Question: Note that Question 2 has two parts - Part (A) and (B). Part (A) is not related to Part (B) Part (A) (8 marks) Consider

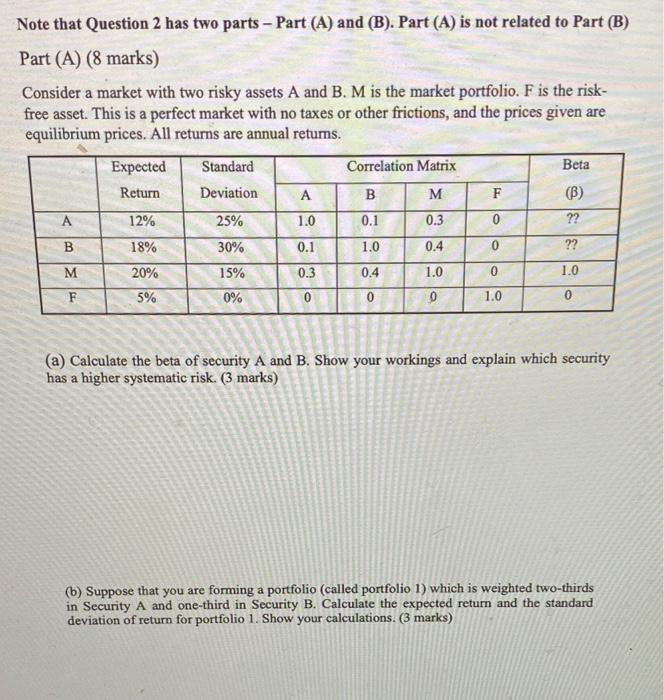

Note that Question 2 has two parts - Part (A) and (B). Part (A) is not related to Part (B) Part (A) (8 marks) Consider a market with two risky assets A and B. M is the market portfolio. F is the risk- free asset. This is a perfect market with no taxes or other frictions, and the prices given are equilibrium prices. All returns are annual retums. Expected Standard Correlation Matrix Beta Return Deviation A B M F (B) A 12% 25% 1.0 0.1 0.3 0 ?? B 18% 30% 0.1 1.0 0.4 0 ?? M 20% 15% 0.3 0.4 1.0 0 1.0 F 5% 0% 0 0 0 1.0 0 (a) Calculate the beta of security A and B. Show your workings and explain which security has a higher systematic risk. (3 marks) (6) Suppose that you are forming a portfolio (called portfolio 1) which is weighted two-thirds in Security A and one-third in Security B. Calculate the expected return and the standard deviation of return for portfolio 1. Show your calculations. (3 marks) Now suppose that the correlation between stock A and B was 0.01 instead of the number given in the table. Without doing any calculations explain what effect this would have on the return and standard deviation of your portfolio. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts