Question: Note that these are the same facts as used in Question 4 (the lessee) On May 1, 2023, Light Co. leased equipment to House Co.

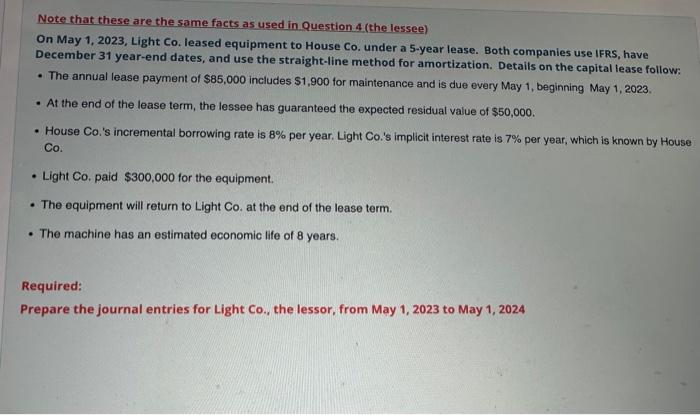

Note that these are the same facts as used in Question 4 (the lessee) On May 1, 2023, Light Co. leased equipment to House Co. under a 5-year lease. Both companies use IFRS, have December 31 year-end dates, and use the straight-line method for amortization. Details on the capital lease follow: - The annual lease payment of $85,000 includes $1,900 for maintenance and is due every May 1, beginning May 1, 2023. - At the end of the lease term, the lessee has guaranteed the expected residual value of $50,000. - House Co.'s incremental borrowing rate is 8% per year. Light Co.'s implicit interest rate is 7% per year, which is known by House Co. - Light Co. paid $300,000 for the equipment. - The equipment will return to Light Co. at the end of the lease term. - The machine has an estimated economic life of 8 years. Required: Prepare the journal entries for Light Co., the lessor, from May 1, 2023 to May 1, 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts