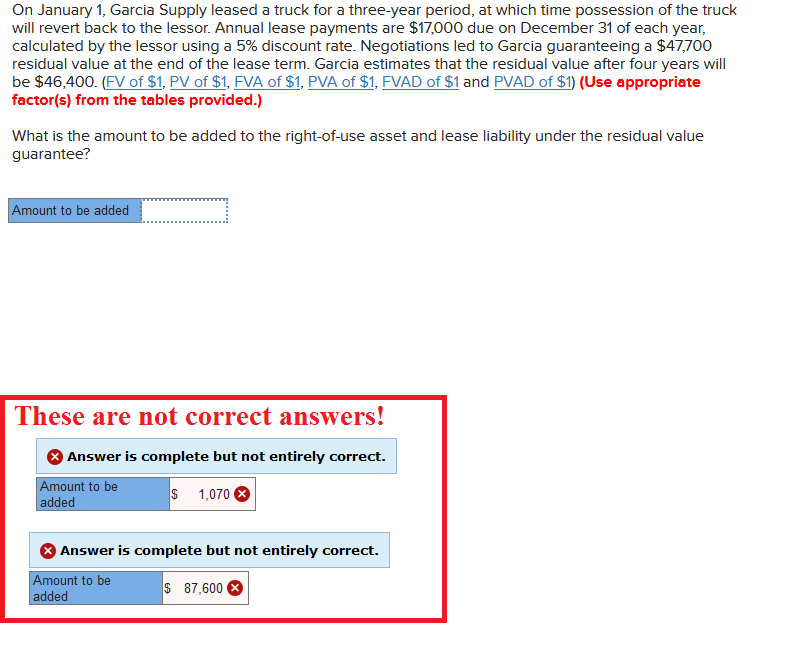

Question: NOTE: The answer is NOT $1,070, $1,069.51, $87,599.66, or $87,600! On January 1, Garcia Supply leased a truck for a three-year period, at which time

NOTE: The answer is NOT $1,070, $1,069.51, $87,599.66, or $87,600!

On January 1, Garcia Supply leased a truck for a three-year period, at which time possession of the truck will revert back to the lessor. Annual lease payments are $17,000 due on December 31 of each year, calculated by the lessor using a 5% discount rate. Negotiations led to Garcia guaranteeing a $47,700 residual value at the end of the lease term. Garcia estimates that the residual value after four years will be $46,400. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) What is the amount to be added to the right-of-use asset and lease liability under the residual value guarantee? Amount to be added These are not correct answers! Answer is complete but not entirely correct. Amount to be $ 1,070 added Answer is complete but not entirely correct. Amount to be added $ 87,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts