Question: note that the two pictures makes a full question QUESTION 12 a). Why are cash flow statements sometimes considered more useful than profit statements? b).

note that the two pictures makes a full question

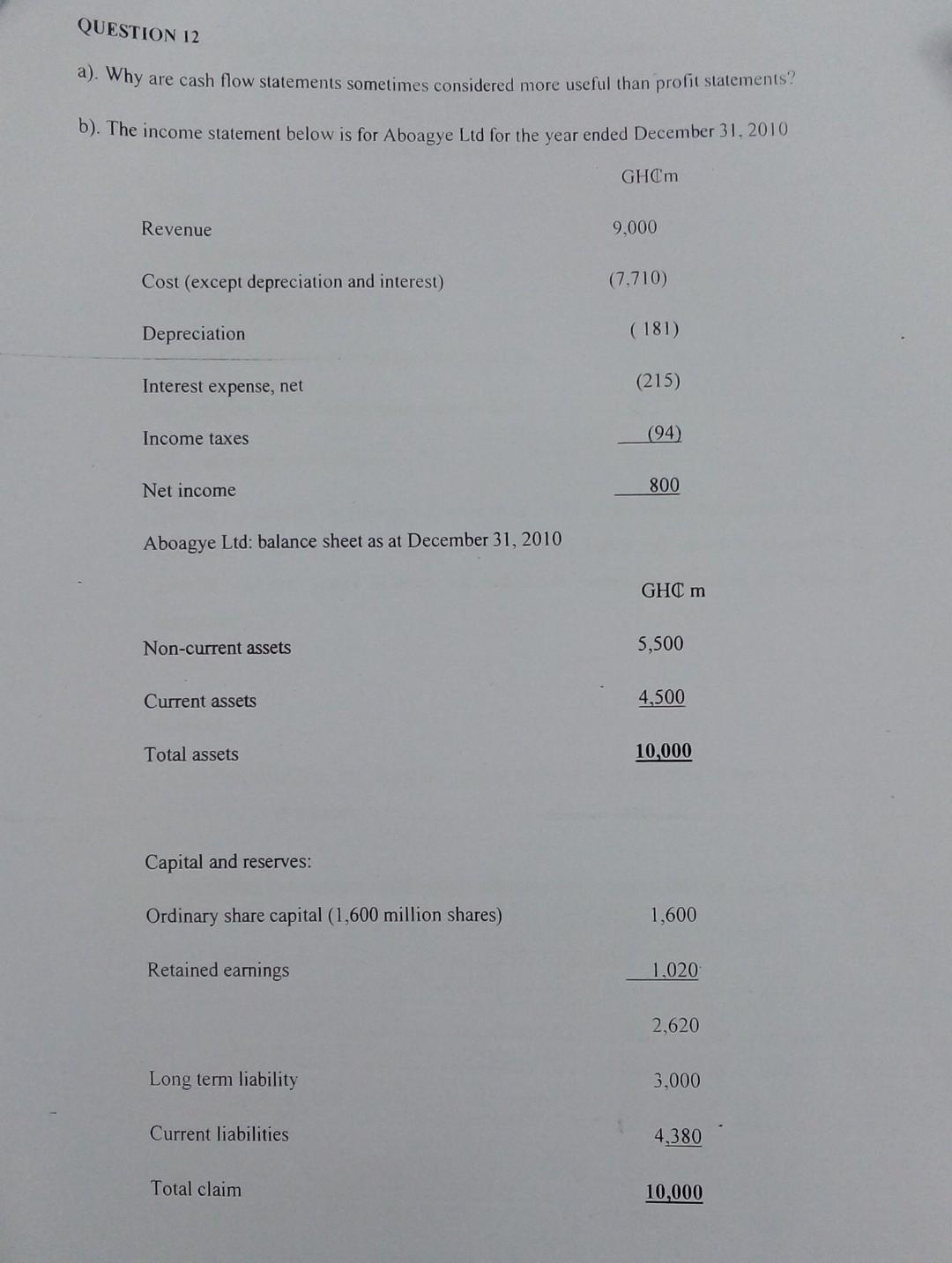

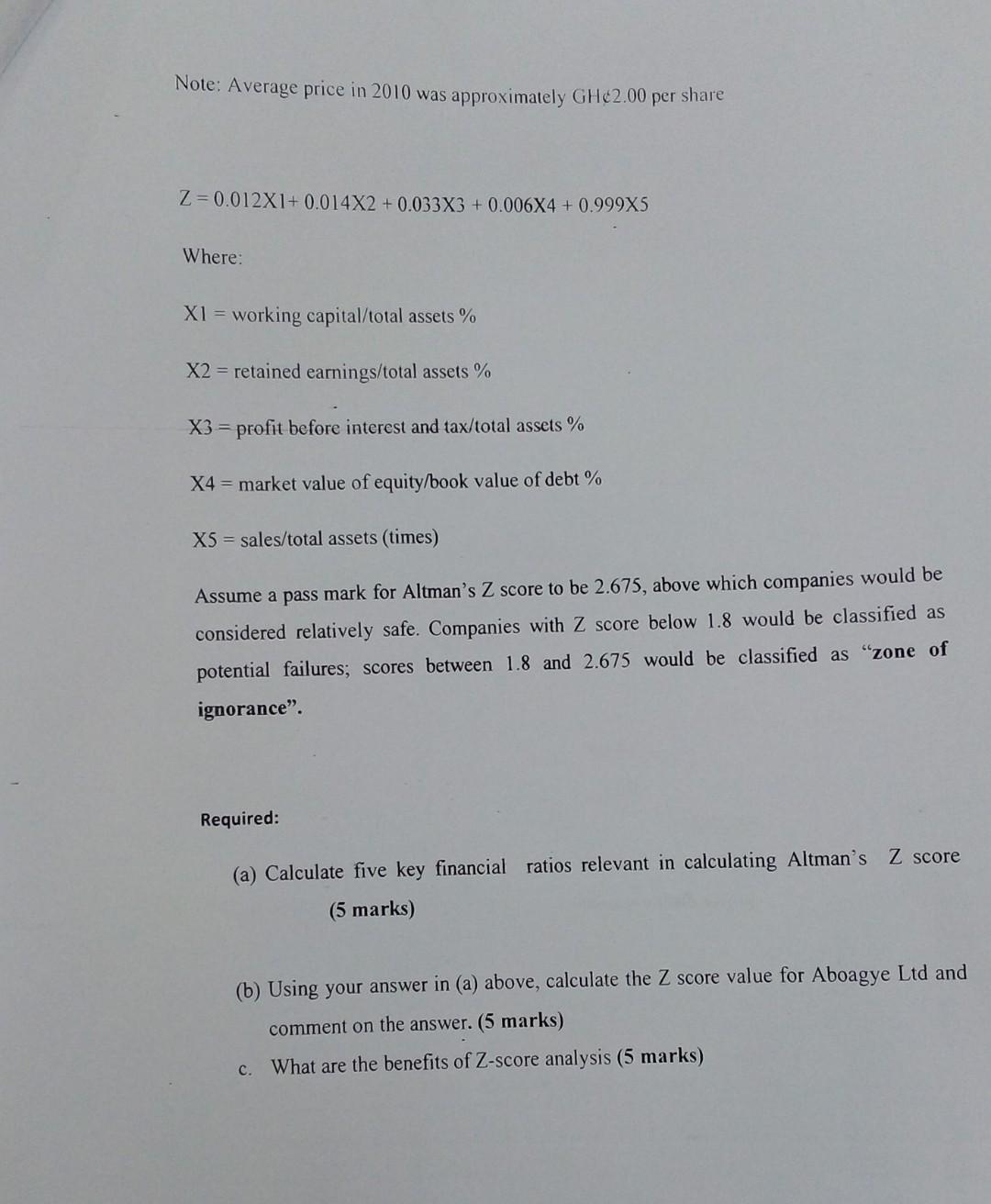

QUESTION 12 a). Why are cash flow statements sometimes considered more useful than profit statements? b). The income statement below is for Aboagye Ltd for the year ended December 31, 2010 GHCm Revenue 9,000 Cost (except depreciation and interest) (7,710) Depreciation (181) Interest expense, net (215) Income taxes (94) Net income 800 Aboagye Ltd: balance sheet as at December 31, 2010 GHC m Non-current assets 5,500 Current assets 4,500 Total assets 10,000 Capital and reserves: Ordinary share capital (1,600 million shares) 1,600 Retained earnings 1,020 2,620 Long term liability 3,000 Current liabilities 4,380 Total claim 10,000 Note: Average price in 2010 was approximately GH2.00 per share Z=0.012X1+ 0.014X2 +0.033x3 +0.006X4 +0.999X5 Where: X1 = working capital/total assets % X2 = retained earnings/total assets % X3 = profit before interest and tax/total assets % X4 = market value of equity/book value of debt % X5 = sales/total assets (times) Assume a pass mark for Altman's Z score to be 2.675, above which companies would be considered relatively safe. Companies with Z score below 1.8 would be classified as potential failures; scores between 1.8 and 2.675 would be classified as zone of ignorance". Required: (a) Calculate five key financial ratios relevant in calculating Altman's Z score (5 marks) (b) Using your answer in (a) above, calculate the Z score value for Aboagye Ltd and comment on the answer. (5 marks) c. What are the benefits of Z-score analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts