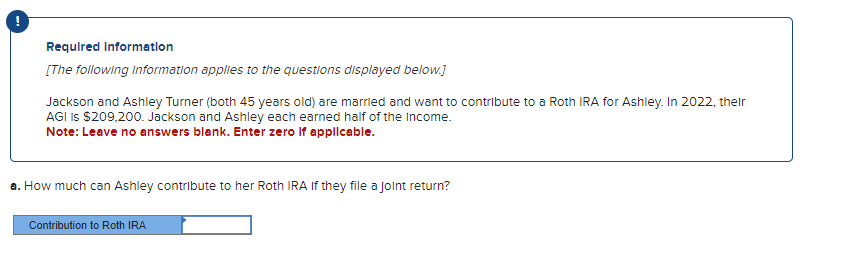

Question: Note that this tax problem is for the year 2022 Required Information [The following Information applies to the questions displayed below.] Jackson and Ashley Turner

![Information [The following Information applies to the questions displayed below.] Jackson and](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6f931491f6_10466e6f930ece73.jpg)

Note that this tax problem is for the year 2022

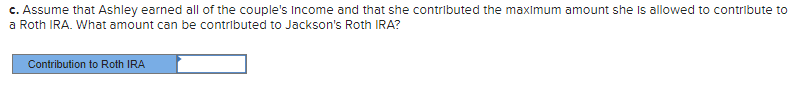

Required Information [The following Information applies to the questions displayed below.] Jackson and Ashley Turner (both 45 years old) are marrled and want to contribute to a Roth IRA for Ashley. In 2022 , their AGI is $209,200. Jackson and Ashley each earned half of the Income. Note: Leave no answers blank. Enter zero if appllcable. a. How much can Ashley contribute to her Roth IRA If they file a joint return? b. How much can Ashley contribute If she files a separate return? c. Assume that Ashley earned all of the couple's Income and that she contributed the maximum amount she Is allowed to contribute to a Roth IRA. What amount can be contributed to Jackson's Roth IRA? Required Information [The following Information applies to the questions displayed below.] Jackson and Ashley Turner (both 45 years old) are marrled and want to contribute to a Roth IRA for Ashley. In 2022 , their AGI is $209,200. Jackson and Ashley each earned half of the Income. Note: Leave no answers blank. Enter zero if appllcable. a. How much can Ashley contribute to her Roth IRA If they file a joint return? b. How much can Ashley contribute If she files a separate return? c. Assume that Ashley earned all of the couple's Income and that she contributed the maximum amount she Is allowed to contribute to a Roth IRA. What amount can be contributed to Jackson's Roth IRA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts