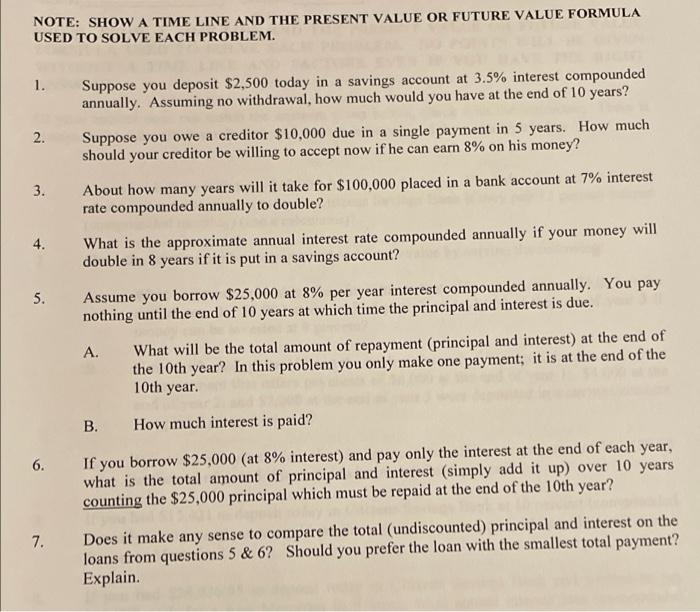

NOTE: SHOW A TIME LINE AND THE PRESENT VALUE OR FUTURE VALUE FORMULA USED TO SOLVE EACH PROBLEM. 1. 2. 3. Suppose you deposit $2,500 today in a savings account at 3.5% interest compounded annually. Assuming no withdrawal, how much would you have at the end of 10 years? Suppose you owe a creditor $10,000 due in a single payment in 5 years. How much should your creditor be willing to accept now if he can earn 8% on his money? About how many years will it take for $100,000 placed in a bank account at 7% interest rate compounded annually to double? What is the approximate annual interest rate compounded annually if your money will double in 8 years if it is put in a savings account? Assume you borrow $25,000 at 8% per year interest compounded annually. You pay nothing until the end of 10 years at which time the principal and interest is due. A. What will be the total amount of repayment (principal and interest) at the end of the 10th year? In this problem you only make one payment; it is at the end of the 4. 5. 10th year. B. How much interest is paid? 6. If you borrow $25,000 (at 8% interest) and pay only the interest at the end of each year, what is the total amount of principal and interest (simply add it up) over 10 years counting the $25,000 principal which must be repaid at the end of the 10th year? 7. Does it make any sense to compare the total (undiscounted) principal and interest on the loans from questions 5 & 6? Should you prefer the loan with the smallest total payment? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts