Question: Note: taxation - Answer letter A with complete solution. Domestic corporation in general Assume that IYA, Inc. a domestic corporation engaged in the sale of

Note: taxation - Answer letter A with complete solution.

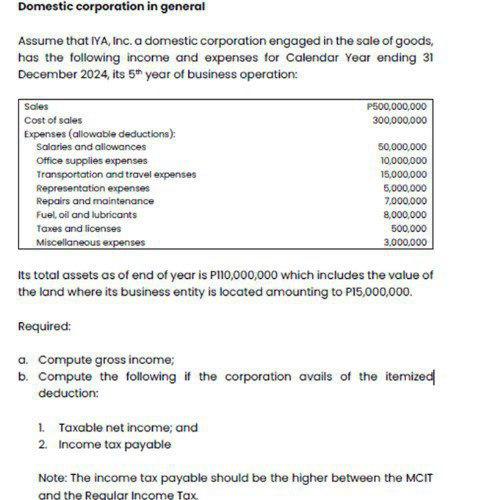

Domestic corporation in general Assume that IYA, Inc. a domestic corporation engaged in the sale of goods, has the following income and expenses for Calendar Year ending 31 December 2024, its 5th year of business operation: Its total assets as of end of year is P110,000,000 which includes the value of the land where its business entity is located amounting to P15,000,000. Required: a. Compute gross income; b. Compute the following if the corporation avails of the itemized deduction: 1. Taxable net income; and 2. Income tax payable Note: The income tax payable should be the higher between the MCIT and the Reqular Income Tax Domestic corporation in general Assume that IYA, Inc. a domestic corporation engaged in the sale of goods, has the following income and expenses for Calendar Year ending 31 December 2024, its 5th year of business operation: Its total assets as of end of year is P110,000,000 which includes the value of the land where its business entity is located amounting to P15,000,000. Required: a. Compute gross income; b. Compute the following if the corporation avails of the itemized deduction: 1. Taxable net income; and 2. Income tax payable Note: The income tax payable should be the higher between the MCIT and the Reqular Income Tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts