Question: Note: The average cost per unit based on the total units and COGAFS is $ 5 4 . Inventory Calculation: Springrieid Pharmacy Degan the year

Note: The average cost per unit based on the total units and COGAFS is $ Inventory Calculation: Springrieid Pharmacy Degan the year with Uov units of test kits Proauct in

inventory with a unit cost of $ The following additional purchases of Product A were made during the

following months: April st units @ $ each, July st units @ $ each, September th

units @ $ each, and November th units @ $ each.

Question: At the end of the year, Springfield Pharmacy had units of Product A unsold. Calculate the

cost of ending inventory and the cost of goods sold using the following methods:

Firstin firstout FIFO

Lastin firstout LIFO

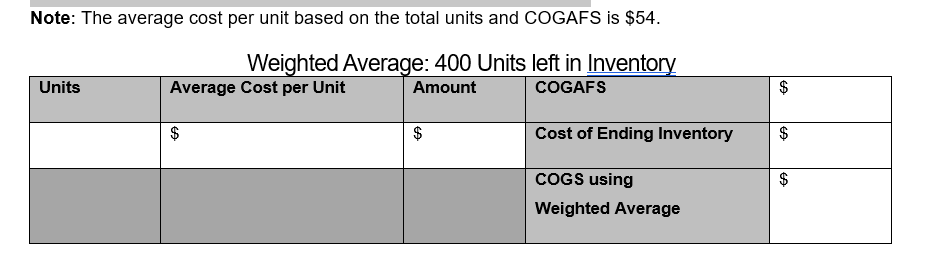

Weighted average

Note: For this activity, the following abbreviations will be used: Cost of goods available for sale COGAFS

and cost of goods sold COGS FIFO: Units left in Inventory

Complete the LIFO calculations in the following table:

LIFO: Units left in Inventory

Weighted Average: Units left in Inventory

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock