Question: Note that the difference between LTL(less than truck load) and TL(truck load) is how the net fixed cost is calculated. For TL, because the whole

Note that the difference between LTL(less than truck load) and TL(truck load) is how the net fixed cost is calculated. For TL, because the whole truck is used, the fixed cost must include TL shipping cost. For LTL, the fixed cost does not include shipping cost.

(assume one supplier per truck)

1. What is the fixed costs for LTL and TL policies?

a.LTL = 101, TL = 100

b.LTL = 100, TL = 1000

c.LTL = 101, TL = 900

d.LTL = 100, TL = 900

2.What are optimal order quantities for LTL and TL policies?

a.LTL = 235, TL = 765

b.LTL = 240, TL = 770

c.LTL = 245, TL = 775

d.LTL = 250, TL = 780

3.For LTL case, what are annual order cost (oc), annual trucking cost (tc), and annual holding cost (hc)?

a.oc = 1000, tc = 2000, hc = 1150

b.oc = 1220, tc = 2500, hc = 1220

c.oc = 1225, tc = 3000, hc = 1225

4 .For TL case, what are annual order cost (oc), annual trucking cost (tc), and annual holding cost (hc)?

a.oc = 370, tc = 3200, hc = 3800

b.oc = 387, tc = 3486, hc = 3873

c.oc = 390, tc = 3500, hc = 3900

(now consider TL with two suppliers per truck)

5 .What is the net fixed cost for this policy? (remember, for TL, the net fixed cost must include both ordering cost and shipping cost)

a.800

b.1000

c.1200

6 .What is the optimal order frequency?(n*)

a.3

b.4

c.5

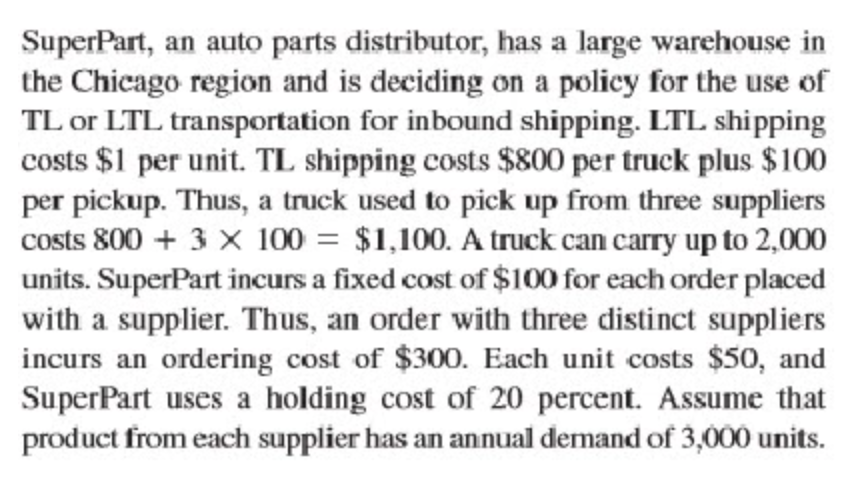

SuperPart, an auto parts distributor, has a large warehouse in the Chicago region and is deciding on a policy for the use of TL or LTL transportation for inbound shipping. LTL shipping costs $1 per unit. TL shipping costs $800 per truck plus $100 per pickup. Thus, a truck used to pick up from three suppliers costs 800 + 3 X 100 = $1,100. A truck can carry up to 2,000 units. SuperPart incurs a fixed cost of $100 for each order placed with a supplier. Thus, an order with three distinct suppliers incurs an ordering cost of $300. Each unit costs $50, and SuperPart uses a holding cost of 20 percent. Assume that product from each supplier has an annual demand of 3,000 unitsStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts